A full 77% of new car purchases made in the United States in December 2021 were higher than the manufacturer’s suggested retail price (MSRP), according to research by Edmunds. By comparison, this portion was 3% in January 2021 and 0.3% for all of 2020.

These price hikes are the result of an imbalance in supply and demand driven mostly by the microchip shortage. Major car manufacturers predict the new vehicle production pipeline won’t be able to effectively meet demand until 2023. Until then, consumers, many of whom are starting to resume their post-COVID work commutes, will continue to pay top dollar in the used auto market.

Key Points

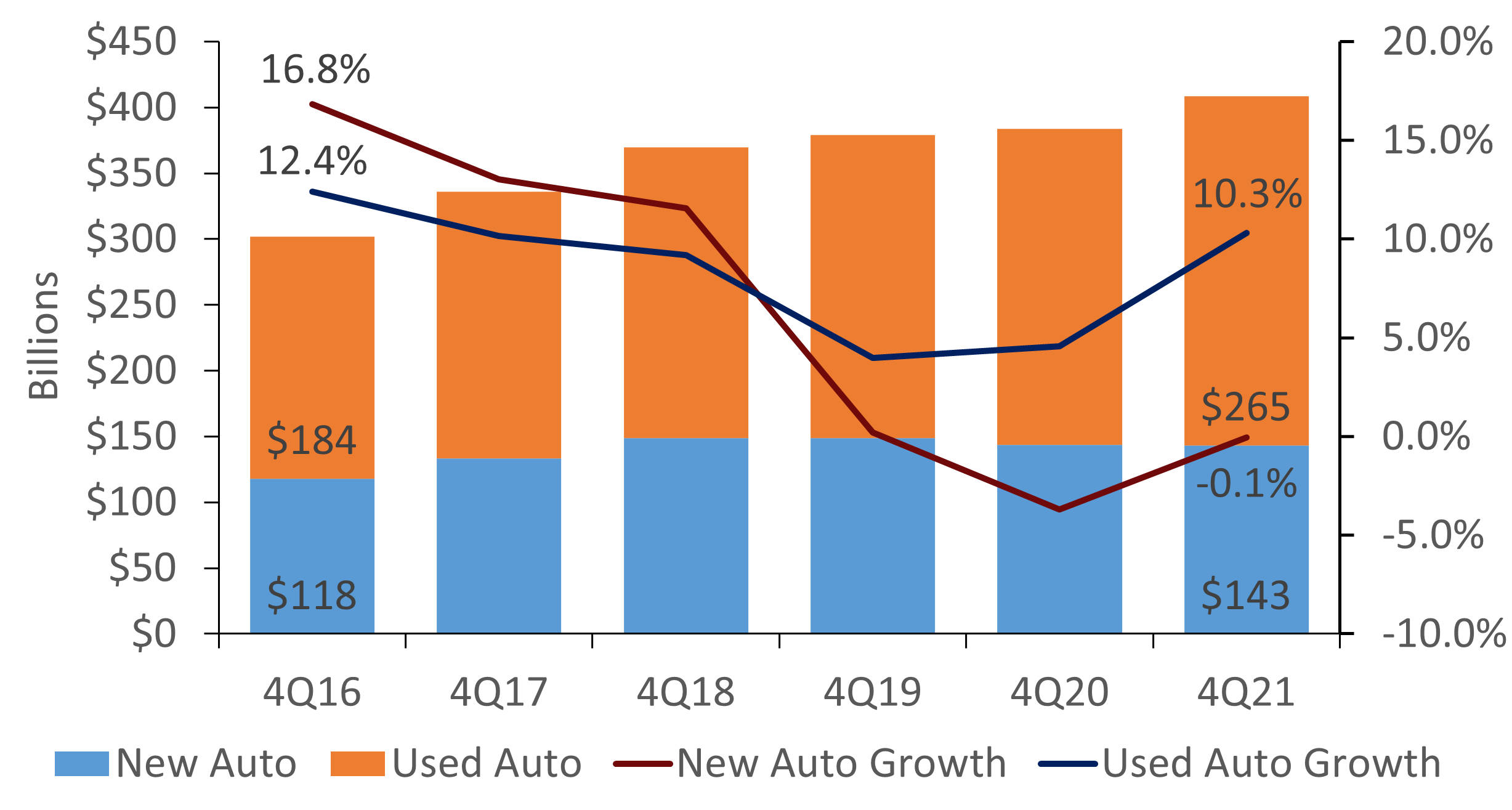

- Total auto loan balances expanded 6.4% annually to $408.6 billion as of Dec. 31. New auto balances declined 0.1%; used auto balances were up 10.3% year-over-year.

- Outstanding indirect loan balances grew 7.2% annually. Indirectly sourced loans comprised 61.5% of total auto loans for credit unions at year-end.

- Auto loan penetration increased 2.6 percentage points year-over-year and 93 basis points quarter-over-quarter. A record 24.1% of members had an auto loan as of Dec. 31.

- Auto loan delinquency increased 7 basis points from the third quarter to 0.42%. However, it is still down 8 basis points from one year ago and remains at historically healthy levels.

NEW VS USED AUTO BALANCES

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.21

Callahan Associates | CreditUnions.com

The new car shortage suppressed growth in new auto balances. However, this dynamic subsequently boosted the demand for used autos as buyers looked to used cars as an alternative to new.

INDIRECT LENDING

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.21

Callahan Associates | CreditUnions.com

Indirect lending through dealerships and fintechs has helped credit unions reach prospective members, who now more than ever before are turning to apps and websites to borrow.

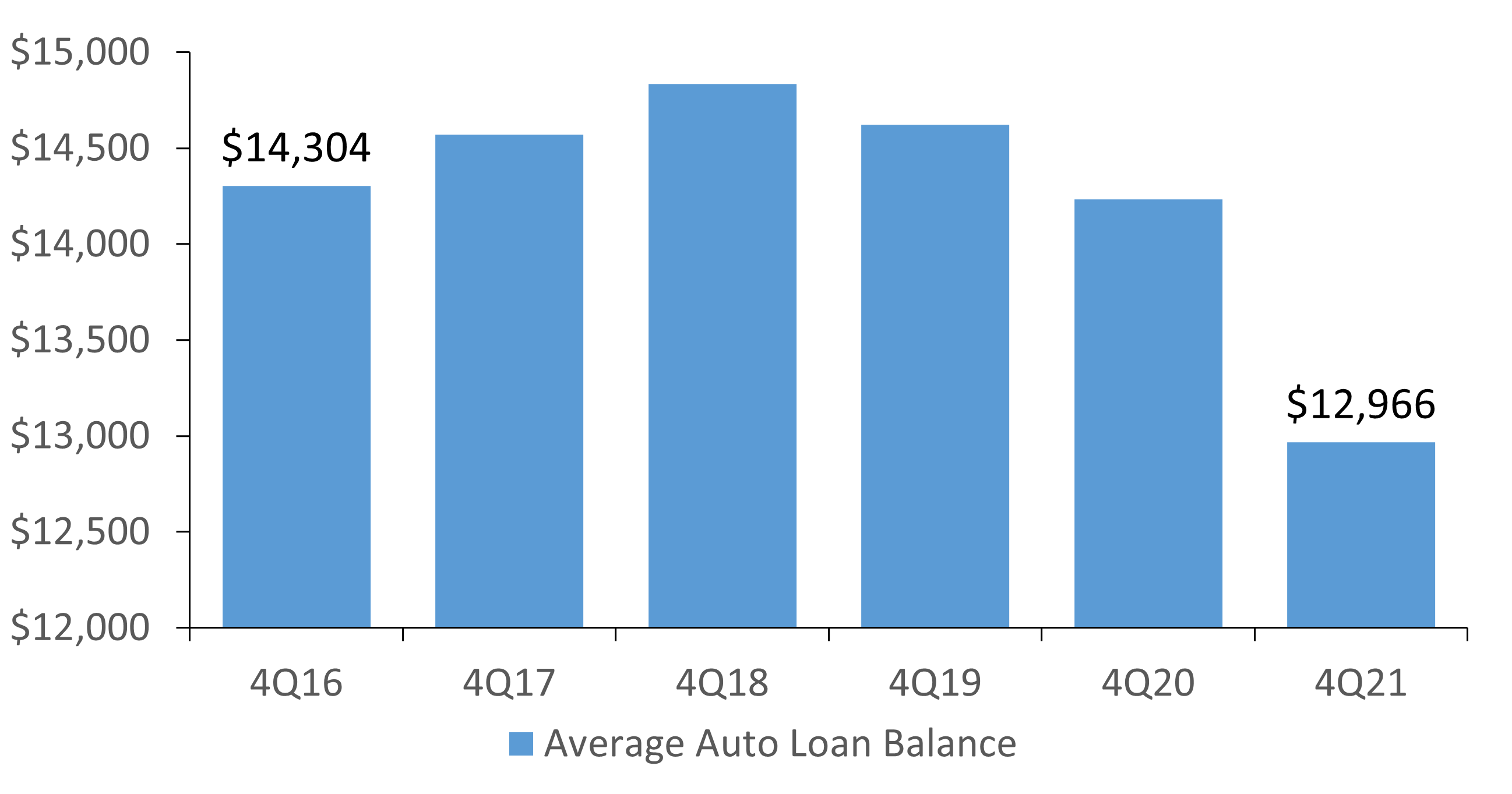

AVERAGE AUTO LOAN BALANCE

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.21

Callahan Associates | >CreditUnions.com

Although used auto prices are up, they are still cheaper on average than new vehicles. Reduced sales prices, loan prepayments from federal relief packages, and an expanded loans participations market have combined to push down the average auto loan balance.

The Bottom Line

The scarcity of new vehicle production continues to hold back new auto loan growth. A return to in-person work has increased demand for cars, and the demand has driven increases in vechicle prices for both new and used autos. Indirect loans continue to be a conduit for credit unions to reach their members and diversify their balance sheets.

Although vehicles are selling, credit unions must consider the risks of financing less reliable used cars at all-time-high prices. Educating members on prudent borrowing practices is important, especially since the end of supply constraints seems far off, and used vehicles will continue to be in demand.

Read the full analysis or skip to the section you want to read by clicking on the links below.

|

AUTO |

EARNINGS |

HUMAN CAPITAL |

|

INVESTMENTS |

LOANS |

MACRO |

|

MEMBER RELATIONSHIPS |

MORTGAGES |

SHARES |