Minnesota credit unions nearly doubled their first mortgage loan originations from one year ago, making Minnesota the leading state in terms of year-over-year growth, according to the 6147 of credit unions reporting as part of Callahan & Associates FirstLook program.

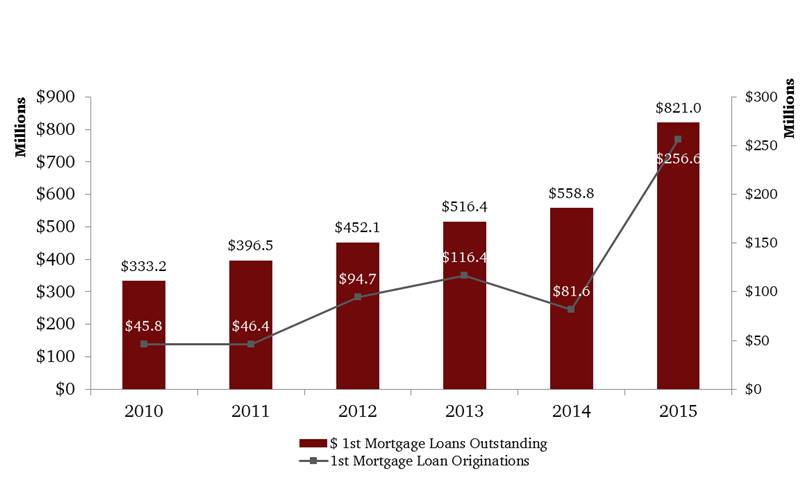

Leading the way for Minnesota is Wings Financial Credit Union ($4.1B, Apple Valley, MN), which posted a 214.45% increase in first mortgage originations. Its soaring origination numbers pushed outstanding first mortgage loans to $821 million, a 46.93% increase from one year ago.

FIRST MORTGAGE LOAN GROWTH

Wings Financial Credit Union | Data as of 06.30.15

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

Credit unions across the country shared in a somewhat milder boon, posting 54.57% growth in first mortgage originations and a comparatively modest 10.11% growth in first mortgage loans outstanding.

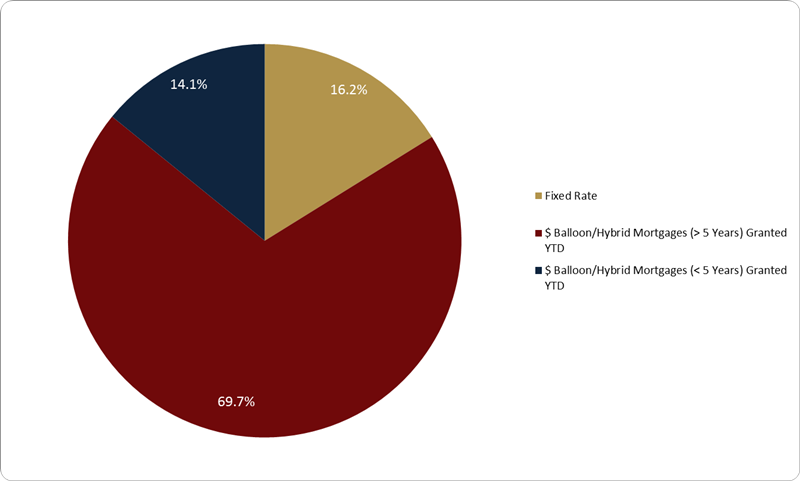

The Apple Valley-based Wings Financial originated $215.1 million in balloon and hybrid mortgages, which represented a large portion of its growth. In fact, fixed-rate mortgages comprised only 16.2% or $41.5 million of Wings Financials first mortgage originations, and it originated no adjustable-rate mortgages. Since second quarter 2014, the amount of loans Wings Financial has sold while maintainingservicing rights has decreased 5.53%, or $21.9 million.

FIRST MORTGAGE ORIGINATIONS COMPOSITION

Wings Financial Credit Union | Data as of 06.30.15

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

How Do You Compare?

Check out Wings Financial’s performance profile.

Click Here