Read the full analysis or skip to the section you want to read by clicking on the links below.

- DEPOSITS

- MEMBERS

- MORTGAGES

- CREDIT CARDS

- LENDING

- BUSINESS LENDING

- AUTO LENDING

- EARNINGS

Member growth at credit unions continued at a near record pace. Credit unions added 4.4 million new members and grew 4.1% in 2017. The member roster totaled 112,651,793 as of Dec. 31, 2017. The lion’s share of those new members joined credit unions with assets that topped $1 billion.

Regionally, Western credit unions led the nation in annual membership growth. Membership at credit unions in Alaska, Arizona, California, Guam, Hawaii, Idaho, Nevada, Oregon, Utah, and Washington increased 6.5%.

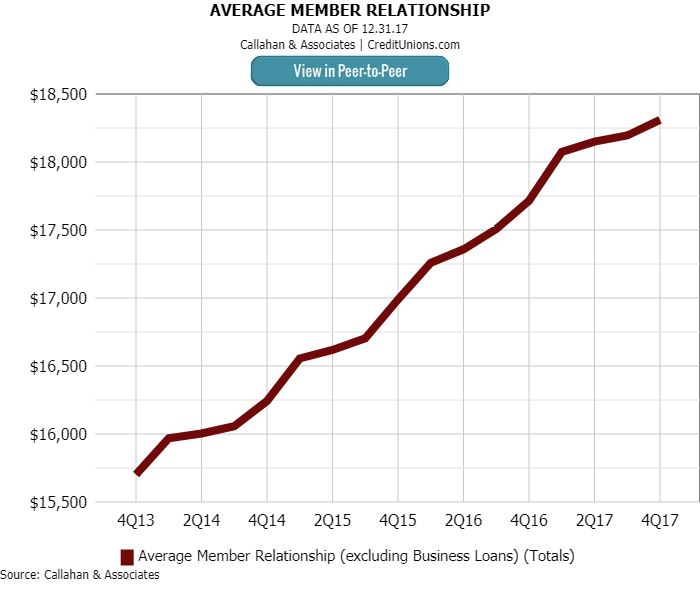

The industry’s average member relationship calculated by adding loans and shares less member business loans secured by 1-4 family and member commercial loans, divided by total members increased 3.3% year-over-year and reached $18,309 in the fourth quarter. Credit unions in the Southeast had an average member relationship that was lower than other regions, but credit unions there also posted the greatest growth in this metric 4.2% or $663 more than year-end 2016. Average member relationships increased across the nation and reached a high of $20,803 in the West.

ContentMiddleAd

Credit unions in the Mid-Atlantic paid the highest average dividends per member, $63. The national average in this metric was up from $53 last year to $57 as of Dec. 31, 2017. All regions increased their dividends per member by at least 5.6% from last year-end, a sign that credit unions are focusing on member relationships.

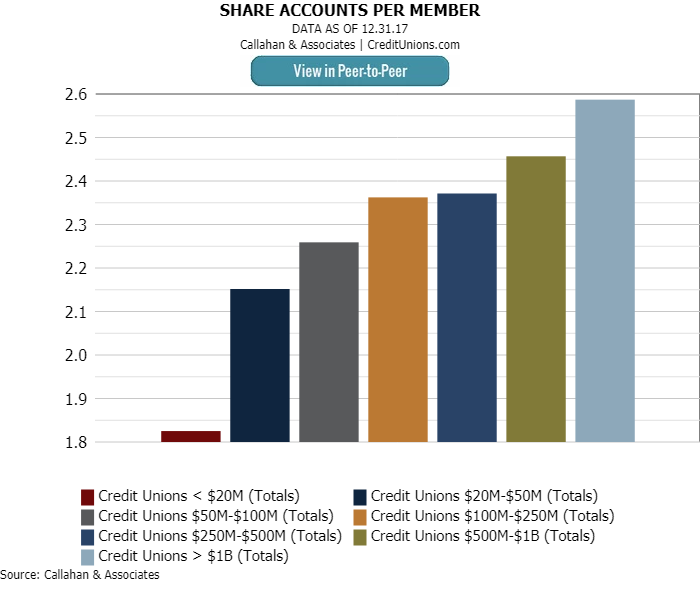

Nationwide, credit union members held 2.5 accounts on average with their credit union. Credit unions with more than $1 billion in assets reported the highest average accounts per member, 2.6. This is 16 basis points higher than the industry average. Accounts per member has increased at credit unions with assets less than $20 million and reached a high of 1.8 in 2017.

All asset classes reported increases in product per member over the past 12-months.

Average dividend per member increased across the nation as credit unions gave more back to their members.

How do your 4Q17 numbers compare to your peers? Find out today.

Credit union membership increased 4.1% year-over-year and reached 112,651,793.

Average member relationship continues to grow and totaled $18,309 at year-end 2017.