Year-end financials are proving prosperous for the members of at least one credit union. Late last year, Sentry Credit Union ($95.8M, Stevens Point, WI) returned $400,000 in bonus dividends and interest loan rebates to its members. The dividend bonus is 2.5 times more than its average dividend output, and the interest loan rebate is 12.5% of what members paid.

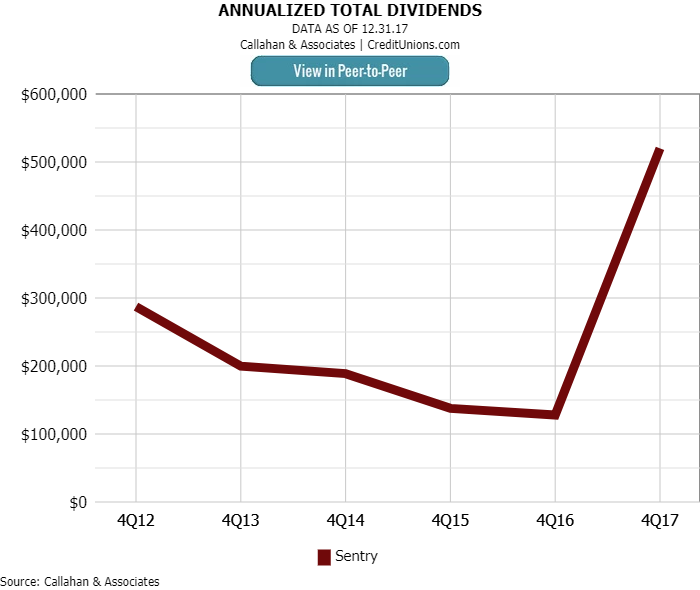

The magnitude of this dividend payout exceeds that of previous year-ends by more than 300%. Sentry’s current average dividends per member is $78, much higher than historical industry averages that have hovered around $55 per member.

So, why now?

Sentry president Rex Fair says his credit union performed exceptionally well in 2017, including exceeding its non-interest income budget by $100,000. So, the Wisconsin cooperative decided to reward its members by returning extra value. ContentMiddleAd

Fair adds that the decision was easy, given the relatively low opportunity cost for bonus dividends. This enabled the credit union to strengthen member relationships and keep its net worth ratio at 15%. And at at 17.8%, Sentry’s dividend-to-income ratio, the amount of dividends paid to members relative to the credit union’s net income, is also higher than industry averages.

Sentry deposited the payout money on Nov. 29, just in time for the holiday season, and made an announcement on its website the day after to explaine to members the sudden growth in their accounts

The credit union received positive responses from members in the form of calls, emails, and even in-person visits to the office proving that members recognize and appreciate the efforts of their credit union.

Going forward, Sentry’s goal is to increase dividends every quarter rather than relying on year-end bonus dividends. Sentry focuses on being different its believes its service should be better than what members find at other financial institutions. This year-end return is just one example of the cooperative ownership difference.

It was, by our estimations, one of the best things that we’ve done in a number of years to communicate back to the membership that we are a financial cooperative, that we work for the benefit of our members, and this was one way to acknowledge and thank them for their business, Fair says.