Genisys Credit Union ($2.1B, Pontiac, MI) has seen its take of non-interest income rise steadily for the past five years after launching a new strategy that focuses on serving member needs with products that also help the credit union boost its bottom line.

The suburban Detroit financial cooperative generated $31.8 million in annual NII at the end of the second quarter of 2016, nearly double the $16.5 million it reported in September 2011.

According to Peer-to-Peer data from Callahan Associates, that’s on par with the $35.3 million average for credit unions with one billion dollars or more in assets at the end of second quarter 2016, and the growth rate is nearly twice that of peers’ over the half-decade.

Meanwhile, Genisys’s 397 employees posted NII of $80,136 in the second quarter, compared with $70,125 for peer credit unions, and NII per member was $174 versus $171. NII as a percentage of total income was 32.26% as of June 30, 2016, compared with 27.39% for the average billion-dollar credit union.

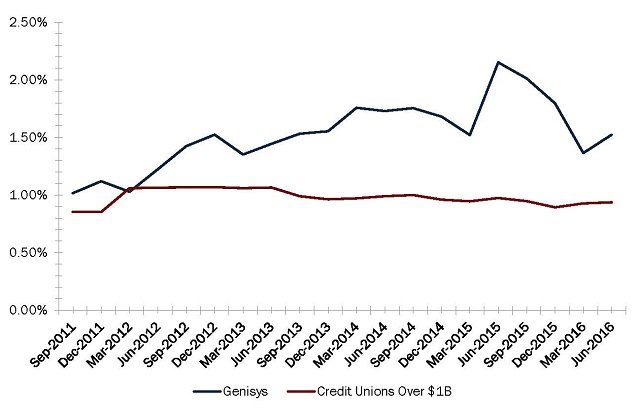

RETURN ON ASSETS

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.16

Callahan Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan Associates.

But one metric for which Genisys really stands out is its ROA. For the second quarter, that was 1.53%, 17th among asset-based peers, whose average was 0.94%

|

| Jackie Buchanan, President/CEO, |

Insurance is one area in which Genisys has had particular success. Here, president and CEO Jackie Buchanan shares insight on how Genisys has generated NII in that area and others, all the while boosting member service.

What is the primary source of Genisys’ strong performance in generating non-interest income?

Jackie Buchanan: Over the past several years, we have developed a strong sales culture. The team does well selling credit life and credit disability insurance, as well as GAP and MRC. We also have strong debit card and brokerage programs.

That said, we can always work harder and smarter to do better.

In today’s rate environment, how important is NII to Genisys?

JB: We have always recognized NII to be an important component of overall revenue, but in 2011 we began looking at each component excluding fees and developed plans around each one to take them to the next level. Over the past five years we have seen an average of 22% growth each year in the NII category.

CU QUICK FACTS

genisys credit union

Data as of 06.30.16

- HQ: Pontiac, MI

- ASSETS: $2.1B

- MEMBERS: 182,982

- BRANCHES: 29

- 12-MO SHARE GROWTH: 8.4%

- 12-MO LOAN GROWTH: 8.4%

- ROA: 1.53%

Will that change? When?

JB: Improving NII is more important than ever given the long-term low interest rate environment and shrinking net interest margins. I don’t ever see the importance of NII changing if we want to continue to grow and continually give more back to the member.

How does Genisys make generating NII a component of outstanding member service?

JB: Products related to NII are products members need. For example, our Genisys Investment Services solve a problem that typical core offerings of savings, money markets, and CDs can’t. Offering these brokerage services fills a gap and builds loyalty with members.

Along that same line, credit life and credit disability brings members peace of mind. We have numerous testimonials from members who have had to take advantage of the claim process, who are in a much better financial position than if they had not had the insurance.

Lastly, our Genisys Rewards program not only increases debit usage and interchange among our members, it also gives back to our members in a way that most financial institutions don’t for a typical debit transaction.

Credit life and credit disability brings members piece of mind. We have numerous testimonials from members who have had to take advantage of the claim process, who are in a much better financial position than if they had not had the insurance.

According to the figures from our Callahan Associates, Genisys generated $2.8 million in income from insurance fees in 2015 and has shown steady growth for the past five years. To what do you attribute the success of your insurance program?

JB: We have seen growth in all insurance sales as our membership has grown and as our sales culture has improved. We strive to have all of our member service representatives offer the products, whether they would themselves use the product or not. It’s not our decision to say no on the member’s behalf; it’s the member’s decision.

This area has grown approximately 19% to 20% per year over the past few years, but we feel it will level off a bit going forward. Right now, credit life and credit disability is approximately 80% of our insurance income. The other 20% comes from GAP and MRC.

We required all of our member service representatives be licensed to sell. Most of them are internal transfers who started as tellers and were identified by branch managers as good fits.

Callahan Associates surveyed 170 credit union executives from 40 states to gain insight into their current and emerging sources of non-interest income. Read 3 Findings From Callahan’s Non-Interest Income Survey to learn more.

Insurance represents 12% or so of your total NII of $25.6 million in 2015. Is there a balance you’re shooting for between different sources? If so, what is it?

JB: We don’t shoot for a percentage in this area. We are careful to maintain our needs-based sales culture and wouldn’t want our team to sell products to members just to hit numbers.

There are areas where we do shoot for growth, but only if it benefits the members. An example would be debit and credit card growth and the resulting growth in interchange income.

You say Genisys is always striving for balance: careful not to dump products on, or hide them from, members. Can you elaborate on that?

JB: This is part of our needs-based sales culture. We never want our team members to sell a product or service if it’s not a good fit for the member. We are upfront about the costs and the benefits before closing the sale. One of our core values is to be trustworthy. Not doing what is best for the member is not being trustworthy.

Describe your relationships with vendors, including CUNA Mutual. How do you build them and maintain them? Who are some of the others vendors with whom you work?

JB: We don’t call them vendors at Genisys; they are our partners and sometimes feel like an extension of Genisys. Each party has to want the other to be successful in order for the relationship to last long-term.

Our working relationship with CUNA Mutual is strong, and because of this, we work closely with them on training, new product development, and enhancements we might want to existing products.

We also have great relationships with our core provider, DH (UltraData), as well as with CO-OP Financial Services and many others.

How Do You Compare?

Check out Genisys Credit Union’s performance profile on Search Analyze. Then build your own peer group and browse performance reports for more insightful comparisons.

What other areas of NII do you consider particularly important? How do you address their growth and maintenance?

JB: We have several shared branch outlets. This helps offset the costs of members going to other shared branches and can help fill the time of idle tellers. I also believe the shared branch network is important to the industry as a whole, since we can’t all have branches in every state or on every corner.

What regulatory changes do you see impacting your NII strategies? For example, how will the CFPB’s action on courtesy pay affect you? After all, Genisys generated $1.84 million in courtesy pay/NSF in 2015.

JB: Courtesy pay is less than 7% of our revenue, so although we are concerned about too many restrictions, it’s more from a member standpoint and not an income generation standpoint.

Many of our members need this service to get through life, and forcing us to simply decline a transaction or return their mortgage payment as a NSF is simply not good member service and causes them more fees and issues on the other end. I hope the CFPB fully understands the impact changes will have.

You Might Also Enjoy

- The State Of Student Lending

- Keith Domingue On Leadership

- Leaders In Outstanding Private Student Loans

- How To Create A Team That Survives And Thrives