Top-Level Takeaways

-

Members, both new and existing, continued to increase their credit and debit use over the last decade.

-

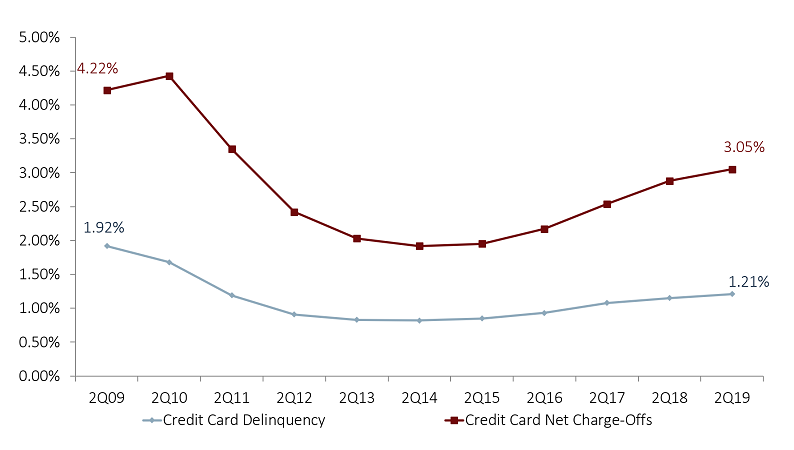

Delinquencies and charge-offs are also on the rise but remain below 2009 levels.

-

Despite rising credit card asset quality, a well-managed card portfolio is still a profitable venture and an important tool for member engagement.

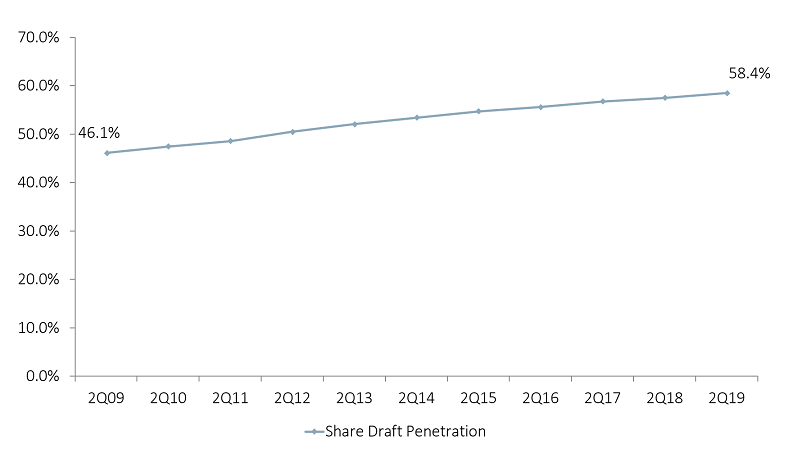

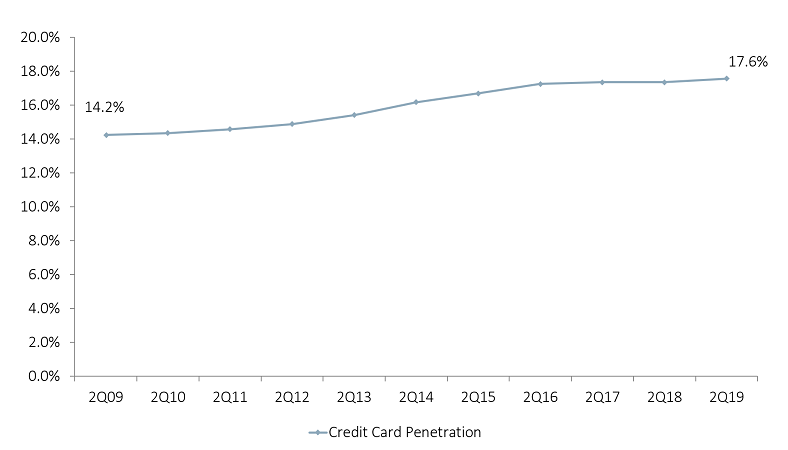

More members at U.S. credit unions use debit and credit cards than a decade prior. As of June 2019, 58.4% of credit union members hold a share draft account with their credit union, while 17.6% have a credit card.

According to the Federal Reserve’s Quarterly Report on Household Debt and Credit 16.8 million credit card accounts were opened by all card issuers in the past year. The Fed also says that in the second quarter of 2019, credit card debt made up 6.3% of total household debt that’s 2 basis points more than the same time last year. At the same time, credit card lending increased $39 billion to $870 billion, which is the highest it has been since the fourth quarter of 2008.

The past four years have been the most profitable for card issuers this century. The credit union movement’s experience with plastic has shown product engagement increasing alongside growth in credit union membership overall.

Engagement Through Checking Accounts Continues Post Recession

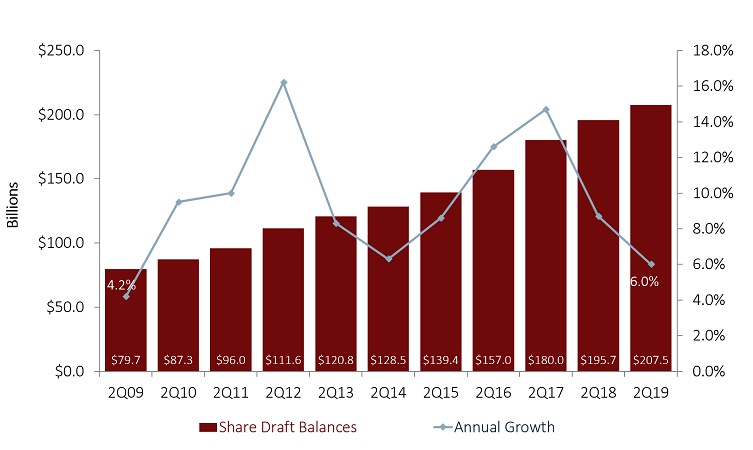

Share draft balances have steadily grown in the past decade. As of the second quarter of 2019, share draft balances at the U.S. credit unions totaled $207.5 billion, up 6.0%, or $11.8 million, year-over-year accounting for 16.2% of total share growth.

Customize Your Scorecard

Engagement credit cards delinquencies where does your credit union stand compared to peers? Request a data scorecard and we’ll compare your credit union to national and local peers using these ratios and more.

Learn More

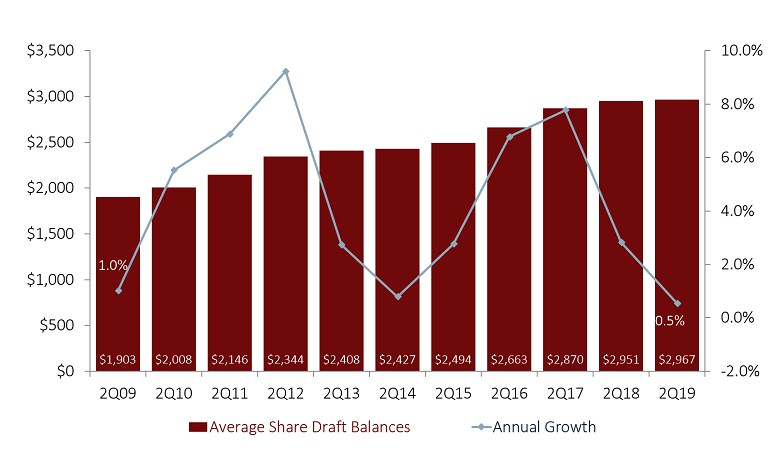

Total share draft accounts make up 30.5% of overall share accounts, a 5.5 percentage point increase over the past 10 years. Balances for this deposit product were 16.0% of total deposits as of June 2019. The average share draft balance among U.S. credit unions increased $16 in the past year, and $1,064 in the last 10 years, to $2,967 as of June 2019.

Share draft penetration, an indicator that a credit union is a member’s primary financial institution, reached its highest point yet: 58.4% as of second quarter 2019. That’s up 12.4 percentage points in the past 10 years.

Credit Card Balances Continue To Expand

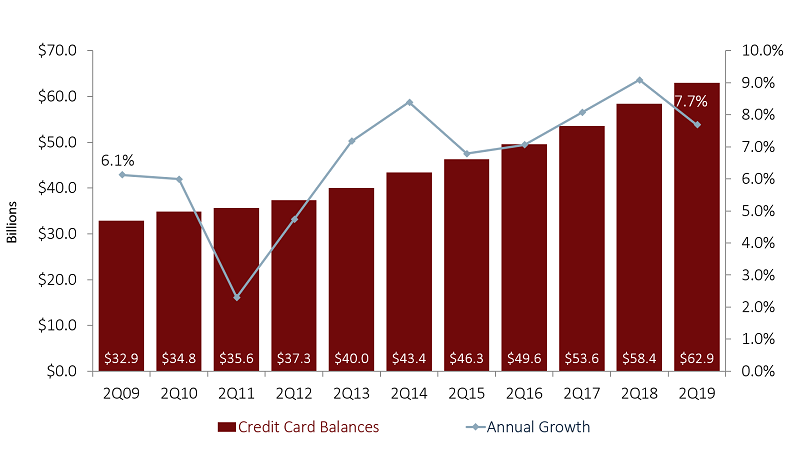

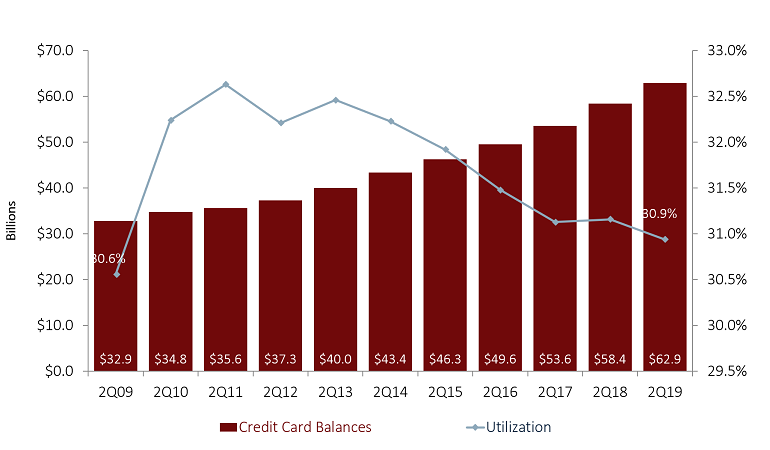

Credit unions held $62.9 billion in unsecured credit card balances at midyear. That’s a $4.7 billion increase in the past 12 months. At the same point, 62.2% of U.S. credit unions offered credit card loans to their members, an increase of 87 basis points year-over-year.

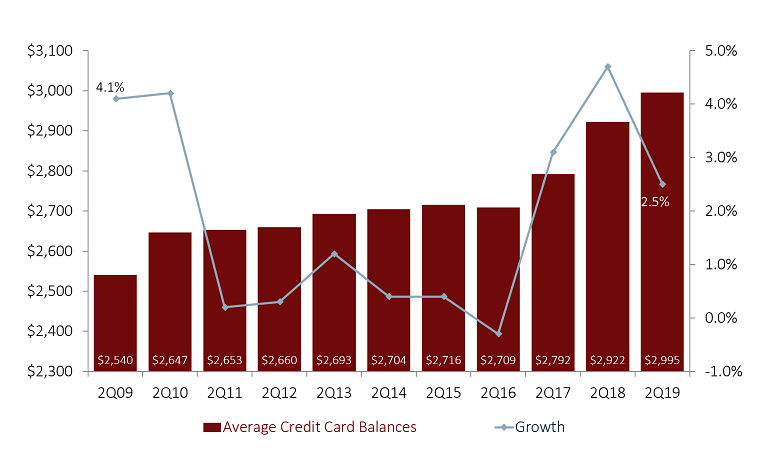

Average credit card balances grew 7.7% year-over-year, up $130 during that period to top $2,900 at midyear. As of June 30, 2019, 17.6% of America’s 119.7 million credit union members held a credit card with their cooperative, accounting for just more than 21 million accounts.

Credit card market share also moved up. Revolving consumer loan balance market share, largely composed of credit cards, reached 6.2% in the second quarter. Unfunded commitments expanded 9.0% to $129.1 billion as credit unions extended credit faster than members used it. The industry average credit card utilization rate as of June 30, 2019, was 30.9%, down 22 basis points from the year prior.

Delinquency Upswing Calls For Careful Management

The credit card delinquency rate as of June 30 was 1.21%, the highest among any loan products. That rate had peaked at 1.92% in 2009. It declined every year until 2014, when it hit a low of 0.82%.

Delinquent credit card loans account for 11.2% of all delinquent loans, 1.2 percentage points higher than the previous year. In 2009, delinquent credit card loans made up 7.2% of that total.

Net charge-offs reached 3.05% for credit cards in the second quarter of 2019. That’s a year-over-year increase of 17 basis points. Overall, credit cards accounted for 32.3% of total net charge-offs across all loan products at midyear. This is an increase of 7.7 percentage points since 2018.

Now, while credit cards might have above-average losses compared to other loan products, they also offer above-average returns in a well-managed portfolio. The decision to implement or expand a credit card program should be done in accordance with a credit union’s risk policy and specified parameters. And, along with debit accounts, consumer loans, and mortgages, they’re an important part of a member’s relationship with their credit union.

SHARE DRAFT BALANCES AND ANNUAL GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Emphasized by spikes in 2012 and 2017, share draft balances among U.S. credit unions have grown from less than $80 billion in 2009 to more than $200 billion in 2019. They now account for 16.0% of all share balances, a 5.3 percentage point increase over the past decade.

AVERAGE SHARE DRAFT BALANCES AND ANNUAL GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

The average share draft balance among U.S. credit unions increased $1,066 over the past 10 years, from $1,901 to $2,967 as of June 2019.

CREDIT CARD BALANCES AND ANNUAL GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Credit card balances grew 7.7% year-over-year to $62.9 billion as of June 2019, nearly double the $32.9 billion reported by U.S. credit unions a decade earlier.

AVERAGE CREDIT CARD BALANCES AND ANNUAL GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Average credit card balances held by credit union members has grown 17.9% over the past 10 years.

SHARE DRAFT PENETRATION

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Share draft penetration, considered a hallmark of member engagement, hit another record high of 58.4% as of June 30, 2019, continuing this metric’s growth since the Great Recession.

CREDIT CARD PENETRATION

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Credit card penetration reached 17.6% in the second quarter this year, up 3.3 percentage points from the 14.2% recorded in the second quarter of 2009.

CREDIT CARD BALANCES AND UTILIZATION

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

The average credit card utilization rate was 30.9% at the end of June as credit unions continue to extend credit faster than members can use it.

CREDIT CARD DELINQUENCY AND NCO

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

At 1.21%, the delinquency rate for credit cards was the highest among any credit union loan product. Overall asset quality in the loan product has risen in the second quarter since 2014.