The average age of the 85,211 members of Altra Credit Union ($1.1B, La Crosse, WI) is 39. The industry average? 48.

Attracting and retaining young members has for some time been a brass ring in the credit union industry. So what’s Altra’s secret sauce?

We knew members were starting to age out of the products and services we offer, says Mary Isaacs, Altra’s executive vice president and chief financial officer.

So the credit union went back to school. It struck up marketing partnerships with colleges in the markets Altra serves in Wisconsin, Tennessee, and Texas and sponsored financial literacy programs as well as events and sports teams at local high schools.

|

| Altra markets to young adult members to encourage them to explore other credit union products and services. (Click to enlarge.) |

The credit union emphasizes social media, and its products include special youth certificates, student loans, and branded student credit cards. For the next stage of life, there are home-buying programs and products and services aimed at an older set.

We were doing a great job of getting youth accounts in the door, but we weren’t retaining them, Isaacs says. We need to stay in front of the members as they transition through life stages. We need their family relationships, their student loans, their business loans.

And it needed to go mobile. On the marketing side, Altra formed a Go Mobile team to spread the word. It also adopted the technology to open accounts online when the moment was ripe. On the delivery side, mobile banking including remote deposit capture (RDC) has seriously taken off.

By The Numbers

Altra’s mobile login requests soared 35% in 2014, from 211,527 in January to 285,544 in December. Mobile RDC use rose even more sharply, nearly doubling from 6,578 deposited items in February 2014 to 12,273 in December and then 10,646 in January 2015.

RDC sells itself, Isaacs says. It’s a good product that works. It didn’t really take off in the PC environment, but once we got mobile RDC, the growth was phenomenal.

CU QUICK FACTS

ALTRA Credit Union

data as of 6.30.15

- HQ: Altra Credit Union

- ASSETS: $1.1B

- MEMBERS: 87,181

- BRANCHES: 17

- 12-MO SHARE GROWTH: 7.18%

- 12-MO LOAN GROWTH: 9.89%

- ROA: 0.92%

- CORE PROCESSOR: Fiserv Spectrum ASPTitusville, soon to be Fiserv DNA In-House (April 2016)

- MCIF/CRM: Raddon Integrator for MCIF/Fiserv Intelligent for CRM

- ONLINE BANKING: Connect FSS

- MOBILE BANKING: Connect FSS

- RDC: Bluepoint Solutions

- BILL PAY: FiPay (ProfitStars, A Jack Henry Company)

Comparatively, the overall percentage of members using online banking edged up a single percentage point during the year, to 47.03% of the credit union’s 84,175 members in January.

Altra’s electronic banking numbers reflect what’s happening in the industry. But that’s not the entire picture. Cheryl Dutton, vice president of marketing, says 23% of Altra’s current membership joined when they were 17 or younger, and its youth membership growth rate jumped from 6.8% in 2011 to 10% last year.

The credit union places a high premium on services per member (SPM) and Dutton says that members who joined when they were youths now average more than five SPM each.

How can other credit unions achieve similar success?

Try to be innovative and unafraid to try new technology, advises EVP/CFO Isaacs. We’ve tried some things that didn’t always work out, like PC RDC. Don’t be afraid to give them up. The same with text banking.

Isaacs also stresses keeping upfront costs reasonable.

We’ve learned that if you want to have success in a certain area, it can’t just be a small part of someone’s job, she says. It has to be their main job.

You Might Also Enjoy

- 4 Ways To Win The War Of The Inbox

- The Matrix From Charlotte Metro Credit Union That Makes Big Data Byte-Sized

- Leaders Credit Union Takes The Lead In Digital Innovation

Next: Mobile Tech And A Lot Of Marketing Spend

Go Mobile, Go Everywhere

Altra, in fact, has had a youth coordinator for more than five years. That staffer’s responsibilities include community events, promotions, and financial literacy coordination for school-based activities such as a the college financial aid night that Isaacs says was well received.

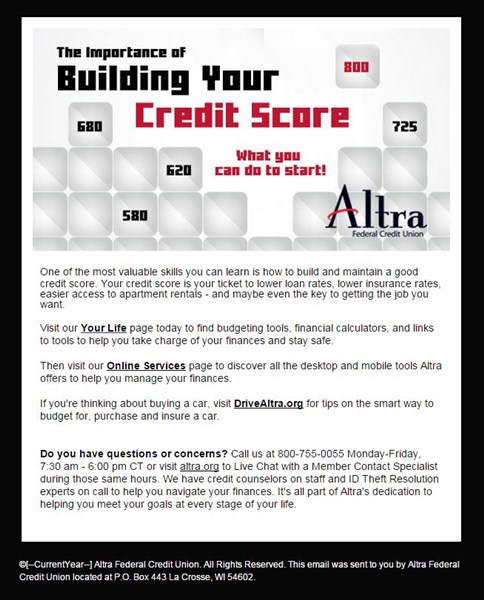

Altra goes beyond one-off marketing and instead targets products and promotions to people of all ages and stages. Rather than opening an account for a teenager and forgetting about it, for example, the credit union sends an email when the member hits age 18 that focuses on building credit scores and other grown-up concerns.

The credit union also offers high-yield savings programs for elementary school kids and holds off-site first-time homebuyer’s sessions in the early evening with beer, wine, and booths staffed by real estate and insurance agents, closing attorneys, and, of course, loan originators from Altra.

In all this youth-oriented outreach, though, the credit union has not forgotten about its older members. For them, it offers products such as its Prime Times Club, a 60-month certificate special and Altra Financial Advisors courses on retirement planning, Social Security, and other targeted topics.

|

|

Left: Altra promotes a special savings certificate for children ages 4 to 12. Right: Altra sends emails to members when they turn 18 to encourage them to use more of the credit union’s products and services. (Click to enlarge.)

And three years ago, Altra created its Go Mobile teams. Comprising representatives interviewed and selected from multiple work areas at all 17 of its locations, the 27 teams travel to branches, colleges, wellness events, and local businesses to show off Altra’s mobile capabilities.

We have a $3 check that we use for RDC demos and the member keeps the deposit, Isaacs says. And we give out cool swag and the team gets to wear super-cool jackets. It’s a good team effort.

Last year, the Go Mobile teams made it to 17 events. The goal this year is 40.

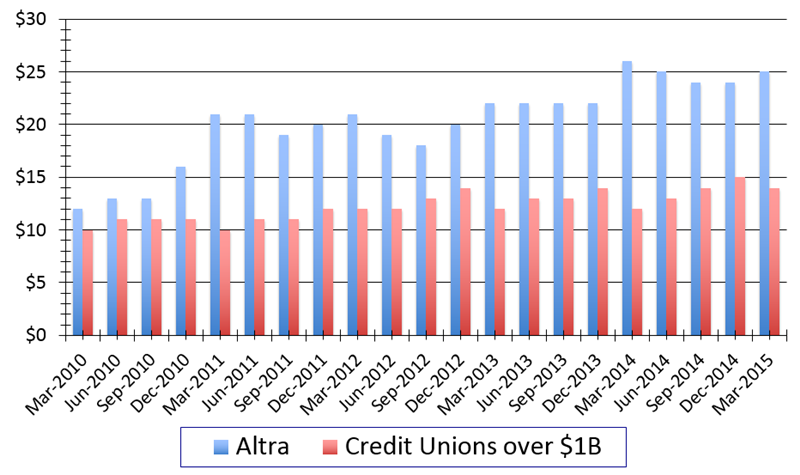

Marketing Spend And Peer Performance

Altra’s aggressive marketing strategy goes back several years. The credit union has doubled its spending in marketing per member from $12 in first quarter 2010 to $25 in 1Q2015, according to data from Callahan Associates. That’s 22nd out of 237 in its asset-based peer group. The average billion-dollar credit union during the same time increased from $10 per member to $14.

Marketing Expense Per Member

For all U.S. credit unions | Data as of March 31

Callahan Associates | www.creditunions.com

Source: Callahan Associates’ Peer-to-Peer Analytics

Altra Credit Union spends sharply more on marketing per member than the average for billion-dollar credit unions.

Meanwhile, its efficiency ratio as of the end of March is 79.95%, compared to a peer average of 75.06%, and its return on assets also is on par at 1.06%, a bit higher than the 0.95% average for its assets-based peer group. Its 12-month share growth was 6.83%, according to first quarter 2015 data from Callahan, compared with 5.90 for the average billion-dollar credit union.

First quarter loan growth was 9.13% in 1Q2015, compared with 13.03% average for the billion-dollar peer group, and loan-to-share was 94.17%, well above the 77.66% LTS ratio posted by the average billion-dollar credit union in the first quarter of 2015.

Staying loaned out is a key part of the credit union’s strategy, Isaacs says, and an indicator of how much members turn to their credit union. That also shows in its Return of the Member score. Altra’s score in that Callahan measure of member value was 92.17 out of 100, placing it 19th among the 229 billion-dollar credit unions at the end of 2014.

Our focus is on relationships services per member but we also strive to balance our loan pricing with our deposit pricing, and we can only do that with a high loan-to-share, Isaacs says.

Keeping that relationship focus requires a commitment to creating and supporting targeted products while meeting members’ digital expectations, including doing what it takes to Go Mobile.