The credit union balance sheet is shifting as the U.S. economy enters a post-pandemic reality. As of March 31, 2022, credit union loan balances were up 11.7% annually; shares were up 9.3%. This is the first time in three years loan growth has outpaced deposit growth.

Cash Balances Decrease

Cash balances totaled $251.0 billion as of March 31 and comprised 34.8% of the credit union investment portfolio. That’s down 1.6 percentage points from last quarter. Securities and investments grew 1.9%, or $8.9 billion, in the quarter to counter a large decrease in cash as credit unions invested in longer-term assets.

Credit unions allocated 49.4% to U.S. government and federal agency securities, the most of any of the top-level categories. Cash came in 34.8%, and credit unions spread the remaining 15.8% across various other debt and equity securities or insurance products.

Breaking down the cash segment, cash balances increased at all institutions where credit unions hold deposits. The crucial exception to this was the Federal Reserve. This is the largest segment and makes up 23.8% of the entire industry investment portfolio; however, cash balances deposited at the Fed declined by $11.3 billion in the first quarter, drowning out the inflows from the other, smaller cash segments.

Cash on hand at credit unions expanded $2.7 billion the largest increase among the cash holdings as credit unions transferred cash from the Fed to internal holdings. The large cash position built up by the industry during the past two years is slowly and consistently shrinking as lending activity picks up.

INVESTMENT PORTFOLIO

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.22

Investments Increase

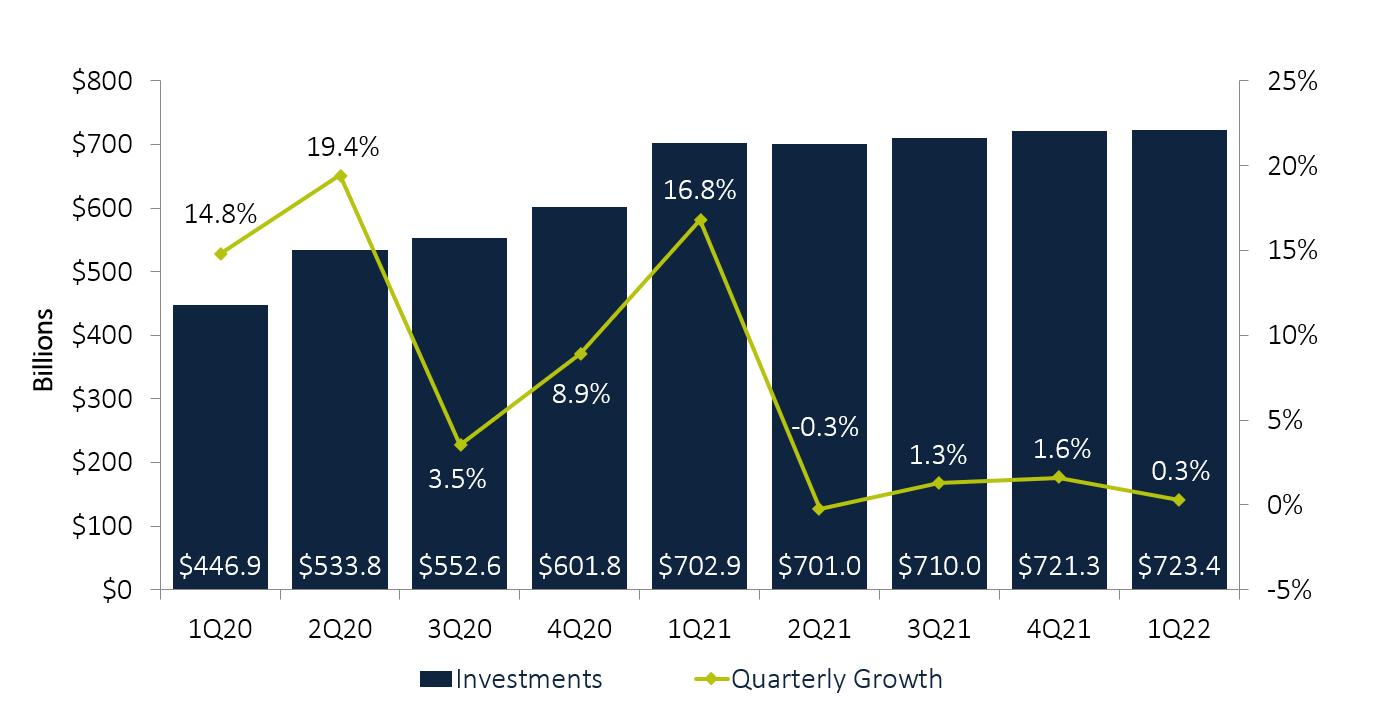

Total investments held by credit unions increased just 0.3%, or $2.1 billion, during the past three months to reach $723.4 billion. This is the fourth straight quarter of sub-2% quarterly growth.

Credit unions used cash balances, which decreased 2.6% from Dec. 31, to fund renewed consumer loan demand amid a reopening economy and growing buyer confidence. Cash comprised 34.8% of the credit union investment portfolio. That’s down 1.6 percentage points from three months ago as rising yields made securities attractive relative to low-yielding cash. In government and agency securities, balances increased $10.7 billion, or 3.0%, from last quarter.

Shares at credit unions increased $64.3 billion from the fourth quarter of 2021, which caused net liquidity to increase $17.5 billion. A strong quarter of lending and a slower pace of early consumer loan paydowns pushed the loan-to-share ratio up to 70.2%. This is a welcome sign for lending institutions; however, it remains far below the pre-pandemic industry high of 84.5% recorded as of Dec. 31, 2018.

Even with heightened loan demand during the past year, the loan-to-share ratio has increased only 1.5 percentage points since March 31, 2021. Continued share growth deceleration will play a key role in balance sheet deployment, but new loans also must stick around for the long term.

The average mortgage rate rose to 5% at the end of the first quarter, making it attractive to keep mortgages on the balance sheet. First mortgages sold to secondary markets declined in the first quarter to $17.9 billion. That’s approximately half the amount sold in the third quarter of 2020, when attractive pricing incentivized institutions to sell mortgages at greater rates.

TOTAL INVESTMENTS AND QUARTERLY GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.22

Derivatives: Notional Balances Increase

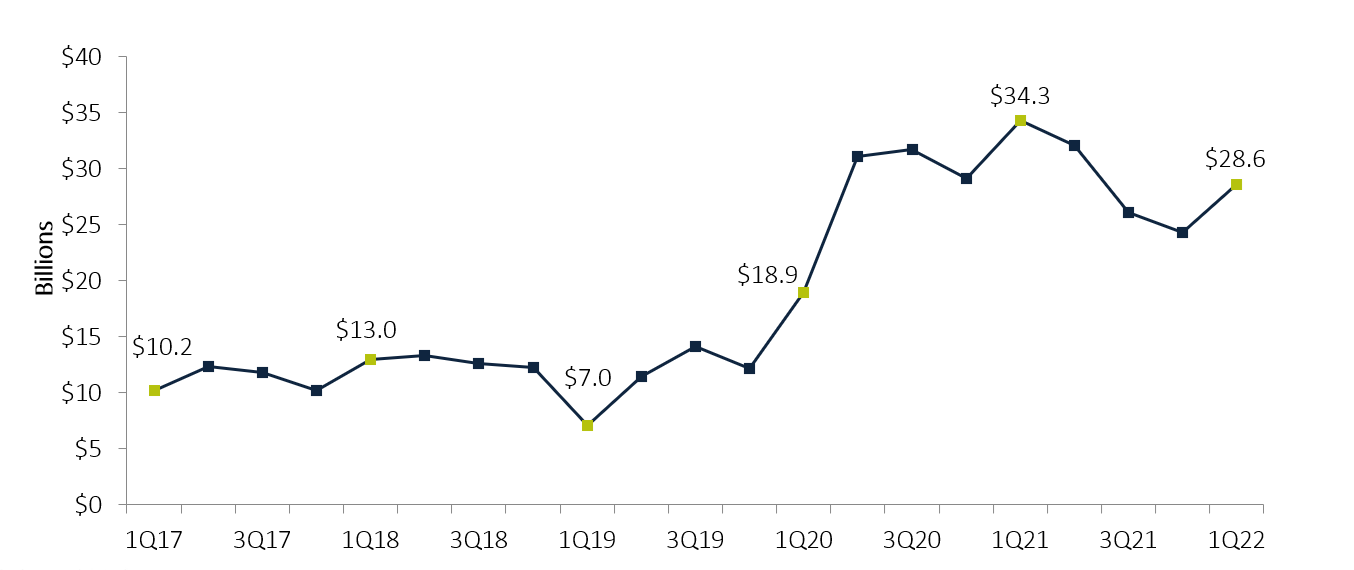

After declining for three consecutive quarters, notional balances rose to $28.6 billion a $4.3 billion increase quarter-over-quarter. On an annual basis, total notional balances were down 19.9%, or $5.7 billion.

Since the NCUA board approved its modernization of derivatives rule in May 2021 which allows for a more principles-based approach the number of credit unions that report derivative usage increased from 96 to 117. Looking forward, more credit unions might turn to derivatives as an alternate route to manage a variety of interest rate scenarios.

TOTAL NOTIONAL DERIVATIVES

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.22

To request a complimentary copy of the full First Quarter Investment Trends Report or to compare your own institution to the industry benchmark or a specific peer group, please contact Trust for Credit Unions at 800-237-5678 or TCUgroup@callahan.com

ABOUT TRUST FOR CREDIT UNIONS

Trust for Credit Unions (TCU) helps credit unions succeed in serving their members by providing a professionally managed family of mutual funds exclusive to credit unions as well as the information and analysis they need to support investment decisions. Created by some of the leading credit unions with oversight by a board of trustees, TCU’s mutual fund options allow credit unions to meet their short duration needs, are professionally managed, and are based on the cooperative values of credit unions.

Visit www.trustcu.com or call us at 800-237-5678 to learn more.

The Trust for Credit Unions (TCU) is a family of institutional mutual funds offered exclusively to credit unions. Callahan Financial Services is a wholly-owned subsidiary of Callahan Associates and is the distributor of the TCU mutual funds. ALM First Financial Advisors LLC is the investment advisor of TCU mutual funds. To obtain a prospectus which contains detailed fund information including investment policies, risk considerations, charges and expenses, call Callahan Financial Services, Inc. at 800-CFS- 5678. Please read the prospectus carefully before investing or sending money. Units of the Trust portfolios are not endorsed by, insured by, obligations of, or otherwise supported by the U.S. Government, the NCUSIF, the NCUA or any other governmental agency. An investment in the portfolios involves risk including possible loss of principal.

What Happened To Investments And Cash Balances In The First Quarter?

The credit union balance sheet is shifting as the U.S. economy enters a post-pandemic reality. As of March 31, 2022, credit union loan balances were up 11.7% annually; shares were up 9.3%. This is the first time in three years loan growth has outpaced deposit growth.

Cash Balances Decrease

Cash balances totaled $251.0 billion as of March 31 and comprised 34.8% of the credit union investment portfolio. That’s down 1.6 percentage points from last quarter. Securities and investments grew 1.9%, or $8.9 billion, in the quarter to counter a large decrease in cash as credit unions invested in longer-term assets.

Credit unions allocated 49.4% to U.S. government and federal agency securities, the most of any of the top-level categories. Cash came in 34.8%, and credit unions spread the remaining 15.8% across various other debt and equity securities or insurance products.

Breaking down the cash segment, cash balances increased at all institutions where credit unions hold deposits. The crucial exception to this was the Federal Reserve. This is the largest segment and makes up 23.8% of the entire industry investment portfolio; however, cash balances deposited at the Fed declined by $11.3 billion in the first quarter, drowning out the inflows from the other, smaller cash segments.

Cash on hand at credit unions expanded $2.7 billion the largest increase among the cash holdings as credit unions transferred cash from the Fed to internal holdings. The large cash position built up by the industry during the past two years is slowly and consistently shrinking as lending activity picks up.

INVESTMENT PORTFOLIO

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.22

CALLAHAN ASSOCIATES | CREDITUNIONS.COM

Investments Increase

Total investments held by credit unions increased just 0.3%, or $2.1 billion, during the past three months to reach $723.4 billion. This is the fourth straight quarter of sub-2% quarterly growth.

Credit unions used cash balances, which decreased 2.6% from Dec. 31, to fund renewed consumer loan demand amid a reopening economy and growing buyer confidence. Cash comprised 34.8% of the credit union investment portfolio. That’s down 1.6 percentage points from three months ago as rising yields made securities attractive relative to low-yielding cash. In government and agency securities, balances increased $10.7 billion, or 3.0%, from last quarter.

Shares at credit unions increased $64.3 billion from the fourth quarter of 2021, which caused net liquidity to increase $17.5 billion. A strong quarter of lending and a slower pace of early consumer loan paydowns pushed the loan-to-share ratio up to 70.2%. This is a welcome sign for lending institutions; however, it remains far below the pre-pandemic industry high of 84.5% recorded as of Dec. 31, 2018.

Even with heightened loan demand during the past year, the loan-to-share ratio has increased only 1.5 percentage points since March 31, 2021. Continued share growth deceleration will play a key role in balance sheet deployment, but new loans also must stick around for the long term.

The average mortgage rate rose to 5% at the end of the first quarter, making it attractive to keep mortgages on the balance sheet. First mortgages sold to secondary markets declined in the first quarter to $17.9 billion. That’s approximately half the amount sold in the third quarter of 2020, when attractive pricing incentivized institutions to sell mortgages at greater rates.

TOTAL INVESTMENTS AND QUARTERLY GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.22

CALLAHAN ASSOCIATES | CREDITUNIONS.COM

Derivatives: Notional Balances Increase

After declining for three consecutive quarters, notional balances rose to $28.6 billion a $4.3 billion increase quarter-over-quarter. On an annual basis, total notional balances were down 19.9%, or $5.7 billion.

Since the NCUA board approved its modernization of derivatives rule in May 2021 which allows for a more principles-based approach the number of credit unions that report derivative usage increased from 96 to 117. Looking forward, more credit unions might turn to derivatives as an alternate route to manage a variety of interest rate scenarios.

TOTAL NOTIONAL DERIVATIVES

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.22

CALLAHAN ASSOCIATES | CREDITUNIONS.COM

To request a complimentary copy of the full First Quarter Investment Trends Report or to compare your own institution to the industry benchmark or a specific peer group, please contact Trust for Credit Unions at 800-237-5678 or TCUgroup@callahan.com

ABOUT TRUST FOR CREDIT UNIONS

Trust for Credit Unions (TCU) helps credit unions succeed in serving their members by providing a professionally managed family of mutual funds exclusive to credit unions as well as the information and analysis they need to support investment decisions. Created by some of the leading credit unions with oversight by a board of trustees, TCU’s mutual fund options allow credit unions to meet their short duration needs, are professionally managed, and are based on the cooperative values of credit unions.

Visit www.trustcu.com or call us at 800-237-5678 to learn more.

The Trust for Credit Unions (TCU) is a family of institutional mutual funds offered exclusively to credit unions. Callahan Financial Services is a wholly-owned subsidiary of Callahan Associates and is the distributor of the TCU mutual funds. ALM First Financial Advisors LLC is the investment advisor of TCU mutual funds. To obtain a prospectus which contains detailed fund information including investment policies, risk considerations, charges and expenses, call Callahan Financial Services, Inc. at 800-CFS- 5678. Please read the prospectus carefully before investing or sending money. Units of the Trust portfolios are not endorsed by, insured by, obligations of, or otherwise supported by the U.S. Government, the NCUSIF, the NCUA or any other governmental agency. An investment in the portfolios involves risk including possible loss of principal.

Daily Dose Of Industry Insights

Stay informed, inspired, and connected with the latest trends and best practices in the credit union industry by subscribing to the free CreditUnions.com newsletter.

Share this Post

Latest Articles

Markets React To Consequential Announcements

Meet The Finalists For The 2026 Innovation Series: Data And Decision Intelligence

A New Product Playbook Is Driving Change At Premier Credit Union

Keep Reading

Related Posts

Markets React To Consequential Announcements

When Members Don’t Turn To FIs, They Turn To Friends And Family

Don’t Wait For Data. FirstLook Analysis Is Available Today.

Markets React To Consequential Announcements

Jason HaleyDon’t Wait For Data. FirstLook Analysis Is Available Today.

Callahan & AssociatesWhat Would A 10% Credit Card Rate Cap Mean For Credit Unions And Members?

Andrew LepczykView all posts in:

More on: