The threat of COVID-19 is adding new potency to consumer demand for frictionless payments, especially those that involve mobile wallets and other contactless options.

How much the pandemic will change shopping behavior going forward remains to be seen, but credit unions need to be ready to respond to new demand for easy-to-use cashless and plastic-free options in-store and online.

Despite the rise of online shopping in the past 20 years, in-store purchases still comprise the great majority of all retail purchases. Brick and mortar businesses are still part of the shopping experience, but the nature of the customer experience withinthese establishments now has the potential to change drastically.

Frictionless payments allow consumers to make seamless, convenient transactions by removing pain points such as waiting in line, swiping cards, providing signatures, entering PINs, or even having to check out at all.

According to a study by Visa, 44% of consumers said they would rather not have to stop at a counter or manually checkout when visiting a retail store.

What does the frictionless payments market look like today and in the future, and how can credit unions offer these desired payments solutions to members and merchants?

Mobile Wallets: A Step Toward Frictionless Payments

Mobile wallets allow members to make payments without using a physical credit card by storing card information securely on a smartphone. The global mobile payments market is estimated to reach nearly $3.4 billion by 2022.

Mobile wallet adoption is increasing, although at a slower rate than expected. A JuniperResearch study predicts that nearly 2.1 billion consumers worldwide will use a mobile wallet to make a payment or send money in 2019, which is up over 30% from the recorded 1.6 billion consumers at the end of 2017.

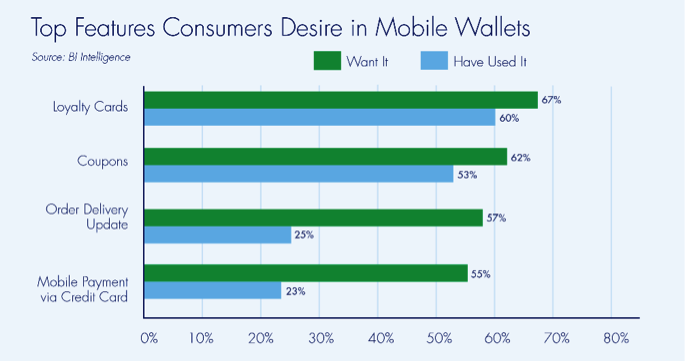

Compared to the merchant-agnostic mobile wallets, merchant-specific mobile wallets are seeing increased usage and traction because of the added value they provide to consumers. The Starbucks app, which is used in 30% of transactions in all U.S. Starbucks stores, enables mobile payments at checkout by pre-loading dollars from a credit card to the app. Customers also have the option to order ahead of time via the app and have their order ready when they arrive at the store, and they are automatically granted rewards points for each purchase made through the app.

Wearables: A Leap Toward Frictionless Payments

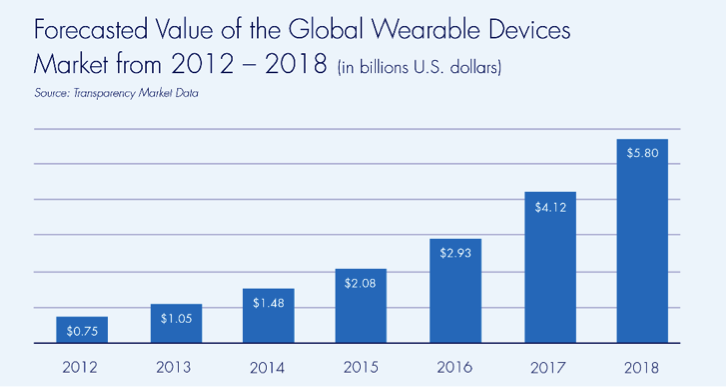

Wearables are smart devices worn on the body. Payment volume via wearables is expected to grow to $501.1 billion by 2020. The most tractiongained for frictionless payments in the wearables space is found in the smartwatch category. Most major manufacturers have enabled their devices to make payments via near-field communication technology,which allows devices to send information without going through multiple steps to set up a connection.

By 2021, smartwatch sales are expected to total nearly 81 million units, making up 16% of total wearabledevice sales.

While the wearables market is competitive, the industry is led by Apple Watch and Samsung Galaxy Watch. Apple has revealed that Q4’19 sales in its wearables division rose 54% year over year to $6.5 billion. This is significant in that overall global spending on wearables is expected to hit $52 billion in 2020.

Voice commerce is also seeing significant growth. Our homes are becoming more and more a frequent place for frictionless purchases, done with our voices. At the end of 2018, 26% of U.S. homes had a smart speaker like Amazon’s Echo Alexa or Google Home. This allows consumers to order products from Amazon or other sites using their existing merchant accounts by voice. As the consumermarket continues to adopt these methods, it will increase the demand for digital payments and frictionless purchases overall.

Though the market is now in its infancy, in the future, payments-enabled wearables could provide maximum convenience and value to consumers by functioning as a sophisticated digital identity that serves as a credit card, key chain, driver’s license,and more, all in one.

Invisible Payments: Frictionless Payments Realized

Invisible payments integrate payments into the internet of things by removing all visible indication of a payment taking place. The internet of things represents all the connected devices on a network that can communicate with each other to complete tasks,including making payments. Invisible payment technologies are predicted to process over $78 billion in transactions by 2020.

Unlike mobile apps and wearables, invisible payments require no device to complete a payment. Instead, a customer’s identifying features (e.g., face, voice, etc.) are linked to his or her credit union account, which is charged when the customerleaves the retail location.

An example of frictionless payments in action is Amazon Go, which is a grocery store from e-retailer Amazon that offers a checkoutfree shopping experience by tracking the products customers take off the shelf and then charging their Amazon accounts when they walk out the door with the products.

Partnering with Elan Advisory Services

In all circumstances creating a customer-centric experience for merchants and members is a new imperative. To meet that challenge, credit unions need to partner with a payments solutions provider invested in forward-thinking solutions. Through a partnershipwith Elan Advisory Services, your credit union will have access to Elavon Merchant Services which allows you to offer a full range of payment processing solutions to members.

Partnering with Elan and Elavon to offer merchant solutions can drive member engagement in your credit union. In fact, merchants who use Elavon’s payment solutions are two times as likely to get a business card with your institution than those withonly a checking account.

Elavon can shoulder the challenges of offering frictionless payment options (such as payment acceptance via mobile wallets and wearables) including high technology costs and helping to protect against fraud.

About Elan Advisory Services

Elan Advisory Services provides strategic consultation to ensure your credit union has the right products and services to compete in your market. Through Elan Advisory Services’ internal partners, we deliver best‐in‐class products and exceptionalservice to more than 3,000 financial institutions across the United States. With solutions such as end‐to‐end credit card, mortgage services, and merchant processing, Elan Advisory Services can help your credit union increase revenue and efficiencies.For more information, visit Elan Advisory Services at www.elanadvisoryservices.com.