The drumbeat of credit union industry consolidation continues.

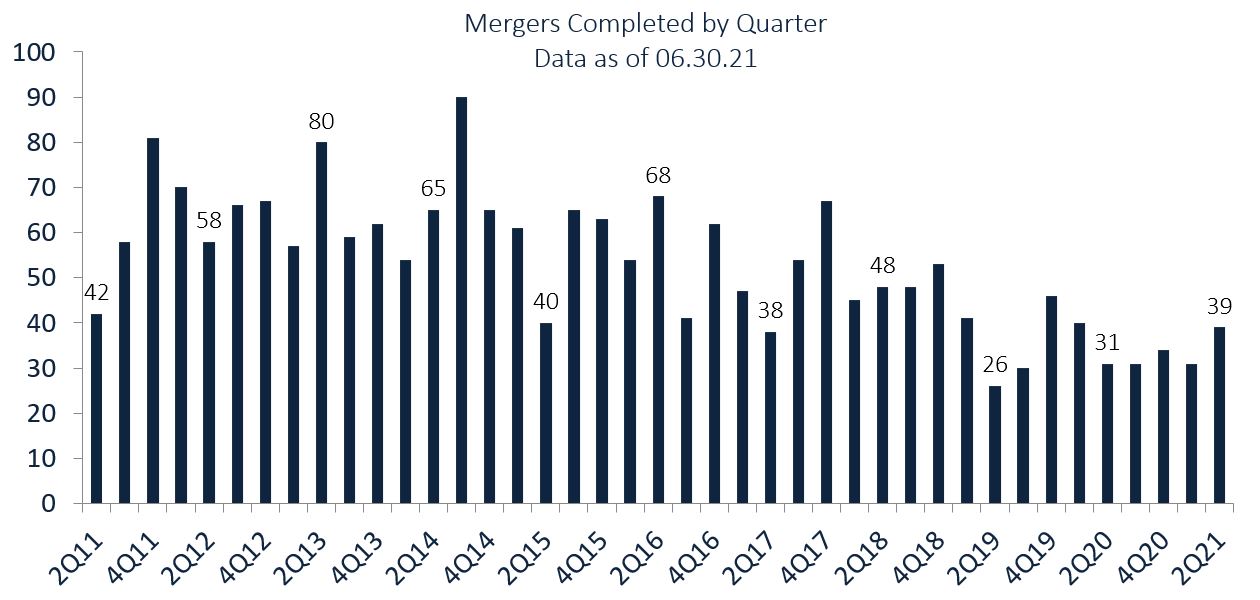

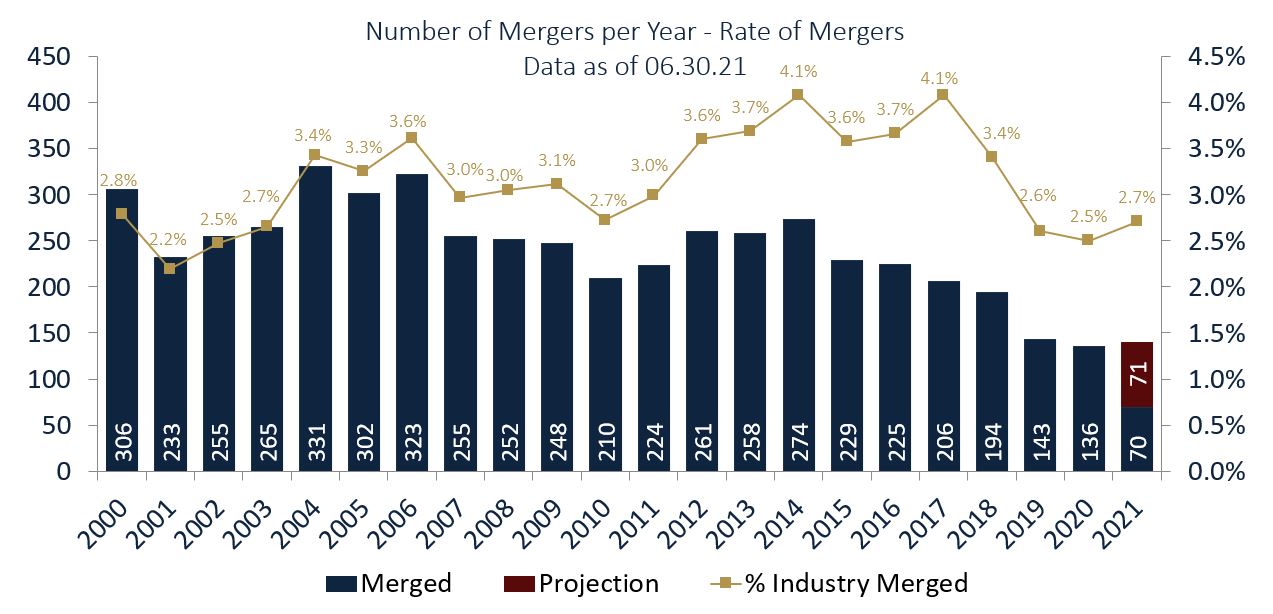

There were 39 mergers in the second quarter of 2021 and 31 in the first. That total, 70, for the first six months of the year is down one from the same time last year but brings the total from June 2020 to June 2021 to 135.

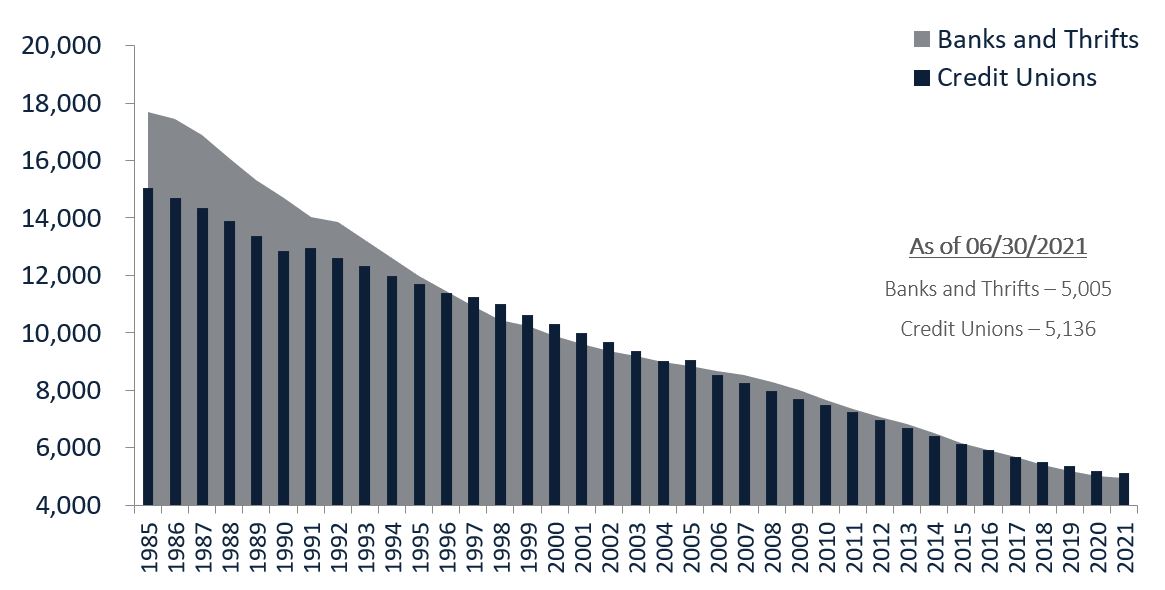

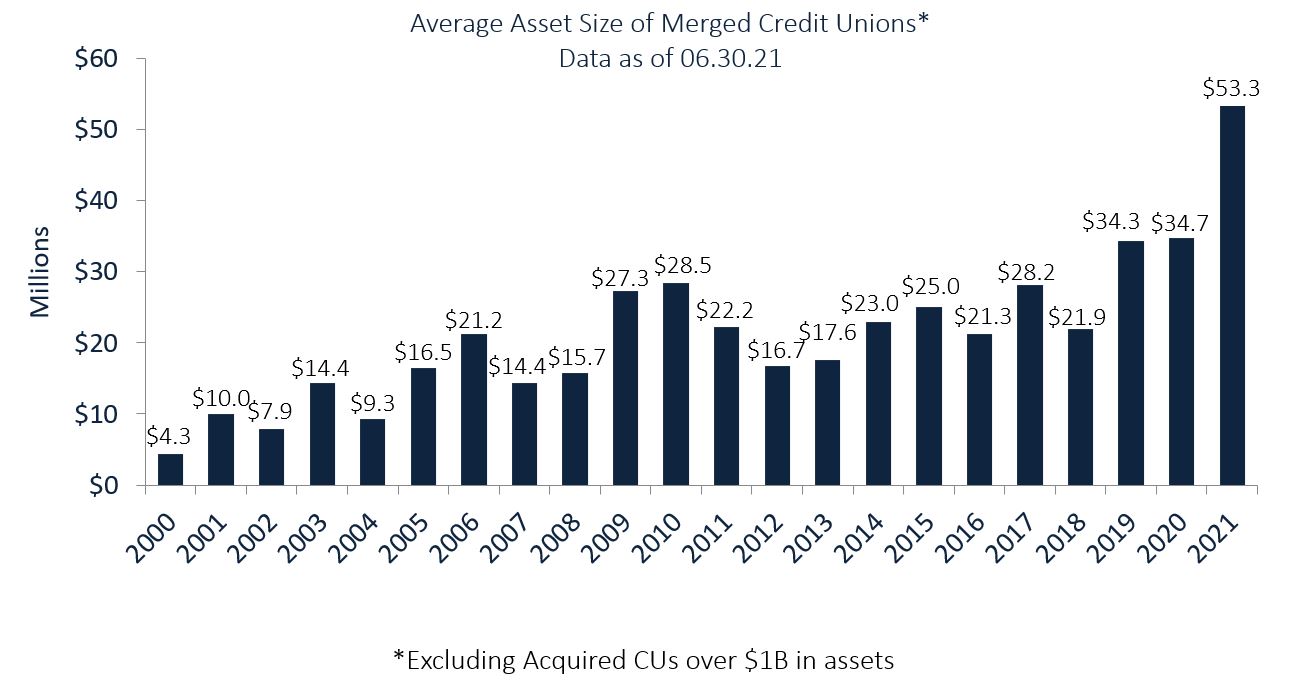

As of June 30, 2021, there were 5,005 banks and thrifts and 5,136 credit unions in the United States. By comparison, there were nearly 18,000 banks and thrifts in the United States and approximately 15,000 credit unions in 1985. It’s also worth noting that even after eliminating credit union mergers of more than $1 billion, 2021 has recorded the largest average credit union merger size by a wide margin.

Mergers By The Numbers

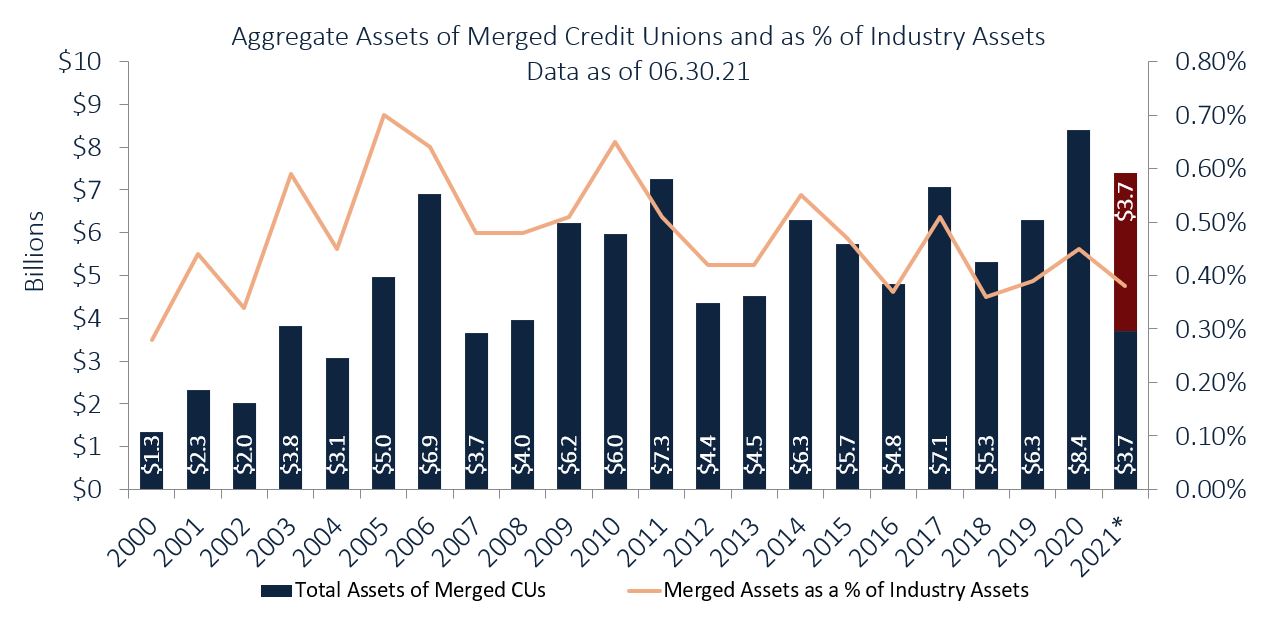

By total assets, the second quarter of this year saw far more merged away than in the first quarter of the year: $2.4 billion compared to $1.3 billion, or 78.5% more. For the first half of the year, total assets merged away was up 13.7% from the first half of 2021, $3.7 billion compared to $3.3 billion. In trailing one-year numbers, $7.2 billion in member assets were merged into other cooperatives from June 2020 to June 2021.

By average asset size, the average was $61.3 million for credit unions merged away in the second quarter of 2021, up 41.9% from the $43.2 million in average size from the first quarter of 2021. The average assets for merged credit unions in the first half of the year was $53.3 million, down 22.4% from $68.7 million on average in the first half of 2020 although one large $2.2 billion merger skewed the 2020 average value upward.

Industry Consolidation

For-profit and not-for-profit financial institutions have vanished by the thousands in the past 35 years, but banks have done so at a faster rate in recent years. Many small credit unions are resisting merger pressure as they continue to serve a dedicated field of membership.

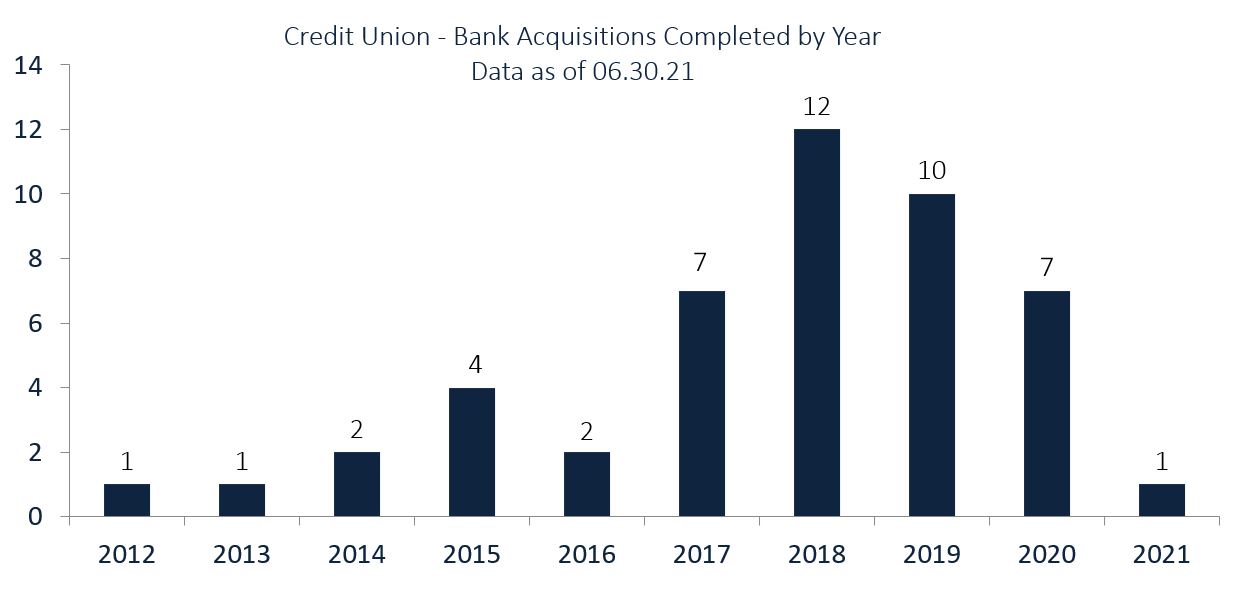

Bank Acquisitions

Some credit unions are searching for partners in the banking space. Although only one credit-union bank acquisition has officially processed so far in 2021, nine more have been accepted and await regulatory approval.

Mergers By Quarter

Mergers picked up in the second quarter compared to recent periods as economies reopened and credit unions reevaluated their growth options.

Merger Rate Per Year

Mergers have slowed in the past few years, but an active second quarter picked up the projected pace in 2021.

Assets Merged Away Per Year

No credit unions with more than $1 billion have been a part of a merger so far in 2021. Consequently, total assets merging (as a percentage of the full industry) has slowed.

Average Merger Assets (Excluding Mergers >$1B)

Standardizing by eliminating outlying mergers more than $1 billion, 2021 has the largest average merger size of any year prior by a wide margin.

The Largest Mergers In The Past Year

By state, Ohio had the most mergers from June 2020 through June 2021 at 14, followed by New York at 11, Illinois at 10, Pennsylvania at six, and five each for California and Virginia. Only 11 states did not have a credit union acquired by another credit during that time.

The five largest mergers in the second quarter of 2021 were:

- XCEED Financial Credit Union ($981.8m, CA) merged with Kinecta FCU ($5.4B, CA)

- Infinity FCU ($336.3M, ME) merged with Deere Employees Credit Union ($1.4B, IL)

- Premier FCU ($251.6M, NC) merged with Charlotte Metro Credit Union ($798.9M, NC)

- Aspire FCU ($141.6M, NJ) merged with Pentagon FCU ($27.3B, VA)

- Leyden Credit Union ($100.6M, IL) merged with Partnership Financial Credit Union ($248.4M, IL)

The five largest mergers from the first quarter of 2021 were:

- Columbus Metro FCU ($259.0M, OH) merged with Telhio Credit Union ($951.8M, OH)

- NorthStar Credit Union ($211.8M, IL) merged with NuMark Credit Union ($332.6M, IL)

- Lower Valley Credit Union ($128.4M, WA) merged with Self-Help Credit Union ($1.5B, NC)

- Riverset Credit Union ($117.6M, PA) merged with Allegent Community FCU ($151.7M, PA)

- Anderson FCU ($107.5M, SC) merged with Spero Financial Credit Union ($543.0M, SC)

No credit unions acquired more than one other credit union during the first half of 2021. However, from June 2020 to June 2021, PenFed acquired three credit unions totaling $441.7 million in assets; 11 others merged two smaller credit unions into their cooperatives.

A 5-Year Lookback

From June 2016 to June 2021, there were 852 credit union mergers. That’s an average of 170 mergers per year. All told, $32.2 billion in assets were consolidated into another credit union during this period.

The average size of each acquisition was $37.8 million in assets. Five credit unions with more than $1 billion in assets merged into a larger credit union a super merger during the past five years. The largest was Schools Financial Credit Union ($2.2B, CA), which merged into SchoolsFirst FCU ($16.8B, CA) in the first quarter of 2020.

Meanwhile, five mergers over the past five years were reverse mergers, where the surviving credit union had less assets than the credit union it acquired.

During the past five years, Pennsylvania had the most mergers with 70, followed by Ohio (58), California and New York (54), and Illinois (50). Every state had at least one merger during that time.

PenFed recorded the most mergers during the past five years. It acquired 16 smaller cooperatives with a total of $2.2 billion assets. American Heritage Credit Union ($3.6B, PA) and Nuvision FCU ($2.8B, CA) had seven mergers each totaling $56.0 million and $785.3 million in assets, respectively. Superior Credit Union ($1.4B, OH) and Peach State Credit Union ($737.1M, GA) recorded six mergers each with total assets of $206.0 million and $113.2 million, respectively.

Bank Acquisitions

In addition to credit unions merging with credit unions, some credit unions have acquired either an entire bank or a handful of bank branch locations. Fourteen credit union-bank transactions occurred between June 2020 and June 2021. Four of these transactions were branch acquisitions, the other 10 were full bank acquisitions.

This article appeared originally on Credit Union Times on Oct. 11, 2021.

Merger Analysis In Peer-to-Peer

Callahan’s Peer-to-Peer can help you analyze a potential merger. Research the performance of potential partners, project the financial impact of merging with other institutions, and identify how your services and technology align. See it in action with a custom scorecard.

Request A Scorecard