Read the full analysis or skip to the section you want to read by clicking on the links below.

- DEPOSITS

- MEMBERS

- MORTGAGES

- CREDIT CARDS

- LENDING

- BUSINESS LENDING

- AUTO LENDING

- EARNINGS

Total credit union revenue increased 9.6% in 2017 and reached $65.9 billion. This is the highest ever recorded year-end revenue. Up 11.4% to $48 billion, interest income comprised 72.8% of credit union revenue as of Dec. 31, 2017.

Total credit union revenue increased 9.6% in 2017 to reach $65.9 billion the highest ever reported year-end revenue.

For non-interest income, credit unions with more than $1 billion in assets held a higher percentage (over assets) of other operating income as compared to fee income. At 0.78%, this was 58 basis points higher than credit unions with less than $20 million in assets. The industry average at year-end 2017 was 0.70%. Credit unions between $100 million and $1 billion in assets had strikingly similar balances of fee income and other operating income, contributing roughly 55% and 45% of total non-interest income, respectively.

Non-interest income as a percentage of average assets was highest for credit unions with assets between $250 million and $500 million.

ContentMiddleAd

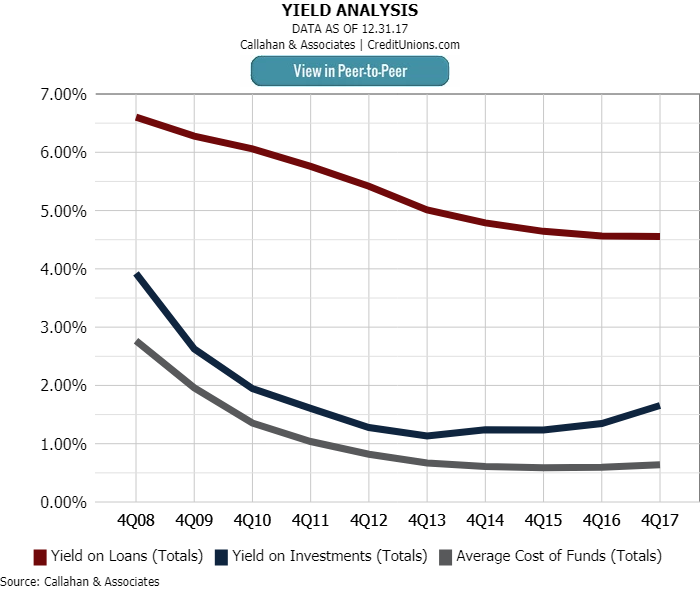

Industrywide, yield on investments improved 31 basis points annually to 1.66% as of Dec. 31, 2017. This is the highest year-end rate since 2011. Yield on loans has steadily decreased since 2008 thanks in part to the low interest rate climate in the United States; however, it was down only 1 basis point in the past year to 4.55%. Additionally, cost of funds increased 5 basis points to 0.64%,the first uptick since 2008. Typically cost of funds increases in the fourth quarter, however the year-over-year increase suggests credit unions are gradually paying more on deposits in certain products.

Yield on investments increased 31 basis points. Yield on loans, which has steadily decreased since 2008, remained relatively steady amid the ongoing low interest rate climate.

The efficiency ratio, excluding the provision for loan losses, decreased in all regions in 2017, and the industry average dropped 1.82%. Credit unions in the Southeast Region posted the highest efficiency ratio in the nation, 74.1%, even though the region improved that metric 2.9 percentage points year-over-year, also the highest in the nation. The region with the lowest efficiency ratio was the Mid-Atlantic. At 64.1%, the ratio was 1.9 percentage points lower than last year.

Dig Deeper Into Data

Want to see how your business lending numbers stack up against peers? Build displays, filter data, track performance, and more with Callahan’s Peer-to-Peer.

Efficiency improved across the nation. Southeast credit unions posted the largest improvement in the efficiency ratio of any region in the past 12 months.