Credit unions faced wide-ranging challenges in 2020 a worldwide pandemic, social unrest, and political and economic upheaval. Still, merger activity largely mirrored the pace set in 2019.

There were 136 credit union mergers in 2020. This was seven fewer than the year prior. Of those, a record-setting two were significant, meaning near or more than $1 billion in assets. It is important to highlight significant mergers because they skew merger activity above the peer average.

Excluding the two outliers, the average asset size of merged credit unions fell in 2020 to $34.7 million. However, since 2015, more than 71% of all credit union mergers included institutions with less than $20 million in assets.

In a departure from recent years, credit union acquisitions of banks contracted. Those fell from 10 in 2019 to five in 2020, with many postponed or pending as of year-end. Read on for insight into key credit union merger trends.

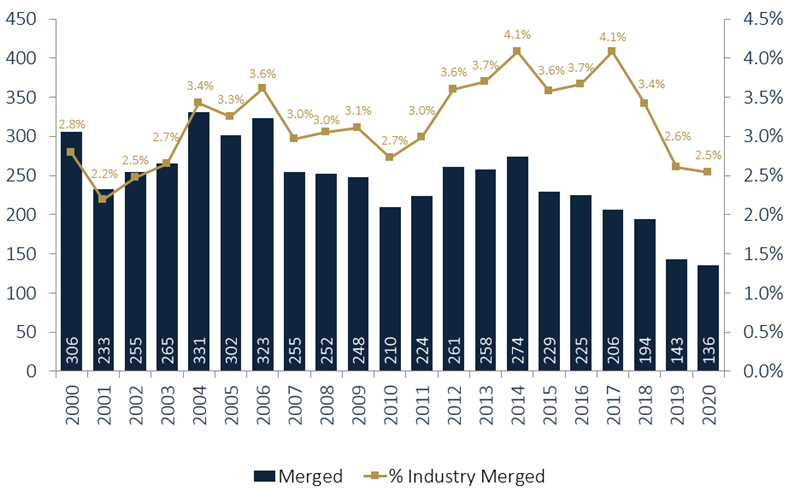

MERGER NUMBERS & RATE

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.20

The credit union merger rate declined slightly to 2.5% in 2020.

SOURCE: CALLAHAN & ASSOCIATES & NCUA

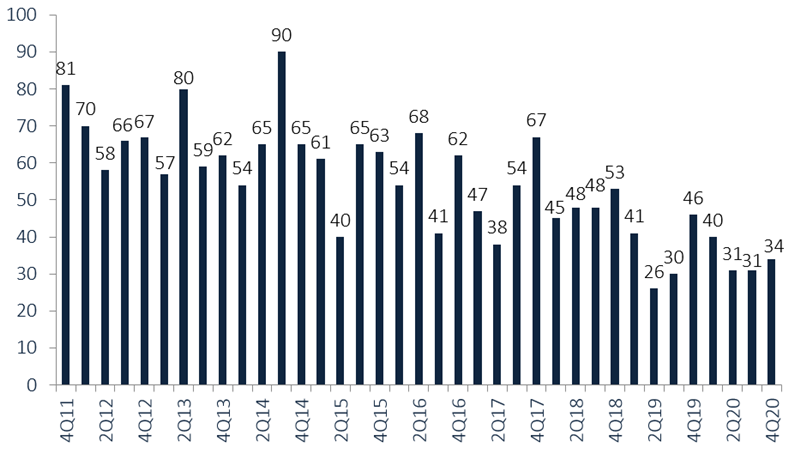

MERGERS COMPLETED BY QUARTER

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.20

In 2020, 136 credit unions merged with other credit unions; that was seven fewer than in 2019.

SOURCE: CALLAHAN & ASSOCIATES & NCUA

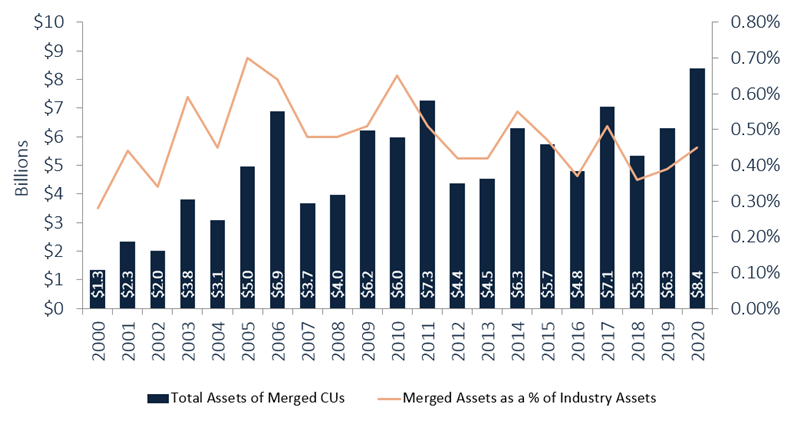

AGGREGATE ASSETS & PERCENTAGE OF INDUSTRY ASSETS OF MERGED CREDIT UNIONS

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.20

As a percentage of industry assets, total merged assets grew 33.9%, or $2.1 billion, year-over year. Excluding significant mergers, total merged assets declined 4.5%, or $217.2 million, during the same period.

SOURCE: CALLAHAN & ASSOCIATES & NCUA

AGGREGATE ASSETS OF MERGED CREDIT UNIONS

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.20

Including significant mergers, the aggregate assets of merged credit unions in 2020 exceeded 2019 by more than $2 billion.

SOURCE: CALLAHAN & ASSOCIATES & NCUA

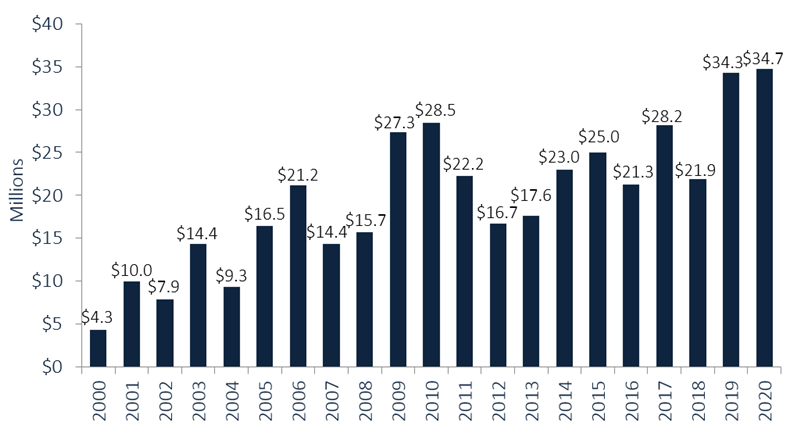

AVERAGE ASSET SIZE OF MERGED CREDIT UNIONS

FOR U.S. CREDIT UNIONS (EXCLUDING SIGNIFICANT MERGERS) | DATA AS OF 12.31.20

The average asset size of merged credit unions in 2020 was $34.7 million, up 1.3% from 2019.

SOURCE: CALLAHAN & ASSOCIATES & NCUA

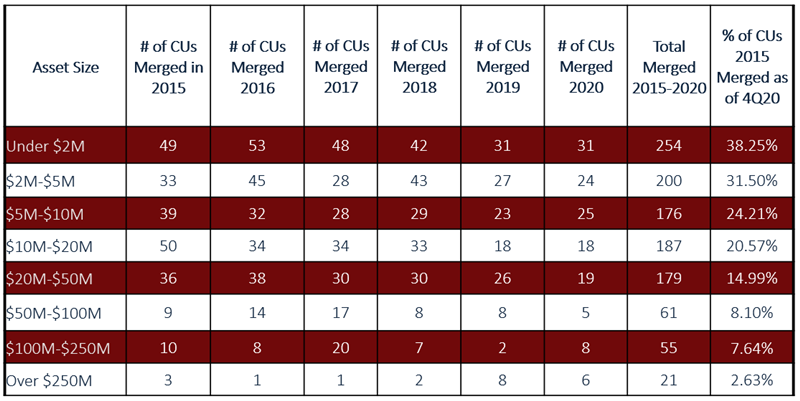

CREDIT UNION MERGERS

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.20

Credit unions with less than $20 million in assets have accounted for 71% of all mergers since 2015.

SOURCE: CALLAHAN & ASSOCIATES & NCUA

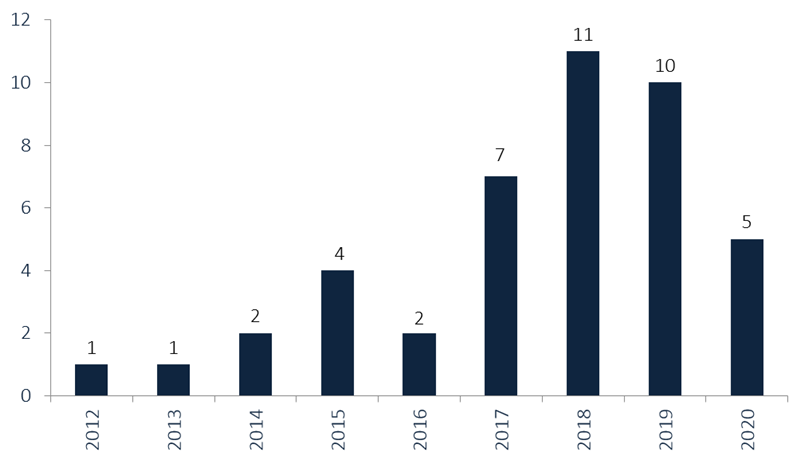

CREDIT UNION BANK ACQUISITION BY YEAR

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.20

Credit union bank mergers slowed in 2020; however, nine remained pending as of Dec 31.

SOURCE: CALLAHAN & ASSOCIATES & NCUA

Considering A Merger?

Callahan’s Peer-to-Peer has built in merger functionality that allows credit unions to scenario plan possible mergers by combining the call report data of two reporting credit unions to see financial impact using all of our pre-built charts including lending, deposits, income, expenses, capital, staffing, members, infrastructure, electronic offerings, and member metrics.

See For Yourself