Top-Level Takeaways

-

Credit union consolidation has been accompanied by core processor consolidation but there are still dozens of choices.

-

Core processors Fiserv and Symitar continue to dominate among the largest credit unions while FedComp is still the leader in client count among the movement’s smallest members.

Choosing the right core processor is critical to the success of credit unions large and small, whether they choose a single provider for all their processing and delivery needs, or select multiple vendors to fit different needs.

And just as there’s a plethora of providers, there are multiple options to choose from among the playing field of core providers themselves. The core system is typically the credit union’s largest expenditure behind only people, and it’s important to play the field.

Here are three best practices in that regard:

- Analyze core processors that have clients similar to your credit union; check for gains made in relevant performance categories.

- Reach out to peers using a core in which you are interested to solicit an unbiased testimonial of the user experience.

- Develop core conversion guidelines, vendor management policies, and vendor risk-rating worksheets to make a smart decision and help ensure a smooth transition.

There’s been significant consolidation in the core processor space over the years, but there are still multiple choices. In fact, there are 29 different core processors offering 43 different platforms and that’s just among competitors serving at least $400 million in aggregated assets.

That said, there are clear leaders in the core provider marketplace. Fiserv and Symitar had a combined market share of 43.0% as of mid-2018. Fiserv alone served 31.7% of the credit union industry.

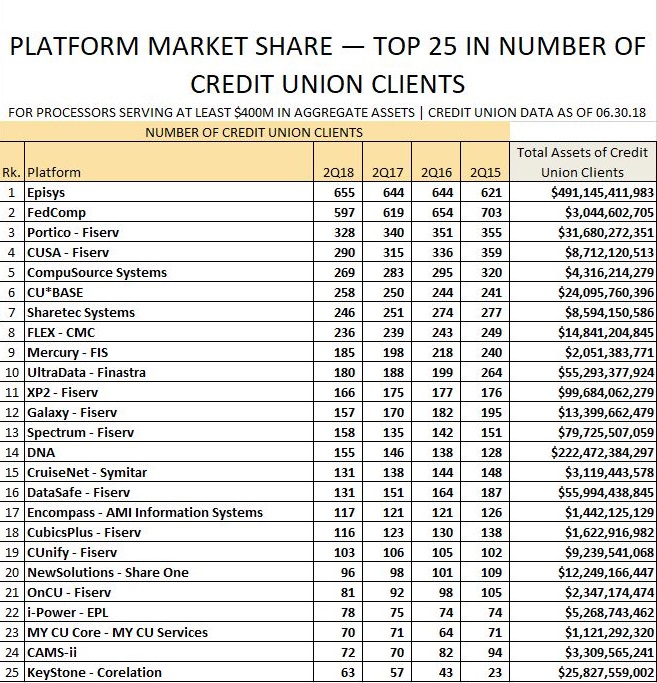

With 131 clients of more than $1 billion in assets running on the Episys solution, Symitar has the edge in large credit unions. Across the industry, Episys is the most commonly used platform. It’s 655 credit union total includes credit unions using third-party Symitar providers Member Driven Technologies (90) and Synergent (65).

ContentMiddleAd

Next up is small credit union specialist FedComp, which serves 597 credit unions.

But in sheer number of clients, Fiserv dominates, with 1,775 of the nation’s 5,551 credit unions running on the fintech giant’s various cores as of mid-year 2018. Two of those Portico and CUSA were third and fourth on the list, at 328 and 290 credit unions, respectively.

The distribution of client adoption among providers varies through the asset bands tracked by Callahan & Associates. For example, in the $50 million to $250 million group, significant market share remains in the hands of CU*Answers (92), CMC-FLEX (90) and Finastra (70).

As size begins to increase, Finastra owner of the UltraData platform gains more traction, moving into third behind Fiserv and Symitar with 40 credit union clients between $250 million and $1 billion in assets.

It’s also interesting to look at year-over-year net gains in client numbers. There were 10 that showed a net positive from the second quarter of 2017 to 2018. Most of the gains were small, with Corelationclaiming the top spot there with a net gain of 6.

Properly choosing and effectively partnering with the right core processor can allow credit unions to respond to a changing marketplace with product and service enhancements, all while controlling expenses.

That’s true regardless of size, as shown in the table that compares performance by asset size.

Callahan’s annual Supplier Market Share Guide: Credit Union Core Processors offers an in-depth examination of the core processor market. Download the 2019 edition today.

Click the tabs below to view graphs.

TOP PROVIDERS BY NUMBER OF CLIENTS <$50M

TOP PROVIDERS BY NUMBER OF CLIENTS <$50M

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.18

© Callahan & Associates | CreditUnions.com

Fiserv had 823 core processing clients of less than $50 million in assets in the second quarter of 2018. That’s from a client count of 1,775 credit unions. FedComp, meanwhile, had 596 in that asset group, all but one of its total client count in the second quarter of 2018.

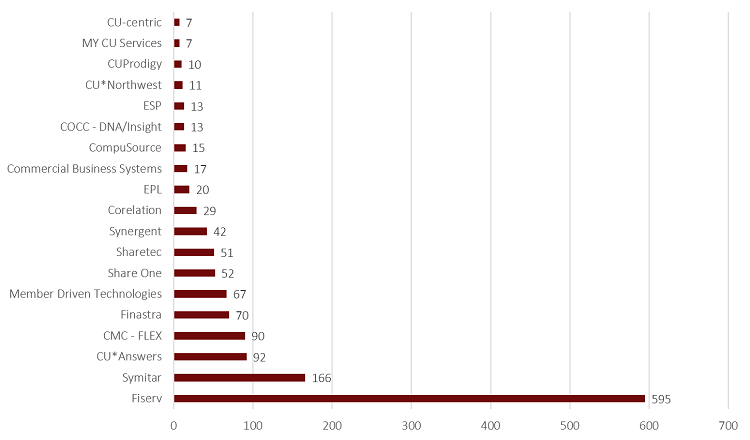

TOP PROVIDERS BY NUMBER OF CLIENTS $50M-$250M

TOP PROVIDERS BY NUMBER OF CLIENTS $50M-$250M

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.18

© Callahan & Associates | CreditUnions.com

Fiserv claimed as core clients 595 of the 1,436 credit unions in the $50 million to $250 million asset class as of mid-2018. Symitar was a distant second at 166.

TOP PROVIDERS BY NUMBER OF CLIENTS $250M-$1B

TOP PROVIDERS BY NUMBER OF CLIENTS $250M-$1B

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.18

© Callahan & Associates | CreditUnions.com

There were 600 credit unions of $250 million to $1 billion in assets as of June 30, 2018. Fiserv and Symitar together, at 234 and 210, respectively, accounted for approximately 75% of the market share for that group. Finastra’s UltraData platform claimed 40.

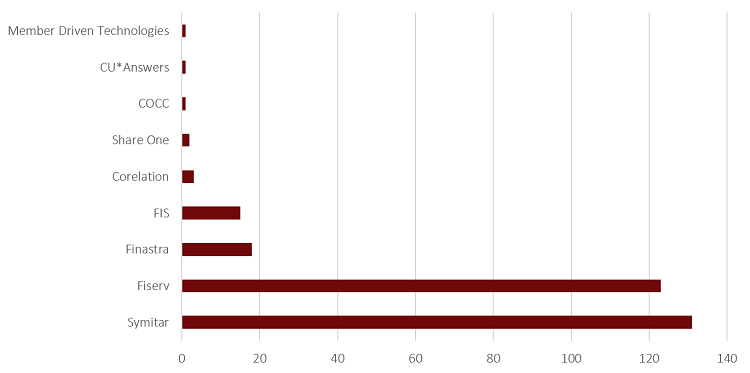

TOP PROVIDERS BY NUMBER OF CLIENTS >$1B

TOP PROVIDERS BY NUMBER OF CLIENTS >$1B

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.18

© Callahan & Associates | CreditUnions.com

Symitar had the most billion-dollar credit union core clients, at 131, with Fiserv close behind at 123. Together, that’s 83.3% of the market share for the big credit unions.

MARKET SHARE FOR TOP 20 CORE PROVIDERS BY NUMBER OF CREDIT UNION

MARKET SHARE FOR TOP 20 CORE PROVIDERS BY NUMBER OF CREDIT UNION

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.18

© Callahan & Associates | CreditUnions.com

Fiserv’s market share as measured by client count dropped slightly from 31.99% to 31.72% in 2018. Symitar’s rose slightly from 10.83% to 11.28%. Small credit union specialist FedComp remained virtually unchanged, moving from 10.67% at mid-2017 to 10.64% a year later.

CORE PROCESSOR CLIENT PERFORMANCE COMPARISON BY ASSETS

CORE PROCESSOR CLIENT PERFORMANCE COMPARISON BY ASSETS

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.18

© Callahan & Associates | CreditUnions.com

The 211 credit unions running on FIS core platforms average $863.2 million in assets and 2.85% in operating expenses/average assets, which is considered a key efficiency measure. Meanwhile, the 597 credit unions on the FedComp platform average $5.1 million in size and have a similar opex ratio. Click here to view larger.

PLATFORM MARKET SHARE: TOP 25 IN NUMBER OF CLIENTS

PLATFORM MARKET SHARE: TOP 25 IN NUMBER OF CLIENTS

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.18

© Callahan & Associates | CreditUnions.com

For the past two years, more credit unions have run on Symitar Episys than any other platform.

This article initially appeared in Credit Union Times in February 2019.