The cooperative financial services industry counted 5,492 credit unions among its ranks as of Dec. 31, 2018. Versus one year prior, that’s 197 fewer institutions, 194 of which were merged or acquired. The year closed out with 3,376 federally chartered and 2,116 state-chartered credit unions.

Despite continued consolidation within the industry, credit unions still operated 21,204 branches throughout the country. At year-end 2018, credit unions served on average 5,600 members per branch. The average amount of deposits per branch was $58.5 million. That’s an increase of 4.6% from 2017 as deposit growth outpaced branch growth.

But over the years, delivery channels have evolved to include much more than brick-and-mortar branches. An increase in demand for technology combined with falling branch traffic has prompted credit unions to scale back the square footage of branches and incorporate technology into daily operations.

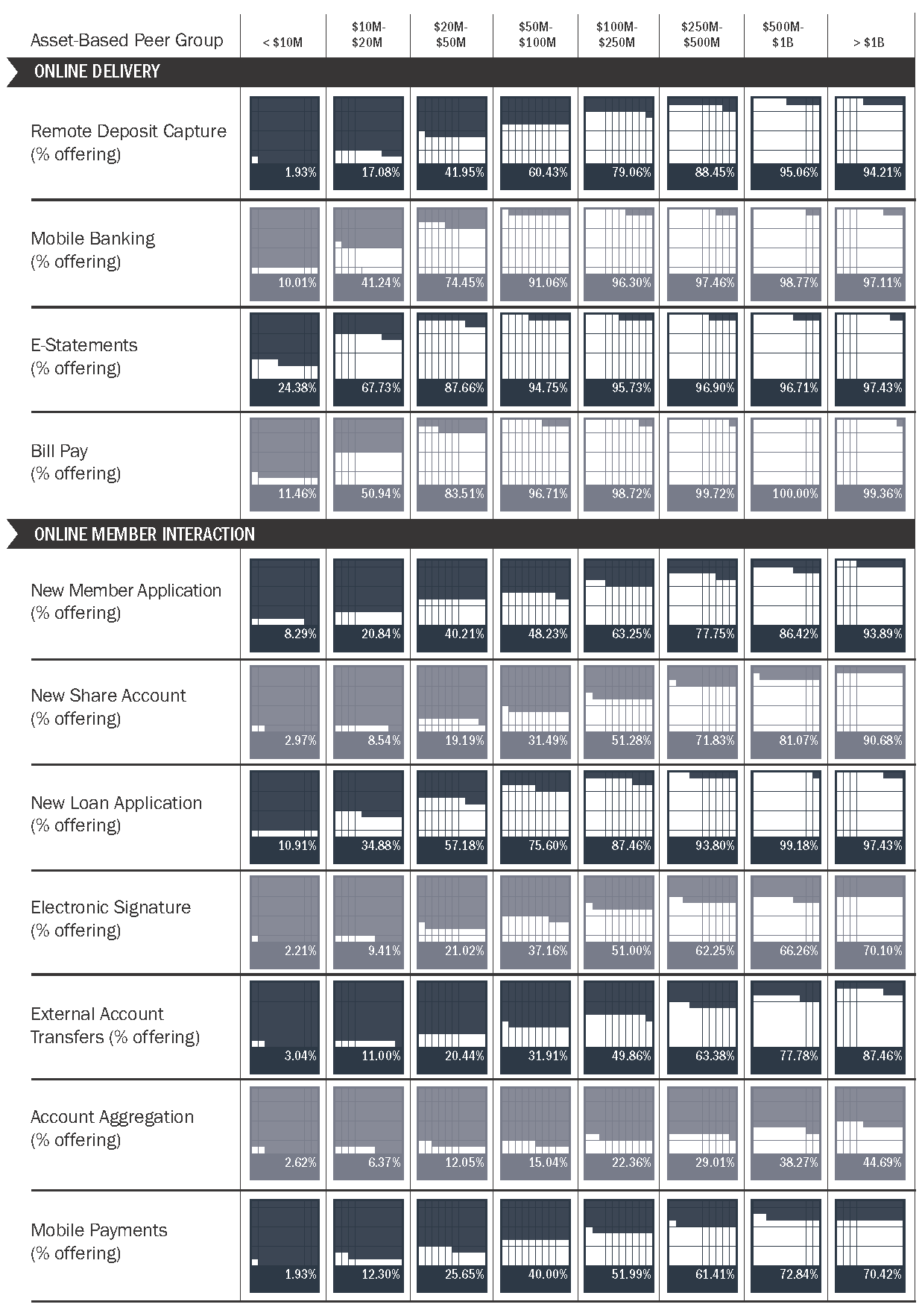

Credit unions operated 16,117 ATMs throughout the country as of Dec. 31, 2018. That’s an annual increase of 2.8%. Also as of Dec. 31, 62.1% of U.S. credit unions reported having mobile banking offerings. Seventy-two percent reported offering e-statements, which is the most popular electronic service. Other common electronic services include bill pay, new member applications, and new loan applications. At year-end, 66.7% of credit unions offered bill pay. For new member and loan applications, 40.8% and 54.9%, respectively, offered those through the virtual channel. With more members on the go, remote deposit capture is also becoming more important. Adoption rates of this service more than doubled annually, from 20.1% as of Dec. 31, 2017, to 43.7% at year-end 2018.

Expanding electronic services is another way credit unions provide more convenience and value for their members. These functionalities allow members to engage with their credit union without stepping foot into a physical location.

DELIVERY CHANNEL DEPLOYMENT & ONLINE INTERACTION

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.18

Callahan & Associates | CreditUnions.com

Case Study: Contact Center Security At The Sound Of A Voice

CU QUICK FACTS

Virginia Credit Union

Data as of 12.31.18

HQ: Richmond, VA

ASSETS: $3.6B

MEMBERS: 277,835

BRANCHES: 20

12-MO SHARE GROWTH: 2.6%

12-MO LOAN GROWTH: 8.1%

ROA: 1.00%

Virginia Credit Union ($3.6B, Richmond, VA) is using its members’ voices to help secure a critical delivery channel and gain efficiencies in the process.

The Richmond-based credit union’s contact center fields approximately 55,000 calls a month one in every 500 a fraudulent one. Unfortunately, challenge questions and other old-school techniques were annoying members and slowing down the authentication process, which was taking 90 seconds on average. So, the cooperative shifted how it authenticated members over the phone.

VACU landed on voice biometrics as a solution and rolled it out in late 2016, putting an end to a laborious process with abandonment rates of 16% to 20%.

Now, members can opt in to voice authentication and submit a digital print of their voice by engaging in 30-40 seconds of natural conversation. The system measures 140 different criteria and attaches the voice to a corresponding member number. When members call the credit union, those who have opted into voice identification speak naturally for six seconds to confirm their voice belongs to them.

Before members can opt into voice identification, however, the credit union must still authenticate them. Rather than continue its lengthy legacy process, VACU looked for a better way. In the Commonwealth of Virginia, driver’s license numbers are not available in the public domain. Only state and local police and the Department of Motor Vehicles keep these numbers on file, which made them ideal for baseline member authentication.

We’ve found that more people have this number ready to provide us, says contact center manager Kate Hopson. Plus, since few organizations have it, it’s something that stops fraudsters each time.

How Do Your Electronic Service Offerings Stack Up?

Curious where you rank amongst your peers regarding electronic service offerings? It takes minutes using Peer-to-Peer to see how you stack up.