When SAFE Federal Credit Union ($1.1B, Sumter, SC) was looking for a new hire to lead the transformation of its operations through critical systems conversions and beyond, it found a purple unicorn n Wayne Keels.

Keels moved to central South Carolina in late 2018 to become SAFE’s new director of continuous improvement after four years with Discover Financial Services in suburban Chicago. It’s the latest stop in a 25-year career in project management that began with extended internships with NASA while he was completing his master’s degree in computer science from Purdue University.

The American Society for Quality defines continuous improvement as the ongoing improvement of products, services, or processes through incremental and breakthrough improvements.

Here, Keels describes his new role of director of continuous improvement at the South Carolina credit union and how he makes it an integral part of the organization.

Why did SAFE create this role? What challenges and opportunities does it address?

Wayne Keels: SAFE Federal Credit Union was looking to hire a seasoned project manager to lead two conversions taking place over the next 12 months. There is a digital banking conversion that will move the credit union to a new online banking and mobile banking platform and a core processor conversion. These two conversions are critical for us to meet our strategic board goals for 2019 and beyond.

Our CEO, Darrell Merkel, had already identified continuous improvement (CI) as a critical foundation to our financial success and meeting the needs of our members.

Did SAFE create this role specifically for you?

WK: I don’t think the position was specific to me. SAFE FCU had a vision and was looking for the right pieces to complete the leadership team. My education, experience, and skill set made it an easy decision and a natural transition.

I was in a similar role while at Discover Financial Services. The recruiter referred to me as a purple unicorn because he and the hiring team felt I was a perfect fit for this expanded role, and they had been searching for a considerable amount of time.

Who do you report to? Who reports to you?

WK: I report to Michael Baker, our executive vice president and chief operating officer. Currently, there is one project coordinator/business analyst who reports to me.

What made you a great fit for this job?

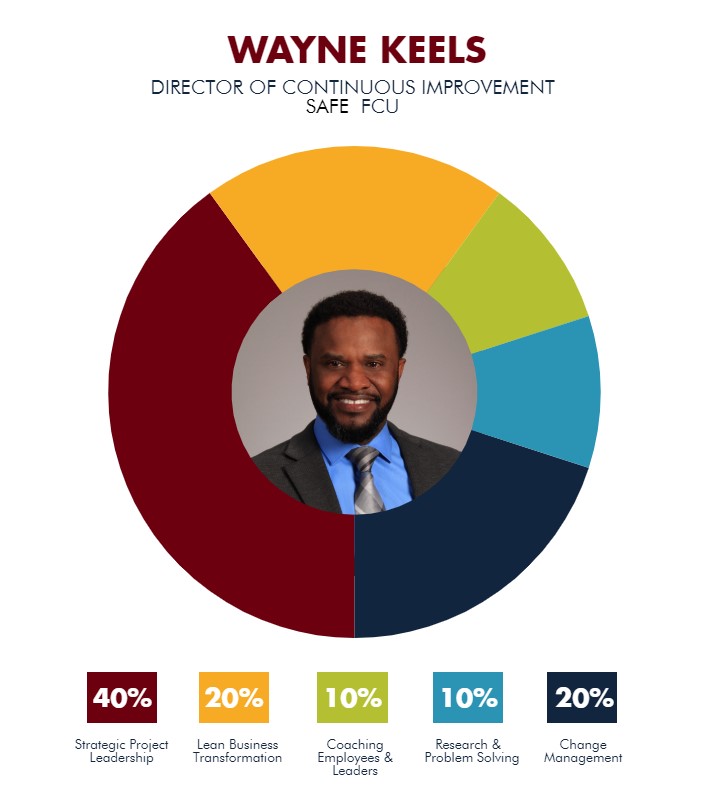

WK: I’m a certified project management professional, and I’ve led previous conversion projects with prior companies. I’m also a Lean Six Sigma Black Belt with lots of experience in the CI area. During the interviews, the senior leadership team recognized I had a lot to bring to the table.

Job titles say as much about the organization as they do the person. The “What’s In A Name” series on CreditUnions.com dives into notable, important, interesting, or just plain fun roles to find out what’s happening at the ground level and across the industry. Browse the whole series only on CreditUnions.com.

What are your primary responsibilities at SAFE?

WK: SAFE FCU is undergoing multiple system conversions. Under my leadership, we’ll also be undergoing a business transformation. I’m primarily responsible for supporting the entire project portfolio for SAFE FCU and daily management initiatives by ensuring strategies are implemented and principles, practices, and tools are incorporated in the culture and processes under transformation.

This position implements and supports actions that bring about incremental improvements which might include, but are not limited to, employee development and training, member value proposition, program management, quality, product delivery, growth, and margin expansion.

How do you stay current with topics that fall under your role?

WK: I’m a huge fan of audio books centered on personal development. To stay current in this industry, I enjoy reading daily briefs from the Credit Union Journal and American Banker. As a Certified PMP, I leverage the Project Management Institute for my annual continuing education. For CI, I stay tuned into organizations such as ASQ and BMGI. However, you don’t need to go far for great educational discussions on continuous improvement; Google and YouTube are just a few clicks away. I’d also love to network with other practitioners in the credit union space.

Do you know of anyone else with your title or role at a credit union? Who do you network with?

WK:I don’t know of any other credit union executive with the title of director of continuous improvement; however, we are seeing a proliferation of this type of role in some of the larger, more progressive banks. It’s not uncommon to find an entire team of Lean Six Sigma practitioners at a bank.

Both the Lean methodology and the Six Sigma approach look to cut waste from a process. Whereas Lean focuses on waste derived from unnecessary steps or analysis, Six Sigma asserts, for example, inefficient loan processing is a result of variations within a set loan process. The reality is that even the largest banks can be poor at formalizing and adhering to a set loan processing methodology. Therefore, the reality is a combination of both disciplines work best when applied to financial institutions; hence, we use the term Lean Six Sigma.

3 Factors For Success

The director of continuous improvement at SAFE FCU is integral to the success of the organization. Wayne Keels cites three factors for measuring his own success within the role.

- Financial results: I’m assisting with the development of scorecards with key performance indicators. Our CEO emphasizes the need to measure success, assess what’s working, and make adjustments to improve.

- Assessment tools: When we implement improvements, our processes, business practices, and results will improve. Assessment scores will also improve, providing SAFE FCU moves along a path of continuous improvement.

- Stakeholders’ view: Members, employees, partners and suppliers, and the communities we serve all have an interest in the financial performance of SAFE FCU. I serve our stakeholders, and I expect them to hold me accountable.

This interview has been edited and condensed.