In January 2021, Callahan & Associates surveyed credit union leaders across the country about their individual approaches to member relief throughout the COVID-19 pandemic. The results were varied and insightful.

Credit unions offered financial support to members in myriad ways, including payment deferrals, emergency loans, fee refunds, waivers, community support, and financial counseling. Callahan’s survey focused on three areas: loan deferrals and enrollments, repossessions, and additional relief packages. Each section offered invaluable insight into credit union decision-making and reinforced the member-centric model they operate under.

Loan Deferral And Automatic Enrollment Criteria

Key Takeaways

-

Fewer than 13% of responding credit unions automatically enrolled members into deferral programs.

-

Of the 87% that did not automatically enroll members, the majority required members to request deferrals but mandated little to no documentation of need in the initial round of requests.

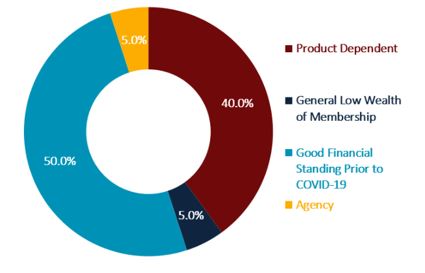

CRITERIA FOR AUTOMATIC ENROLLMENT IN DEFERRAL PROGRAMS

FOR SURVEY RESPONDENTS | DATA AS OF 12.31.20

Callahan & Associates | CreditUnions.com

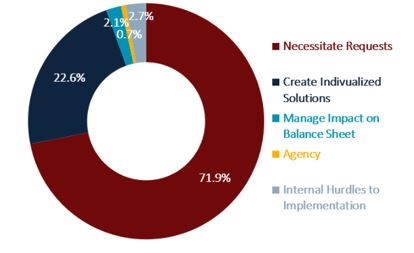

REASONS FOR NON-AUTOMATIC ENROLLMENT IN DEFERRAL PROGRAMS

FOR SURVEY RESPONDENTS | DATA AS OF 12.31.20

Callahan & Associates | CreditUnions.com

Fewer than 13% of responding credit unions automatically enrolled members in payment deferral programs. The two most common factors these credit unions considered when implementing such programs were product type and the financial standing of accounts prior to COVID-19.

Of the credit unions that automatically enrolled members, 40% did so for an entire product line. Most commonly, they removed minimum payments and did not require payments on credit card balances.

Additionally, half of the credit unions that automatically deferred payments did so based on whether the account was in good standing prior to COVID-19. These credit unions automatically extended relief to members who demonstrated financial hardship as a direct result of the pandemic.

A full 87% of survey respondents did not automatically opt members into deferral programs. Almost 72% of those credit unions said they declined to do so because not all borrowers needed to defer payments and it was the member’s prerogative to request one. In such cases, the credit union promptly offered its programs, often requiring little or no documentation.

Slightly more than one-fifth of credit unions that required members to request a deferral created customized programs based on specific member needs. These credit unions gauged individual situations and offered relief that worked for both the credit union and the member.

Repossessions

Key Takeaways

-

Almost 70% of responding credit unions adjusted repossession strategies in response to COVID-19.

-

The total balance of repossessed assets fell 22.9% between the first and second quarter of 2020 and has not increased to pre-COVID-19 levels.

-

Credit unions reported they eased repossession policies if members communicated financial burdens related to COVID-19.

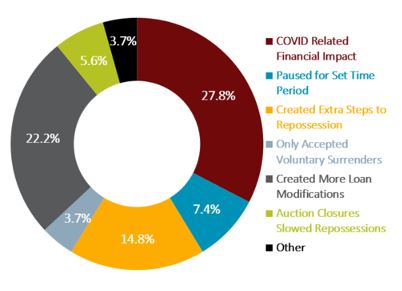

REASONS FOR CEASED OR SLOWED REPOSSESSIONS

FOR ALL SURVEY RESPONDENTS | DATA AS OF 12.31.20

Callahan & Associates. | CreditUnions.com

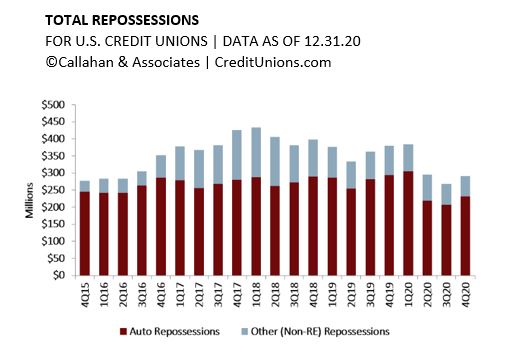

TOTAL REPOSSESSIONS

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.20

Callahan & Associates | CreditUnions.com

Across the country, various state and local governments instituted moratoriums on repossessions for specific loan products. In addition to government-mandated pauses, credit unions altered their own strategies for repossessions and collections based on the individual circumstances of their members as well as other factors.

Almost 70% of responding credit unions reported ceasing or slowing repossessions as a result of COVID-19. Of these credit unions, all reported changing their approach to repossessions starting at the end of March 2020, with altered strategies varying from two months to indefinitely. More than 25% of these credit unions said they declined to repossess if the member expressed financial hardship related to COVID-19. Similar to deferments, if a member was unresponsive or past due prior to the pandemic, many credit unions worked toward a mutually beneficial solution with those members.

Of credit unions that paused repossessions, 22% said they worked individually with members using a case-by-case approach. To help members keep their cars, credit union offers included skip-a-pay options and loan modifications.

At credit unions nationwide, the total balance of non-real estate repossessed assets decreased 23.3% year-over-year to $291.2 billion through Dec. 31, 2020. Between the first and second quarters of 2020, balances declined 22.9% to less than $300 million, a threshold credit unions have not surpassed since.

Other Relief Programs And Plans For 2021

Key Takeaways

-

Beyond loan payments, credit unions offered an array of relief programs, including fee waivers, financial counseling, and emergency loan programs.

-

Different segments of the economy are recovering at different rates, and credit unions are tailoring relief options to the specific needs of their members.

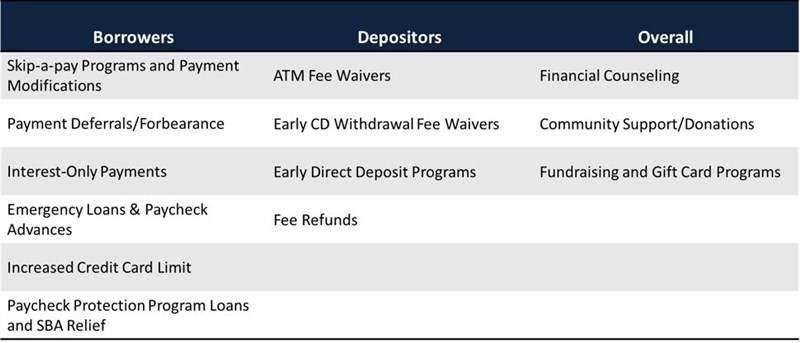

In addition to deferred loan payments and ceased vehicle repossessions, credit unions have offered myriad other programs for member relief. Many credit unions tailored options specifically to the needs of their market and communities.

A majority of credit unions that responded to Callahan’s survey reported creating low-interest emergency loan options in addition to payment relief. Credit unions also waived or refunded various deposit fees to provide members breathing room and access to liquidity. Lastly, credit unions offered financial counseling, focused on fundraising, and made generous donations all factors that impact the financial health of their members.

As the economy recovers from COVID-19 in what economists call a K-shaped recovery, some consumer segments will recover more quickly while others will face more pronounced challenges. Professional services and sectors that transitioned to work-from-home arrangements have experienced a more rapid recovery, whereas the service, retail, and hospitality industries continue to face hardships and significant uncertainty. If 2020 is any indication, credit unions will continue to adapt their relief programs to address the distinct needs of their members.