As member demand for financial technology increases and branch traffic decreases, credit unions looked to scale back the square footage of branches and placed a greater focus on incorporating technology into daily operations.

Download The 2018 Credit Union Directory

The credit union movement notches another year of strong growth and sound fundamentals, but there’s potential for much more. Use the annual Callahan Credit Union Directory to review past performance as well as look forward to the year ahead.

Download The Directory

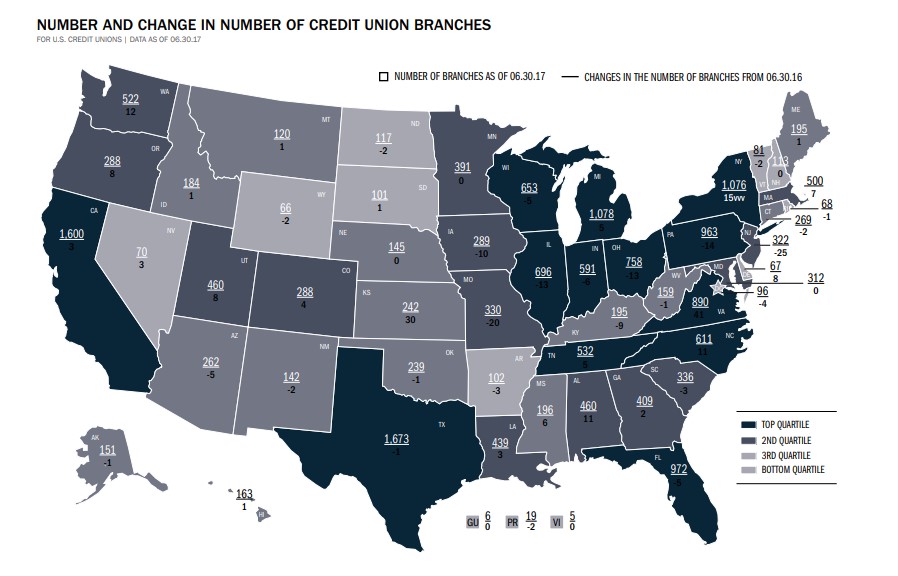

Credit unions operated 21,012 branches nationwide as of June 30, 2017, a net increase of 35 branches year-over-year. The credit union membership base expanded 4.3% over time time, to 110.6 million. With membership growth outpacing branch growth, credit unions served 204 more members per branch as of mid-year than in 2016. For second quarter 2017, credit unions served an average of 5,265 members per branch.

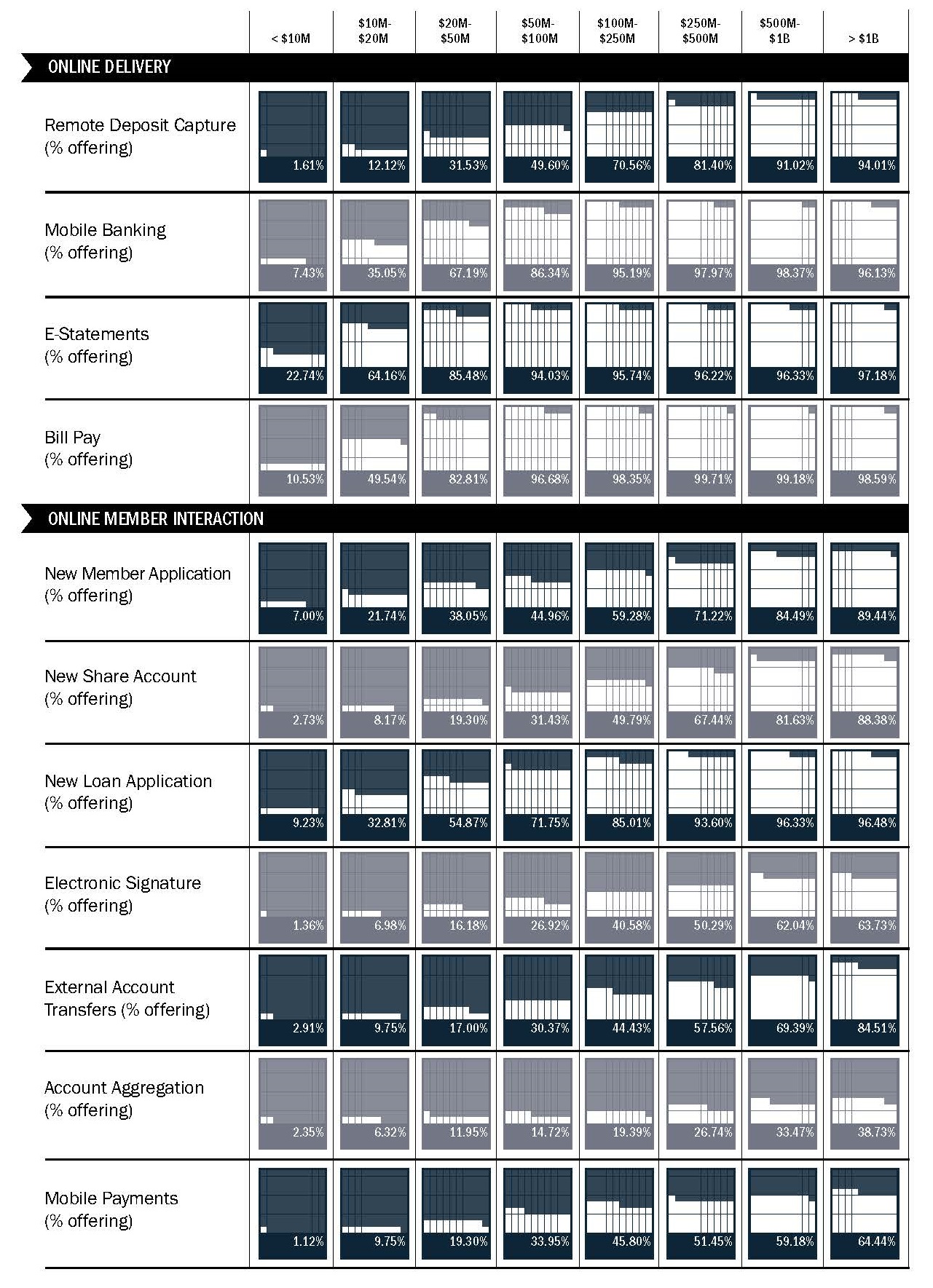

As of second quarter 2017, credit unions reported 16,141 ATM locations, down 607 from June 2016. This can be attributed to shared ATM strategies and increased online and mobile initiatives. Credit unions offer convenience through an array of channels outside of ATMs:

- 77.2% of credit unions reported offering online banking.

- 56.9% of credit unions reported serving members through mobile banking.

- 70% of credit unions reported offering e-statements.

- 64.6% of credit unions reported offering bill pay.

- 37.3% of credit unions reported offering online new member applications.

- 51.4% of credit unions reported offering online new loan applications.

- 36.4% of credit unions reported offering remote deposit capture.

Read on to learn more about industry delivery channel trends and see the credit union leaders in branches, ATMs, members per branch, and online banking penetration. All this data and more is available in Callahan’s Credit Union Directory.

Number And Change In Number Of Credit Union Branches

LEADERS IN BRANCH & ATM NETWORK

FOR U.S. CREDIT UNIONS > $20m IN ASSETS | DATA AS OF 06.30.17

© Callahan & Associates | www.creditunions.com

| Rank | Credit Union | State | Branches & ATMs* | Branches | ATMs* | Members Per Branch | Total Assets |

|---|---|---|---|---|---|---|---|

| 1 | Navy | VA | 592 | 306 | 286 | 23,493 | $82,038,635,993 |

| 2 | State Employees | NC | 510 | 258 | 252 | 8,725 | $36,879,840,265 |

| 3 | America First | UT | 251 | 123 | 128 | 7,002 | $8,936,450,570 |

| 4 | Alaska USA | AK | 171 | 85 | 86 | 7,390 | $6,862,725,808 |

| 5 | The Golden 1 | CA | 149 | 75 | 74 | 11,667 | $11,158,918,497 |

*ATMs owned by the credit union; as reported by the NCUA.

LEADERS IN MEMBERS PER BRANCH

FOR U.S. CREDIT UNIONS > $20M In Assets* | DATA AS OF 06.30.17

© Callahan & Associates | www.creditunions.com

| Rank | Credit Union | State | Members Per Branch | Members | Branches | Members Per FTE Employee** | Total Assets |

|---|---|---|---|---|---|---|---|

| 1 | America’s Christian | CA | 61,882 | 123,764 | 2 | 1,338 | $353,335,573 |

| 2 | Northwest | VA | 34,766 | 243,365 | 7 | 497 | $3,260,744,967 |

| 3 | United Nations | NY | 32,131 | 128,523 | 4 | 240 | $4,946,156,154 |

| 4 | Alliant | IL | 30,723 | 368,681 | 12 | 783 | $9,885,327,304 |

| 5 | Digital | MA | 28,853 | 663,621 | 23 | 566 | $8,071,182,667 |

* >$20 Million in assets and 2+ branches

** FTE=Full-Time Equivalent. FTE Employees is calculated as all full-time employees plus 50% of part-time employees.

LEADERS IN ONLINE BANKING PENETRATION

FOR U.S. CREDIT UNIONS > $20m IN ASSETS | DATA AS OF 06.30.17

© Callahan & Associates | www.creditunions.com

| Rank | Credit Union | State | Members Using Online Banking (%) | Members Using Online Banking (#) | Members | Total Assets |

|---|---|---|---|---|---|---|

| 1 | Purdue | IN | 99.13% | 72,427 | 73,065 | $1,098,333,236 |

| 2 | One Nevada | NV | 99.09% | 78,173 | 78,888 | $874,544,456 |

| 3 | Schlumberger Employees | TX | 99.05% | 30,775 | 31,070 | $828,195,389 |

| 4 | First Service | TX | 98.87% | 55,662 | 56,301 | $679,882,394 |

| 5 | Genesee Valley | NY | 97.41% | 7,856 | 8,065 | $79,519,158 |

ContentMiddleAd

DELIVERY CHANNEL DEPLOYMENT & ONLINE INTERACTION

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.17