The median credit union loan portfolio expanded 4.0% year-over-year. Performers in the top 20th percentile posted 12.3% growth while those in the bottom 20th percentile reported their loan portfolios shrunk 4.2% over the period.

Read more about fourth quarter lending.

Credit unions in the bottom 20th percentile sold on average 16.7% of their first mortgage loans to the secondary market while top-selling credit unions in the upper 20th percentile sold 80.5% on average. The industry median for sales to the secondary market as a percentage of total first mortgage originations was 45.0%.

Read more about fourth quarter mortgage lending.

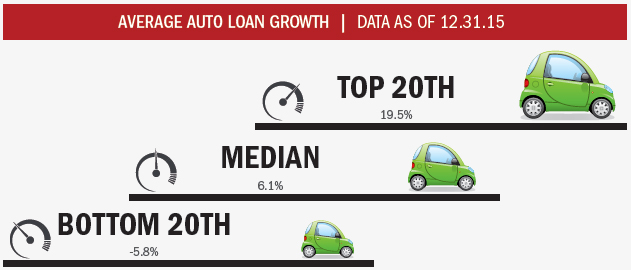

Credit unions reported median year-over-year auto loan growth of 6.1% as of December 2015, up from 5.2% the previous year.

Read more about fourth quarter auto lending.

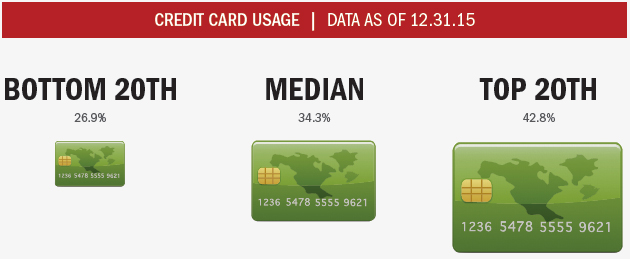

For all three percentile rankings (bottom 20th, median, and top 20th), credit card usage rates declined slightly from the previous year-end levels.

Read more about fourth quarter credit card lending.

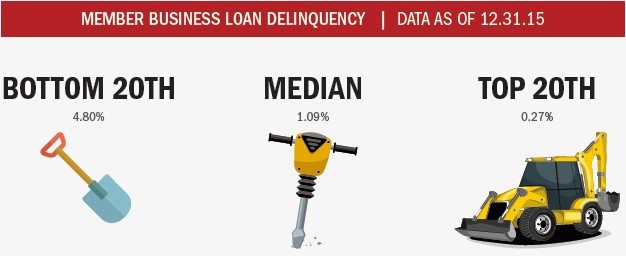

The median MBL delinquency for the industry was 1.09% as of December 2015, over 3 percentage points lower than credit unions in the bottom 20th percentile who reported delinquency of 4.80%, but greater than the top 20th percentile, where credit unions posted an MBL delinquency rate of 0.27%.

Read more about fourth quarter member business lending.

Source: Peer-to-Peer Analytics by Callahan & Associates.