Facebook probably doesn’t want to be a bank. But that doesn’t mean that like Apple, Wal-Mart, Spotify, and others, it’s content with stasis.

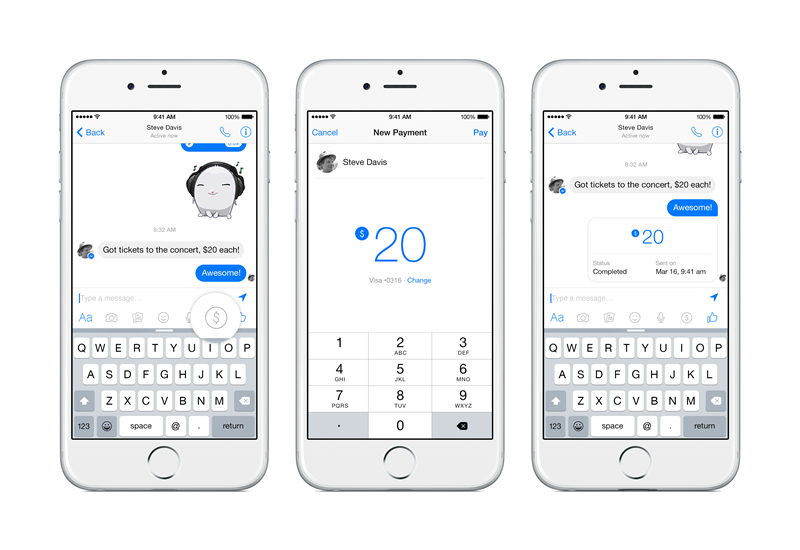

Facebook launched a new feature in its Messenger application that allows users to send or receive payments to and from friends. The service, according to Facebook, is free and the process just a few steps.

Image courtesy of Facebook

Sent money is transferred right away, though it may take one to three business days before the money becomes available. Because Facebook has developed its entire payment system in-house the funds are transferred through the digital behemoth.

To send or receive money for the first time in Messenger, the user needs to add a Visa or MasterCard debit card issued by a bank or credit union in the United States. Once a card is added, users can create a PIN to add an additional layer of security, and users on iOS devices can also enable Touch ID biometrics.

If the recipient of the funds has not attached a card to their account, Facebook holds onto the funds until that’s done.

Facebook describes itself as a dependable and trusted payments processor for game players and advertisers since 2007. Facebook processes more than one million transactions daily on the site and also handles all the payments processed on Messenger.

What Does This Mean?

With Snapchat launching Snapcash in November 2014 in partnership with Square, it was really only a matter of time before Facebook announced its similar service, especially considering its previous forays into consumerism such as its Buy button. The goal with Buy? To keep people on Facebook longer and, presumably, collect more accurate and (extremely) valuable data on the buying and usage habits of its user base.

The ability to conduct payments on Facebook Messenger, on the other hand, is a move to leverage the 600 million reported active monthly users of Messenger against competitors in the person-to-person payments market, such as Venmo and PayPal.

But to truly understand Facebook’s decision, one must first understand the role of the mobile app in today’s landscape and Facebook’s rapidly aging user base.

Because I’m Appy

For years, Facebook had allowed users to access a private chat option through its mobile app. Then, in August of 2014, it made an unpopular decision when it forced mobile usersto switch to its new standalone Messenger app. Still, with 600 million active users, Facebook will trade initial annoyance with long-term utility.

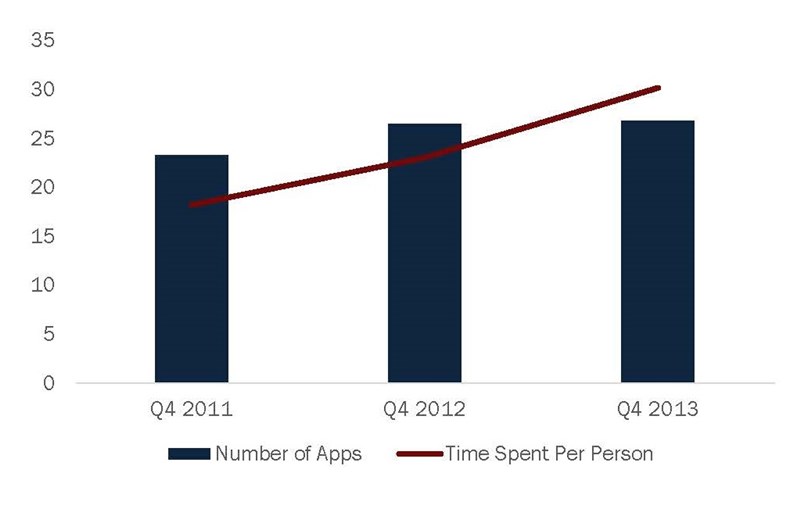

And the move coincided with a growth in app usage and popularity, according to Nielsen, as the following charts illustrate:

AVERAGE NUMBER OF APPS USED AND AVERAGE TIME SPENT PER PERSON

Data as of 07.01.14

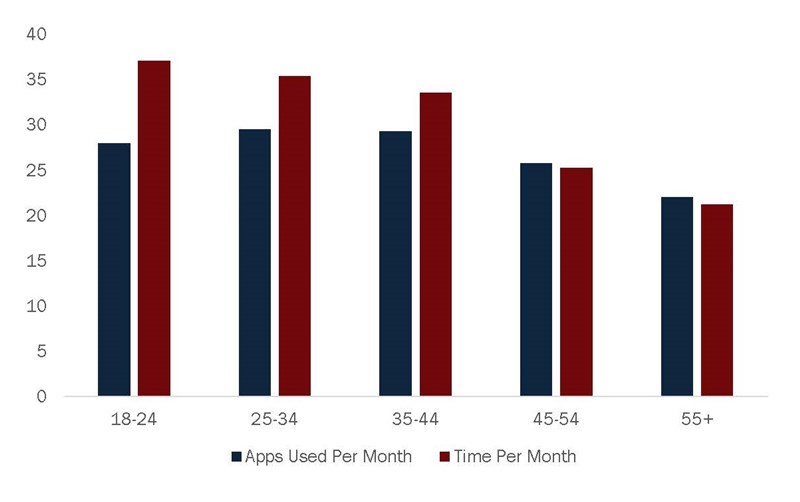

MOBILE APP USAGE PER AGE

Data as of 07.01.14

TOP 10 SMARTPHONE APP CATEGORIES BY TIME PER PERSON

Data as of 07.01.14

| Q4 2012 | Q4 2013 | Percentage Growth | |

|---|---|---|---|

| Search Portals & Social | 8:33 | 10:56 | 28% |

| Entertainment | 6:11 | 10:34 | 71% |

| Communication | 3:29 | 3:48 | 9% |

| Productivity & Tools | 2:00 | 2:16 | 14% |

| Commerce & Shopping | 1:23 | 1:33 | 12% |

| News & Information | 1:00 | 1:33 | 55% |

| Travel | 1:14 | 1:18 | 6% |

| Family & Lifestyle | 0:59 | 1:16 | 29% |

| Photography | 0:26 | 1:01 | 131% |

| Finance | 0:33 | 0:35 | 10% |

| Total | 23:02 | 30:15 | 31% |

Source: Nielsen

With more customers using and spending more time on apps, companies like Facebook want to grab a larger piece of that market share. That means building horizontally through the addition of new features that fulfill more user needs.

Which begs the question, does the ability to send payments through Facebook Messenger fulfill any need? We’ll come back to that.

Facebook’s Facelift

As much as people connect social media sites with millennial tastes, Facebook has, according to a 2014 study by digital consultancy iStrategy Labs, aged.

The study shows that while Facebook grew its U.S. user base by 22.6% in the three years from January 2011 to January 2014, it lost approximately 11 million high school and college-age users. If you’re aware of Facebook’s history, you’ll know that it exploded through colleges in the mid-2000s. It came to life in a pre-smartphone world, where maintaining contact with those in and around one’s social circle took some care. Facebook reduced that friction.

Today, maintaining social connections is almost totally frictionless, largely due to the rise of apps like Snapchat and Instagram (which Facebook owns). While younger generations jumped to those apps whether due to concerns over security or parents commenting on status updates Facebook aged up. In the past three years, users ages 35-54 and 55+ grew 41.4% and 80.4% respectively. Compare that with users ages 13-17 and 18-24, who lost 25.3% and 7.5% respectively.

Younger generations are more willing to use P2P payments than older generations, and since this is a market Facebook has somewhat lost connection with they’re clearly hoping one plus one will equal two; give the young people what they want, add the Facebook brand name, and reap the benefits.

Will This Work?

The largest obstacle Facebook must face is an underlying sense of distrust that many feel toward the brand. In an August 2014 study by online identity manager MyLife of 4,000 Facebook users in the U.S., 82.9% said they did not trust Facebook with their personal information. That’s compared to 76.8% who don’t trust the government, 67.1% who don’t trust LinkedIn, and 52.8% who don’t trust Google.

That’s a poor showing, especially considering the Edward Snowden saga, and recent evils done by Google.

While Facebook does apparently have excellent security measures, its willingness to sell information to advertisers turns a lot of people off.

Another question to ask is what value this product will provide to those who may choose to use it. It’s easy? P2P is, by nature, easy. It’s secure? I would hope so. It’s free? Others are, too, or so inexpensive it doesn’t matter.

Venmo, which we’ve written about on this site many times in recent months, makes its bacon on the social aspect of money transfer: allowing users to see what their friends (you can choose to link your Facebook account) are doing. Facebook’s P2P, curiously maybe, doesn’t have that social aspect. It’s a private transaction between two people, which, no doubt, many would prefer.

More Venmo

- Mobile Lessons From Payment Space Invaders

- What New Payment Players Can Teach Credit Unions

But is it really all that different than other P2P payment services in the market, whether offered by credit unions or non-traditional competitors? Or is it just a way for Facebook to keep up with the Benjamins?

Based on this, if Facebook really wanted to be a bank it would have tried harder.