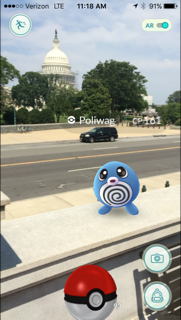

There were Pokmon everywhere. We (my colleague Liz Furman and I) had ridden the train and walked through downtown Washington, DC, on a hot July afternoon looking for them. There were plenty to be had.

Say hello to our little friends.

But we weren’t just looking for Pokmon. We had a more focused approach. Washington is a city of more than 40 credit unions and at least that many branches. Our idea was to visit four branches, see what these credit unions were doing if anything to attract the Pok-crowds, and have a larger conversation about marketing to trends. And yes, we caught a number of Pokmon.

On July 6, the developer Niantic (through a partnership with Nintendo) released Pokmon GO, a free-to-play, location-based augmented reality game. Like Team Rocket, it blasted its way to the top of the Android and iOS download charts. By its third day of release the app was being used for an average of 43 minutes per dayper player higher than WhatsApp, Instagram, Snapchat, and Facebook Messenger. At the height of its popularity Pokmon GO could boast similar numbers of daily active users as Twitter.

Pokmon GO has become the toast of the social conversation, and some credit unions are participating as well.

#PokemonGo may be inspiring a new generation of #art lovers. https://t.co/J1D8amtFOK

via @luxury#pokemon #nintendo pic.twitter.com/fsCiUpxBr6

OAS Staff FCU (@OASFCU) July 15, 2016

#PokemonGO Hill edition: Find the 3 Pokestops and 2 Pokegyms on #CapitolHill and tweet us your pics! pic.twitter.com/HXivWI7VdY

Congressional FCU (@CongressFed) July 20, 2016

These would be our credit union guides.

It was these posts that led Liz and I into the July heat to find some of these little monsters, but also some answers.

Along our journey we hit four area credit unions: Congressional Federal Credit Union ($852.3M), Library Of Congress Federal Credit Union ($229.8M), Department Of The Interior Federal Credit Union ($169.7M), and OAS Staff Federal Credit Union ($193.2M).

The first two took us to Capitol Hill, while the second two pulled us back toward Callahan’s offices near the White House. And while we didn’t see anyone actually playing the game at any one of these branch locations (besides us, of course), there was probably a reason for that. We had to go through a security checkpoint to reach each branch likely too high a barrier for even the most intrepid collectors.

But while these DC-based credit unions weren’t likely to receive any visitors, Arizona Federal Credit Union ($1.4B, Phoenix, AZ) was actively luring them in. The credit union sent out a post on Instagram announcing its intention to spend four hours luring Pokmon to one of its branch locations for four hours. (Luring is game-speak for setting up a module that attracts Pokmon to certain locations for 30 minutes)It’s difficult with us because we’re in a government building and you need clearance, says Danny Rivera, Department Of The Interior FCU’s e-commerce manager.It’s hard to get into the building so I doubt we’ll get many playing the game.

A photo posted by Arizona Federal (@arizonafederal) on Jul 18, 2016 at 11:49am PDT

Arizona FCU wasn’t just looking to help players catch Pokmon, however. It had ulterior motives. During the summer the credit union has helddigital focus days three times per week, according to Jason Paprocki, the credit union’s executive vice president and chief operating officer.

CU pok FACTS

cONGRESSIONAL FCU

Data as of 06.30.16

- HQ: Washington, DC

- ASSETS: $852.3M

- MEMBERS: 46,461

- EMPLOYEES: 152

- ROA: 1.3%

- POKEMON CAUGHT: 2

- POKESTOPS: 3

- SECURITY CHECKPOINTS:1

- EMPLOYEES PER POKEMON CAUGHT: 71.75

We hoped we might be able to lure some Pokemon players to the branch where they’d see the other technology and want to join a forward-thinking credit union with a great digital offering, Paprocki says.On those days the credit union has a team of employees demo the institution’s digital solutions for members in branch to get them both activated and asking questions. Solutions include mobile banking, mobile deposit, card management, and wearable apps, among others. Arizona FCU also brings out virtual reality headsets and an Amazon Echo for members to play with as a kind offuture of banking concept.

But even for credit unions without this kind of tie-in there can be value in posting about Pokmon or other trending topics.

CU POK FACTS

department of the interior FCU

Data as of 03.31.16

- HQ: Washington, DC

- ASSETS: $169.7M

- MEMBERS: 12,155

- EMPLOYEES: 34

- ROA: 0.32%

- POKEMON CAUGHT: 4

- POKESTOPS: 4

- SECURITY CHECKPOINTS:1

- EMPLOYEES PER POKEMON CAUGHT: 8.50

We tell credit unions all the time that your brand is a living, breathing thing and is as alive as anyone else in your credit union, says Amanda Thomas McMeans, founder and president of Two Score, an Ohio-based credit union marketing firm.So if your credit union is trying to determine whether to do something on social media or in-branch it has got to fit your brand personality.

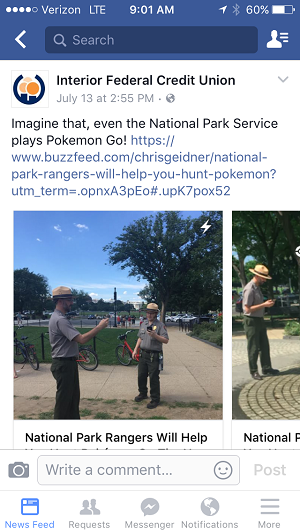

That’s a sentiment echoed by the Department Of Interior’s Rivera as well:

For us it needs to be trending but also relevant to our membership base, he says. The credit union posted a Buzzfeed article on Facebook showing how park rangers had downloaded Pokmon GO and would have conversations with other players, showing them around the parks and sharing a little history in the process.

CU POK FACTS

library of congress FCU

Data as of 03.31.16

- HQ: Washington, DC

- ASSETS: $229.8M

- MEMBERS: 9,646

- EMPLOYEES: 26

- ROA: 0.98%

- POKEMON CAUGHT: 6

- POKESTOPS: 8

- SECURITY CHECKPOINTS:1

- EMPLOYEES PER POKEMON CAUGHT: 4.33

I thought it was relevant, brought some comic relief, and drew attention to one of our SEG groups, Rivera says. For him, showing the credit union’s SEG groups that their credit union actually pays attention to the doings of the National Park Service and others differentiates the institution fromthe other banks that have nothing to do with them.

After deciding something is worthy of a post, the next step, says McMeans, is to put your own credit union spin on it essentially making sure that, whatever the initiative, the institution remains true to its brand.

Says Rivera,We want to let people know we’re part of the community and we stay up to date on what’s going on with them and we are available for their needs.

CU POK FACTS

o.a.s. staff FCU

Data as of 06.30.16

- HQ: Washington, DC

- ASSETS: $193.2M

- MEMBERS: 6,299

- EMPLOYEES: 22

- ROA: 0.32%

- POKEMON CAUGHT: 5

- POKESTOPS: 2

- SECURITY CHECKPOINTS:1

- EMPLOYEES PER POKEMON CAUGHT: 4.30

Because the rules for brands publishing on social media are a bit different, credit unions would do wise to edit expectations.

It can be hit or miss with some of these social sites, Rivera says.Our expectation is that it’s going to go out to everyone but it doesn’t really do that. The company works with a third party to handle its paid social media posts, but that outfit doesn’t promote its fun, trendy posts. While Rivera did not yet have the analytics available for how its Pokmon post fared, there’s almost always a large difference between the engagement on paid and unpaid posts.

McMeans advocates building a launch plan for communications by utilizing all of a credit union’s channels in multiple ways; whether that’s on social, online, mobile, or email.

We think when we put something out on social media once we’re going to have this flood of people come in, but that’s not how it works, she says. Of course, communication strategy will also depend on a credit union’s target market, she says.

For example,If it’s Pokmon do you want a bunch of 11-year-olds coming to your branch?

Like with any social media post, there are risks associated. Credit unions are governed by various regulations that are little concerned with popular trends or an in-branch Doduo.

Caught a doduo at @CongressFed Longworth branch! #pokemonGo #pokemonCU pic.twitter.com/y1ak7mZotv

Liz Furman (@LizFurmanCU) July 22, 2016

This means before posting, marketers must consider both the positive and negativewhat ifs? of a given post, including insurance and fraud ramifications. McMeans suggests having key credit union players in those conversations to help draw up internal policies and best practices. Having those conversations early can help mitigate risks later on.

For more on how to best use Pokmon GO at your credit union, check out our infographic below.

Liz Furman contributed to this article.