What’s In A Name: Chief Culture Officer

Emma Hayes brings a career built on a commitment to inclusion and internal development for her new role at SECU.

Emma Hayes brings a career built on a commitment to inclusion and internal development for her new role at SECU.

Three ways credit unions are delivering on a promise to support members, neighborhoods, communities, and more.

Nusenda Credit Union works with community partners to identify and support borrowers shut out of traditional lending.

Jeremy Cline helps Truliant FCU leverage data and teamwork to improve the member experience.

Afena FCU partners with a local foundation to take on payday lenders with long-term, low-rate loans with a savings component and financial counseling.

User experience research helps specialists define and refine the BECU member experience.

After four years of dreaming, planning, and acting, Growing Oaks FCU opened its doors for business in December 2020.

The Vermont cooperative relies on a little-known state statute to make direct investments in cooperatives to bolster local economies and create a better world.

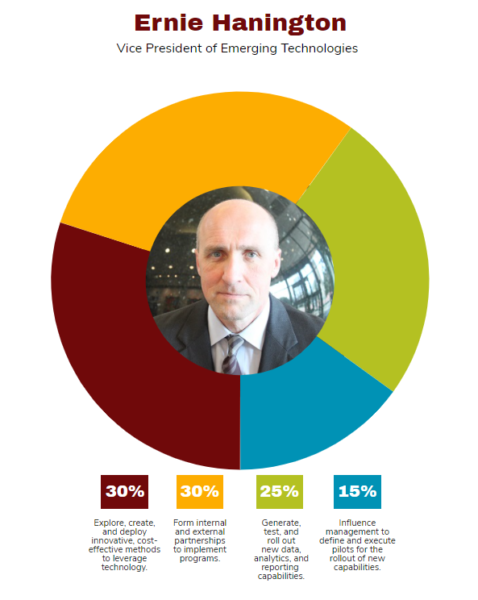

Ernie Hanington kicked off his new role by choosing a new core platform. Now, he focuses on making the most of it across the enterprise.

Credit union chief executives share key takeaways from 2020 and talk about how they’ll turn challenge into opportunity in the year ahead.

Emma Hayes brings a career built on a commitment to inclusion and internal development for her new role at SECU.

Three ways credit unions are delivering on a promise to support members, neighborhoods, communities, and more.

Nusenda Credit Union works with community partners to identify and support borrowers shut out of traditional lending.

Jeremy Cline helps Truliant FCU leverage data and teamwork to improve the member experience.

Afena FCU partners with a local foundation to take on payday lenders with long-term, low-rate loans with a savings component and financial counseling.

User experience research helps specialists define and refine the BECU member experience.

After four years of dreaming, planning, and acting, Growing Oaks FCU opened its doors for business in December 2020.

The Vermont cooperative relies on a little-known state statute to make direct investments in cooperatives to bolster local economies and create a better world.

Ernie Hanington kicked off his new role by choosing a new core platform. Now, he focuses on making the most of it across the enterprise.

Credit union chief executives share key takeaways from 2020 and talk about how they’ll turn challenge into opportunity in the year ahead.