Wes Girling has had an interesting year at State Employees Credit Union of Maryland ($4.2B, Linthicum, MD).

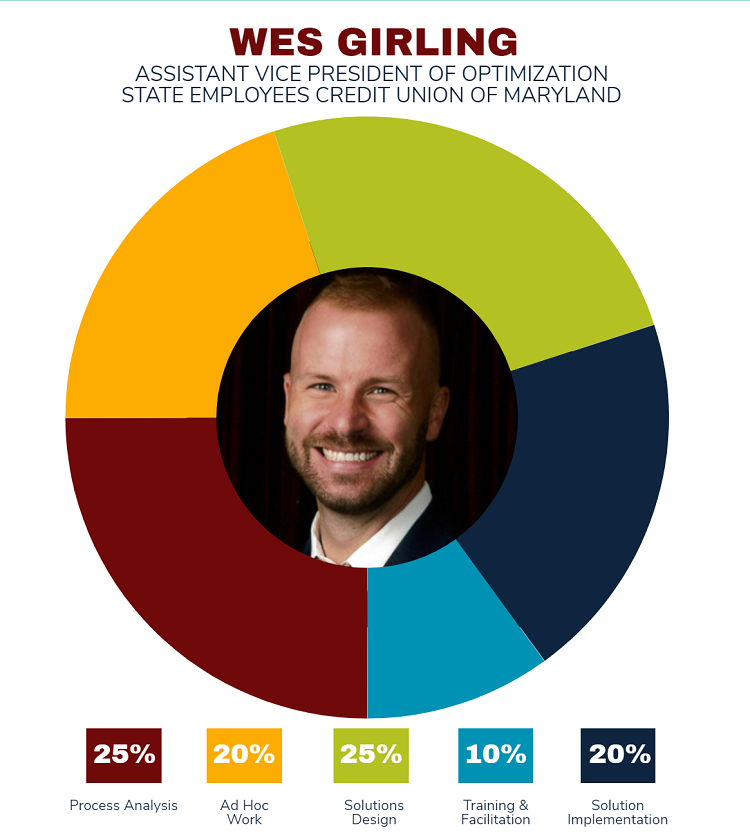

He joined SECU in 2016 and since January 2020 has been serving as assistant vice president for optimization, taking on a new role just as the coronavirus pandemic began rolling across America.

I’ve been all over the map the past few months, from helping to stand up our virtual branch functionalities to rolling out a loan deferment program, Girling says.

Here, he talks about what’s involved in leading optimization at the big Maryland cooperative.

Why did SECU create the role of assistant vice president of optimization? What challenges and opportunities does it address?

Wes Girling: SECU is focused on providing exceptional value for members and delivering seamless, frictionless, personalized service across their channels of choice. We believe organizational transformation depends on the optimization of key foundational work, and we needed to dedicate resources to that.

SECU also is part of a consortium of three credit unions that requires deep collaboration and alignment across critical business areas that support our members. We created the optimization role to support the organization as we bring our vision to life.

Did SECU create the role for you?

WG: The need for the role naturally emerged over time, but I think I put myself in position to be a strong candidate. I’ve always gravitated toward process optimization and solution design. By the time SECU needed this role, I had established a decent portfolio of related work.

Who do you report to? Who reports to you?

WG: I report to Kevin Kesecker, our executive vice president and chief administrative officer. I don’t have any direct reports, but my work supports all the areas of our organization, and it fills critical roles in SECU’s participation in the consortium.

What made you a great fit for this job?

WG: A combination of a few things. In a former role, I worked on process optimization projects and completed Lean Six Sigma training. The Lean Six toolset has been the backbone of my problem-solving and solutions-design techniques.

While I worked as a product owner, I got certified as a Scrum Product Owner and Scrum Master. Many of the agile methods I learned have been useful in supporting the cross-functional teams that execute optimization efforts.

More recently, I did some postgraduate work with the University of Maryland that focused on technology entrepreneurship and corporate innovation. The whole program was great. I regularly use the user-centered design and customer validation skills that I learned.

What’s does your daily routine look like?

WG: I support all areas of our organization, and I’ve been working remotely since the COVID-19 pandemic. Although I’m always in the same place, my day rarely has a set routine. I tend to structure my work around the people I’m working with on any given project. I like the variability that comes with that approach; it keeps things fresh.

What’s one project you’re working on now?

WG: One of the projects I’m working on will provide an organizational backlog for execution at SECU. Like many financial institutions, we have accelerated some of our larger scale digital transformation initiatives in addition to our current strategic projects. The vision is to provide a single source of truth that supports our executive leadership team with strategic prioritization, our execution leads with tactical management, and the rest of the SECU team with resourcing and departmental prioritization.

By providing more transparency throughout the organization on our various projects, we’ll be able to make decisions more quickly during a time when speed-to-market is so critical.

What has been your favorite project in this role so far?

WG: My favorite project was standing up our loan deferment programs. In the spring, we saw the impact the COVID-19 pandemic was having on our member base, and the organization moved quickly to provide relief. I was excited for the opportunity to help SECU make such an immediate and positive impact. Every time I hear a story of someone that we helped, it makes me smile.

Job titles say as much about the organization as they do the person. The “What’s In A Name” series on CreditUnions.com dives into notable, important, interesting, or just plain fun roles to find out what’s happening at the ground level and across the industry. Browse the whole series only on CreditUnions.com.

How do you track success in your job?

WG: I track it based on what we hear from our members. SECU has an excellent member experience team. They are constantly monitoring our members’ touchpoints and have a deep understanding of our members’ experiences. The optimization work we do is a direct response to those insights, and when I see improvements in those areas, I know we succeeded.

How do you stay current with topics that fall under your role?

WG: Websites like Fast Company or Inc. are good to confirm what’s emerging. The book “This is Service Design Doing” is a good read for those interested in User Centered Design. Back when my focus was on corporate innovation, I got value out of Gartner’s IT Symposium. Particularly the research that came from Mary Mesaglio and her team.

This interview has been edited and condensed.