Earth Day Is Every Day For Green Lenders

New stores of federal funding are now available to help credit unions cultivate a growing business in solar and more.

New stores of federal funding are now available to help credit unions cultivate a growing business in solar and more.

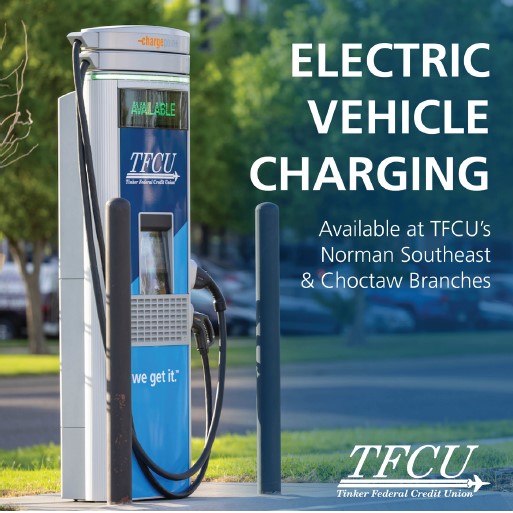

Rising electric vehicle usage has led some institutions to install electric vehicle charging stations at branches. The move could help both the planet and the bottom line.

The playing field isn’t always even, but credit unions can attract new members, increase deposit volume, and remain viable without sacrificing ethics, standards, or community commitment.

A program at Abound Credit Union has helped hundreds of would-be small business owners since its launch eight years ago.

Summit Credit Union has partnered with a local startup to sponsor a one-year fellowship for women entrepreneurs.

Two credit unions — one large, one smaller — offer insight from their experience serving the business community.

By offering financing options at the top of the funnel, lenders can influence purchasing decisions and establish themselves as trusted financial partners.

How Member Loyalty Group grows credit unions’ ability to understand and act on feedback through AI-powered analytics.

Four ways credit unions can harness their data to show up in their members’ lives at the right time — and in the right way.

With a total solar eclipse on the horizon and another not expected for two decades, credit unions across the country are gearing up — even if that means closing down for the day.

New stores of federal funding are now available to help credit unions cultivate a growing business in solar and more.

Rising electric vehicle usage has led some institutions to install electric vehicle charging stations at branches. The move could help both the planet and the bottom line.

The playing field isn’t always even, but credit unions can attract new members, increase deposit volume, and remain viable without sacrificing ethics, standards, or community commitment.

A program at Abound Credit Union has helped hundreds of would-be small business owners since its launch eight years ago.

Summit Credit Union has partnered with a local startup to sponsor a one-year fellowship for women entrepreneurs.

Two credit unions — one large, one smaller — offer insight from their experience serving the business community.

By offering financing options at the top of the funnel, lenders can influence purchasing decisions and establish themselves as trusted financial partners.

How Member Loyalty Group grows credit unions’ ability to understand and act on feedback through AI-powered analytics.

Four ways credit unions can harness their data to show up in their members’ lives at the right time — and in the right way.

With a total solar eclipse on the horizon and another not expected for two decades, credit unions across the country are gearing up — even if that means closing down for the day.