The FFIEC has released preliminary mortgage origination information from credit unions, banks, and mortgage finance institutions that meet the council’s HMDA reporting criteria. This data sheds light on the U.S. mortgage market every year. Given the tumultuous environment individuals and institutions have faced during the pandemic, three trends stand out in the 2020 data.

1. Mortgage production flourished

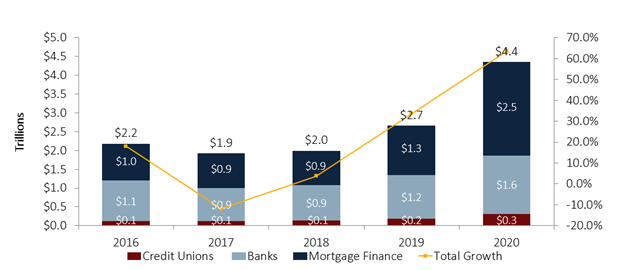

Mortgage production in the United States approached $4.4 trillion at year-end 2020. The Federal Reserve cut rates to near zero at the beginning of 2020. In response, the first mortgage market flourished and total originations grew 63.6% from year-end 2019 to year-end 2020.

MORTGAGE ORIGINATIONS AND TOTAL GROWTH

HMDA REPORTING INSTITUTIONS | DATA AS OF 12.31.20

Mortgage origination contributed greatly to overall loan growth in 2020. Total originations grew 63.3% year-over-year.

Mortgage finance companies reported the largest growth in mortgage originations at 89.7% annually. Credit unions followed closely with 71.6% annual growth, accounting for $316.7 billion in total originations. Notably, credit unions gained 34 basis points in market share to hit 7.3%, whereas banks lost 8.2 percentage points. Banks originated 35.6% of total mortgages in 2020; mortgage finance companies originated 57.1%.

Credit unions, banks, and mortgage finance institutions must report HMDA data if they have $47 million or more in assets, have a branch or home office in a metropolitan statistical area, and have originated at least 25 closed-end mortgage loans or at least 500 open-end lines of credit during the prior two calendar years. Callahan & Associates MortgageAnalyzer allows users to analyze mortgage data by loan purpose, MSA, and more.

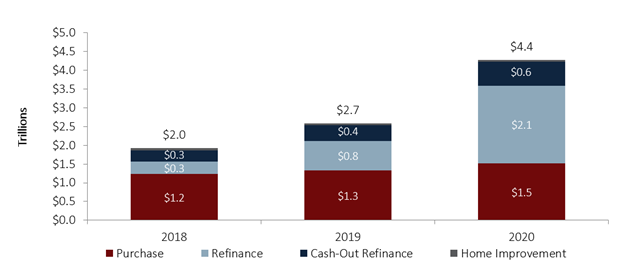

2. Refinances anchor mortgage origination growth.

Refinances predominantly drove first mortgage growth throughout 2020. These are a relationship-driven loan type with which credit unions have historically thrived.

Total refinances across the industry increased 125.2% year-over-year; purchase loans increased only 14.0% annually. Refinances accounted for 62.3% of all originations in 2020 and 61.6% for credit unions alone. Purchases comprised 30.0% of credit union originations, home improvements made up 4.5%, and the remaining 3.2% fell into the other loan purpose category.

MORTGAGE ORIGINATIONS BY PURPOSE

HMDA REPORTING INSTITUTIONS | DATA AS OF 12.31.20

Thanks to near-zero interest rates throughout the year, refis drove total mortgage growth in 2020.

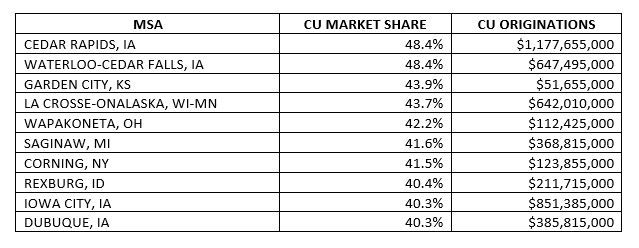

3. Credit union mortgage market strongholds bulk up even more.

The 10 metropolitan statistical areas in which credit unions hold the strongest mortgage market share have expanded 2.6 percentage points on average since 2019.

At year-end 2020, credit unions held the largest market share 48.4% in Cedar Rapids, IA. Credit unions in Garden City, KS, almost doubled their market share from 24.9% in 2019 to 43.9% in 2020.

TOP 10 MSAs IN CREDIT UNION MARKET SHARE

HMDA REPORTING CREDIT UNIONS | DATA AS OF 12.31.20

Midwestern credit unions led the way in property-secured lending. Eight of the top 10 MSAs for credit union market share in 2020 were in Midwestern states.

Credit unions turned out a record year for mortgage growth in 2020. Borrowing spiked when the Fed cut interest rates, and cooperatives stayed true to their mission by minimizing costs and extending smaller loans to more members. As the mortgage lending marketplace continues to evolve and digitize, credit unions would be well-served to continue evaluating processes to ensure the institution is positioned to serve current and future members.

2020 Home Mortgage Disclosure Act (HMDA) data is here and in MortgageAnalyzer. This tool allows credit unions to identify industry leaders as well as better understand their position and strategy moving forward. Request a custom Real Estate Lending Trends Analysis to see the data in action for your credit union.