The COVID-19 pandemic and resulting lockdowns have wreaked havoc on health, livelihoods, and routines. The nation was focused in March and April on fighting the direct health impact of the virus; now, many economists predict the economic fallout from the pandemic will send the United States into a recession for the first time since the Financial Crisis of 2008.

Unemployment numbers support this forecast. The U.S. Department of Labor reported a loss of 20.5 million jobs in the month of April alone, sending the national unemployment rate to 14.7% the highest rate since the Great Depression.

Although there is hope many of these jobs will return after the lockdowns ease, it is undeniable that millions of Americans are facing a period of financial uncertainty. Credit unions, for their part, are pivoting their strategies to ensure the changing needs of their members remain front and center.

Early first quarter data from Callahan & Associates from more than 4,500 of the nation’s credit unions shows some of these changes in action.

Credit Union Balance Sheets

Callahan analysts project the collective loan-to-share ratio for U.S. credit unions a key metric for tracking major balance sheet dynamics dropped 1.3 percentage points year-over-year to 81.0% as of March 31. Although the credit union industry’s loan-to-share ratio typically declines between the fourth and first quarters as, among other factors, members deposit tax returns and cut spending after the holidays, this is the first time there has been a full year-over-year decline in the first quarter since March 2013.

On a quarterly basis, the drop is also substantial. The collective credit union loan-to-share ratio dropped 2.9 percentage points between December 31, 2019, and March 31, 2020. When viewed in conjunction with last year when credit unions reported a first quarter decline of 3.2 percentage points following the recession fears of December 2018 loan-to-share ratios are falling at rates not seen since the years following the Great Recession.

LOAN-TO-SHARE RATIO AND DECLINE FROM PREVIOUS QUARTER

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.20

Callahan & Associates | CreditUnions.com

Loan-to-share ratios steadily climbed during the recent economic recovery, but that growth seems to have plateaued.

Many macroeconomic factors can impact loan-to-share ratios, but one important historical trend is that consumers tend to spend and borrow more when an economy is booming and people feel confident in their financial situation. The opposite trend occurs in times of economic uncertainty or recession.

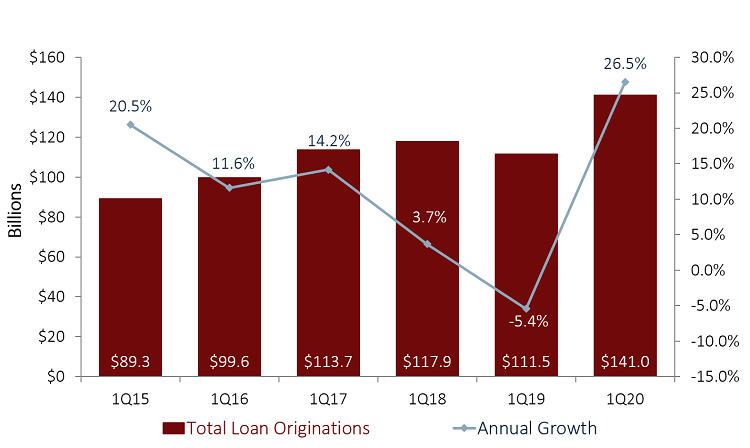

However, strikingly, loan originations in the first quarter were near record levels. A key factor here is that the Federal Reserve cut interest rates several times over the past year as part of its effort to sustain the longest economic expansion on record. As COVID-19 hit the U.S. economy in March, the Federal Reserve cut rates two more times to near 0% to stave off total collapse. These measures have been somewhat successful, as these cheaper loans are counteracting the downward pressure on the credit union lending business.

Credit unions originated a projected first quarter record of $141.0 billion in new loans during the first three months of the year, up 26.5% from last year’s rate. First mortgages were particularly successful, as credit unions helped their members purchase or refinance $51.2 billion in collective real estate, a whopping 96.7% more than at this point in 2019.

YTD LOAN ORIGINATIONS

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.20

Callahan & Associates | CreditUnions.com

Federal Reserve rate cuts are helping to counteract the economic fears of borrowers, making it easier to provide attractive lending terms, particularly in first mortgages.

However, the Mortgage Bankers Association projects that 54% of first quarter mortgage originations in the country were refinances, one of only four times this rate has topped 50% in the past seven years. This calculation is drawn from all institutions types not just credit unions but credit union first mortgage market share grew from 8.2% on December 31st to the highest-ever rate of 9.1% on March 31st, so it is likely refinances make up an even larger percentage for credit unions than for the national average.

Although capturing market share is great for the industry, the overall consumer trend of preferring refinances over purchases underscores a population that is more focused on saving than spending. This nationwide mindset of austerity is more notable in consumer lending, where Federal Reserve rate cuts have not had such a drastic impact.

Non-real estate loans, mostly consumer, make-up approximately 50% of the industry’s loan portfolio but are up only 3.7% year-over-year, the lowest first quarter growth rate since 3.0% in 2012. Auto loans reported the greatest deceleration they’re up 2.5% year-over-year after averaging double-digit growth for the previous six years while credit card balances grew 5.7%, their lowest March rate in eight years. Consolidating the above information, Callahan projects industry loan balances to be up only 6.7% annually, the lowest first quarter rate since 2013. This is well below the 8.4% share growth Callahan projects for the same period.

GROWTH BY LOAN PRODUCT OUTSTANDING

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.20

Callahan & Associates | CreditUnions.com

Despite record levels of originations, all loan types other than first mortgages are on a decidedly downward growth trend compared to recent years.

In short, members are buying and refinancing houses more than before, but they are not doing much else as non-real estate loans are falling off the books almost as fast as they are added. Additionally, credit unions are selling 35.5% of first mortgage originations YTD to the secondary market (Fannie and Freddie), so real estate lending is propelling credit union loan growth by approximately one-third less than the absolute origination total of $51.2 billion would imply.

These macroeconomic trends produce the declining loan-to-share dynamic we see today. Callahan projects volatility in loan and share balances will be even greater in the second quarter as credit unions deal with a huge influx of Federal money both from relief check deposits and PPP loan approvals.

Eugene Sela, the senior director of finance and accounting for AEA Federal Credit Union ($276.4M, Yuma, AZ), says the credit union has witnessed some of these changes firsthand, and he expects the trends to accelerate.

When we understood the [COVID-19] situation was not going away, we realized we would not have an easy path to generate budgeted loan amounts, Sela says. Loans will be hard to generate in the coming months. People are scared to spend. This is evidenced by the higher-than-normal liquidity nationwide.

Credit Union Reaction

Placed in the context of COVID-19 shutdowns, economic uncertainty, and a historically low interest rate environment, the movement of these top-line balance sheet categories makes sense. Put another way, the movement in loan and share balances reflects the changing needs of a scared and financially strained membership.

Early data points to one major strategy credit unions are employing to respond to these changes industrywide, they are increasing their provision for loan and lease losses (PLL). Credit unions hope if they can appropriately prepare for the economic impact of COVID-19, then they can remain solvent and available to provide financial support to members when they are most in need.

PROVISION FOR LOAN & LEASE LOSSES (BY QUARTER)

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.20

Callahan & Associates | CreditUnions.com

Although quarterly provisions have been rising since 2014, a 25.9% quarterly increase in the first quarter of 2020 moved PLL to levels not seen since the Great Recession. Note the PLL trends correlate closely with the loan-to-share graph above.

Credit unions allocated nearly $2.2 billion to their PLL in the first three months of the year, 25.9% more than last quarter and 34.2% more than the first quarter of last year. The $442.8 million increase since last quarter represents the largest quarterly increase in absolute dollar terms since the fourth quarter of 2008. Relatedly, the industry’s coverage ratio (total allowance for loan and lease losses divided by the total balance of delinquent loans) stands at 142.6%. This trails only the first quarter of last year for the highest level since 2000. Compared to March of 2007 when the industry’s coverage ratio was 112.6% credit unions are more well-covered and prepared for the prospect of a recession.

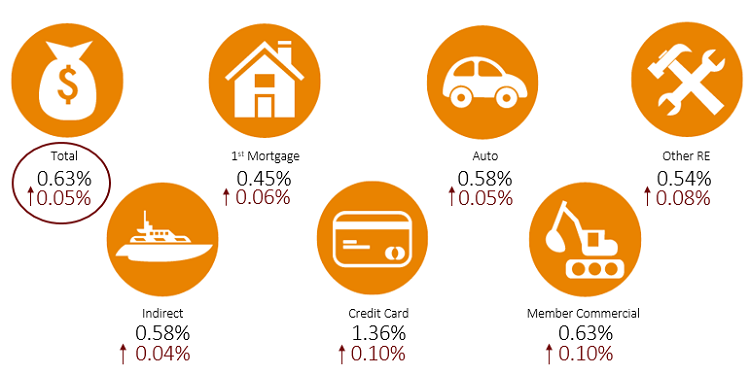

Clearly, credit unions are analyzing their balance sheet dynamics, listening to the news, and adjusting their strategies accordingly. Although the first quarter delinquency data is not severe right now 0.63% industrywide all major loan types reported higher delinquency than in the first quarter of last year, and credit unions are preparing for these numbers to swell in the coming months.

DELINQUENCY BY LOAN TYPE AND ANNUAL CHANGE

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.20

Callahan & Associates | CreditUnions.com

Led by spikes in credit card and member commercial delinquency, late repayment rates have increased in all major loan categories since this point last year. Many credit unions expect these rates to increase moving forward as members are hit with the full impact of COVID-19.

Hiway Federal Credit Union ($1.3B, Saint Paul, MN) expects to see a slowdown in loan repayment in the near future.

We are beginning to see COVID-19’s economic effects within our membership, says Aaron Kastner, the senior vice president of finance for Hiway. Although we’re trying to find solutions for our members including extended payment deferments, restructures, low-interest emergency loans, and fee waivers we anticipate we will see more dramatic effects by the end of the second quarter. We already increased our allowance nearly 20% in April and are forecasting increases for the remainder of the second quarter and throughout 2020.

Another credit union preemptively preparing for the future is 121 Financial Credit Union ($550.9M, Jacksonville, FL). The Florida cooperative increased its PLL 256.7% quarter-over-quarter to $2.6 million.

Due to the uncertainty of how the economy might rebound from the COVID-19 pandemic, we calculated an environmental factor to estimate potential losses, says Cathy Hufstetler, the senior vice president of lending at 121 Financial. The CUNA economics team projected credit union delinquencies and charge-offs will increase to 1.25% and 0.87%. We performed analysis using Callahan’s tools to benchmark how we compare to the general credit union trends [in conjunction with] the projections from CUNA to calculate our environmental factor.

The hope is that the proactive moves made by Hiway, 121 Financial, and other credit unions will help the industry weather what promises to be a tumultuous next few quarters and demonstrate that credit unions are the financial bedrocks that members can count on to help them in their time of need.

Get Creative With Data Using A Custom Data Scorecard

With the industry balance sheet changing due to COVID-19, credit unions are analyzing their balance sheet dynamics and adjusting their strategies as needed. Request a custom data scorecard and see your credit union’s data paired with macroeconomic trends and peer group comparisons.

Learn More

Some of the value that credit unions provide to members is already leading to business success, says Hufstetler.

We have a strong business portfolio and expect that to be one of the hardest-hit segments, the lending SVP says. We’re doing several things to mitigate the losses PPP loans, up to 90-day forbearance upon request, and calling to check on how the businesses are doing. We’e actually seen an increase in business accounts being opened because of how well our team handled processing of PPP loans.

As Americans across the country face financial difficulty in the fallout of COVID-19, examples like these show how the credit union mission of strong, personal service can make all the difference for a member who needs someone to be there. With careful planning, credit unions can view this crisis as an opportunity to be creative in adding new products and services including forbearance policies, loan modifications, and overdraft protection to help delinquent and struggling members in the days to come.