When a member walks into their credit union’s branch for the first time, what are the chances that is their initial interaction with the credit union?

The chances are unlikely because credit unions have a new front door: Their online brand presence.

Brick-and-mortar locations have historically served as the primary way members and potential members learned what the credit union was all about. For marketers, controlling the credit union’s image and ensuring consistency across locations was a finite endeavor.

Then the internet entered the game, and corporate websites became the new front door. Again, though, marketers had a single focal point to consider. Images, selling points for products and services, contact information, and more all lived in one location.

Today, social media and ever-evolving search engine optimization (SEO) standards are changing the whole concept of brand management. Gone are the days when marketers were in complete control. ContentMiddleAd

Members as well as strangers now influence the way potential members interact with credit unions. When someone has a negative experience with a loan officer, they go on Facebook and complain about the interaction. It doesn’t matter if the poster’s gripe is legitimate it’s out there for the world to see. So, too, is other content and images that credit unions have not posted or approved.

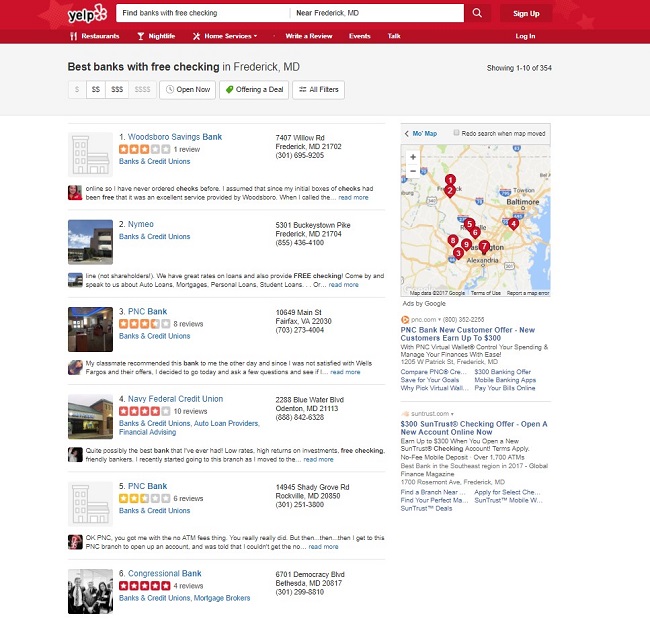

I often use Yelp to research local businesses. For my role as director of marketing and engagement at Callahan & Associates, I recently searched banks with free checking. It’s a common enough search phrase and I wanted to see how credit unions fared in the results.

Check out my search results.

Even with little information, the star ratings and reviews tell people a lot about these institutions. These at-a-glance snapshots help searchers decide what they want to learn more about.

Reviews make up approximately 13% of the Google search algorithm. Reviews help search engines determine what results to return and are a major consideration for potential members. Reviews mean credibility and credibility is everything especially when it comes to financial services.

But, there are a lot of financial institutions in Frederick, MD. And many are missing from this search result. Why is that?

Most multi-location companies set up an online presence under their corporate headquarters. In this case, Google wouldn’t list a Frederick branch for a credit union based in Columbia, MD, with Facebook, Google, Yelp, etc. pages attached to the Columbia address. Google might not know that Frederick branch location exists. Or, Google might have found an unclaimed listing page for Frederick, but that page does not contain enough consistent information with the corporate pages to deem the branch page a legitimate business.

The problem with this is members are looking locally.

If websites, social accounts, and listing pages only reflect a credit union’s corporate branch, how will members find other branch locations?

The short answer is: They won’t.

A better answer is: They won’t until the credit union builds a local presence for each branch on every social media and search engine outlet.

In many cases, those outlets have already created pages for local locations. These pages exist, unclaimed, on the internet. Unclaimed listings appear real to members. These outlets can review the credit union, allow members to check in, and even provide false hours. This is a real reputational threat.

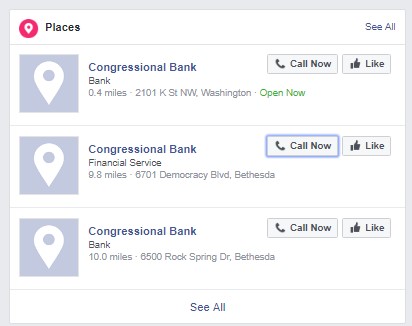

To further illustrate, the below Facebook results for Congressional Bank are all unofficial pages.

Congressional Bank has not claimed these pages and has no control over their content and images.

A savvy potential customer might recognize these pages are unclaimed and question their validity. But they’d have to be pretty savvy. Even on pages like this, negative images and reviews will still do damage.

So, how do credit unions take control? How do marketers manage the brand of the new front door?

By using these five steps:

- Search the major providers Facebook, Yelp, Google, and Yellow Pages for the credit union’s name. Look for rogue pages. They can be difficult to find.

- Once you find those rogue pages, claim those listing pages. You might be surprised to learn Google uses sites like the Real Yellow Pages to authenticate locations. This isn’t solely a way to find the pizza delivery number anymore.

- Add listing pages for the credit union’s remaining locations. You want all your locations to compete locally!

- Build out listings pages to include photos, accurate NAP (name, address, phone) information, categories, updated office and more. Members and potential members need the most updated information.

- Develop a review policy internally. Who responds to reviews and when do reviews need to be escalated to management? Remember, members look at responses, so respond to ALL of them.

It’s like the Wild, Wild West out there on the internet, and it is constantly changing.

Getting, and staying, on top of the credit union’s online brand reputation can be time consuming, but it’s worth it in the long run. This is the way to preserve the institution’s brand and ensure when a member opens the front door, they’ll be seeing the best representation.