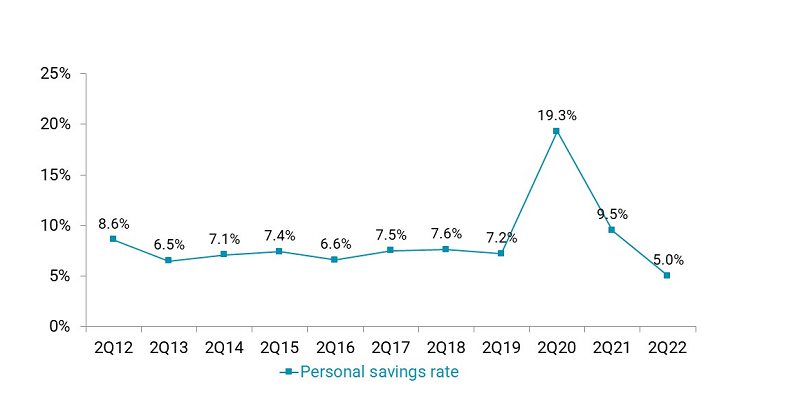

PERSONAL SAVINGS RATE

FOR U.S. CONSUMERS | DATA AS OF 06.30.22

SOURCE: Federal Reserve Bank of St. Louis

- The personal savings rate, or personal saving as a percentage of disposable income, hit 5% at midyear, marking a return to relative normalcy after a pandemic-induced spike and subsequent decline.

- Although the current rate is broadly in line with normal trends, it marks a slight decline from traditional midyear figures, and is 1.5 percentage points below its lowest figure in the past decade. The rate has not been this low in more than 10 years, landing at 4.5% in August 2009, when the nation was still dealing with the fallout from the financial crisis and the Great Recession.

- The shift is partly the result of a return to normal deposit activity after government relief efforts to combat COVID-19 wrapped; however, inflation is also playing a factor, along with rising rates and higher prices resulting from supply chain constraints.