The industry continued to post double-digit loan growth rates in the third quarter of 2017. Seventy percent of credit unions reported positive year-over-year loan growth, with the median loan growth at 4.9%.

Click here to learn more about lending trends in third quarter 2017.

Auto loans expanded 12.4% annually for credit unions nationally. That’s 6.2 percentage points higher than the median auto growth rate of 6.2%.

Click here to learn more about auto lending in third quarter 2017.

Sales to the secondary market dropped 8.9% compared to the same period last year and fell from $41.6 billion to $37.9 billion. Credit unions with more than $1 billion in assets sold the largest portion of their first mortgage originations, 37.1%. By comparison, credit unions with $50 million to $100 million in assets sold 18.4%.

Click here to learn more about mortgage lending in third quarter 2017.

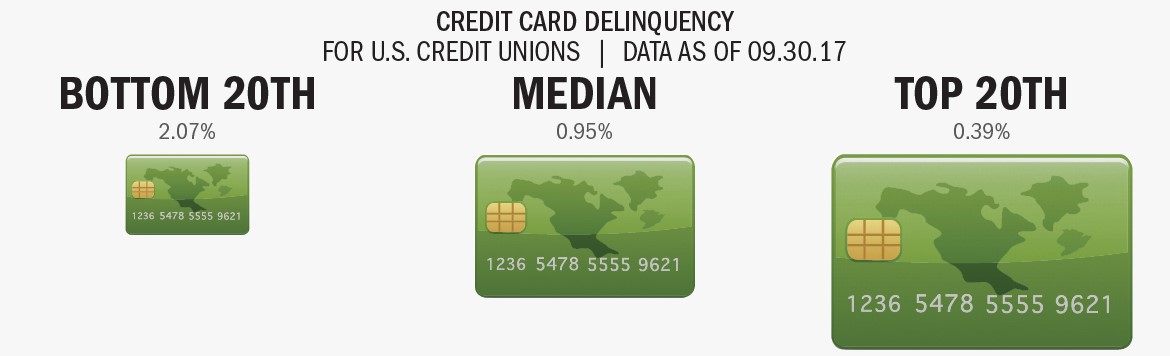

As of Sept. 30, 2017, credit card delinquency for the industry was up 19 basis points from the third quarter of 2016. This was a continuation of a recent upward trend.

Click here to learn more about credit cards in third quarter 2017.

The lending data from this article was pulled using Callahan’s analytics software. Learn how it can help your credit union.

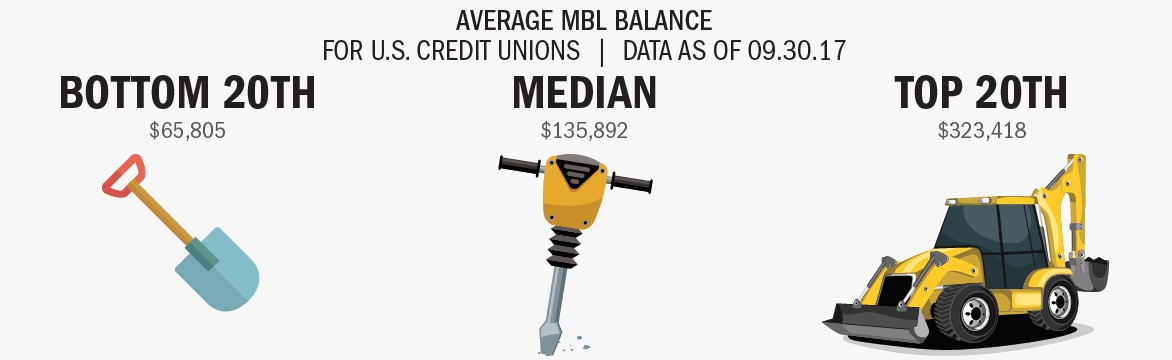

Member commercial loan balances in the third quarter totaled $54.5 billion. The average balance was $283,200.

Click here to learn more about member business lending in third quarter 2017.