Seasonal share growth and accelerating loan demand will make early 2015 a critical juncture if credit unions are to continue their successful financial performance.

Credit unions use shares to fund balance sheet loan growth. When share increases are not sufficient, they draw down investments and occasionally borrow. For the past five quarters, credit unions have posted a negative annual net change in share growth minus total loans. This is good because the loan-to-share ratio has increased, and credit unions net interest margins have slowly improved as members access credit.

A $26.6 Billion Funding Gap

A turning point from positive to negative liquidity buildup in the credit union system occurred during the third quarter of 2013. The fortunate outcome is that the loan-to-share ratio has risen from 70.8% to 74.8% in the past year.

Specifically, since December 2013, loans on the balance sheet have increased $67.7 billion while shares have grown $41.1 billion. Credit unions met this $26.6 billion funding gap in three ways: They drew down investments by $11.6 billion, they increased borrowings by $8.3 billion, and they increased net worth by $8.7 billion.

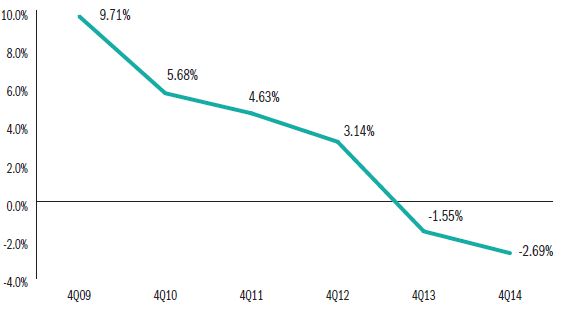

Change In Net Liquidity

For all U.S. credit unions | Data as of 12.31.14

Callahan & Associates | www.creditunions.com

Credit unions experienced a 2.69% decline in net liquidity as a percentage of shares from one year earlier.

Source: Callahan & AssociatesPeer-to-Peer Analytics

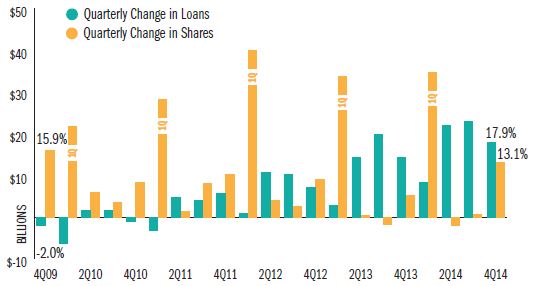

Quarterly Reality Is Different From Annual Trends

However, when this net change of shares minus loan growth is calculated quarter by quarter, a different picture emerges.

Two facts jump out from this five-year picture. First, most of the share growth for credit unions occurs in the first quarter of each year. With the exception of 2010 and 2011, loan growth surpasses share growth in each of the following three quarters of the year.

Second, the trend of loans growing faster than shares is accelerating. With one minor exception, the first quarter of each year is the only quarter from 2012 through 2014 when shares grew faster than loans.

Quarterly Change In Share And Loan Balances ($ in Billions)

For all U.S. credit unions | Data as of 12.31.14

Callahan & Associates | www.creditunions.com

With the exception of the first quarter, loan growth has significantly outpaced share growth in recent periods, contributing to a gradual increase in the national loan-to-share ratio.

Source: Callahan & AssociatesPeer-to-Peer Analytics

Annual and Quarterly % Change in Net Liquidity

For all U.S. credit unions | Data as of 12.31.14

Callahan & Associates | www.creditunions.com

Credit unions typically receive the majority of their annual liquidity inflow in the first quarter of the year yet net liquidity balances continue to decline into 2015, further demonstrating the urgency for credit unions to grow share balances.

Source: Callahan & AssociatesPeer-to-Peer Analytics

The Urgency For Marketing Shares in 2015

Combining the long-term annual change in shares minus loan growth with the quarterly pattern produces the following picture.

Growing shares early on in the year should be a top priority for credit unions. If they are to continue to fund the increasing loan demand that is generated by an improving economy, then they must re-energize their share growth.

With the prospect of short-term rates rising in the second half of 2015, it may make sense to pay slightly above market now in order to lock in some longer-term CDs and possibly reactivate interest in money market offerings.

Additional Factors Driving Savings Growth

The seasonal pattern of first quarter’s net share increases reflects a pullback by consumers after holiday shopping sprees. This is also when people accumulate savings for tax returns due in April. Historically, share growth also benefited from year-end bonuses paid by major corporations, but that factor is declining for most credit unions.

For those paying close attention to trends inside and outside the industry, a clear consensus is emerging: the time is right and the need is eminent to start launching share campaigns aplenty.

First Quarter Growth In 2015 Is Critical To Sustain Momentum

Seasonal share growth and accelerating loan demand will make early 2015 a critical juncture if credit unions are to continue their successful financial performance.

Credit unions use shares to fund balance sheet loan growth. When share increases are not sufficient, they draw down investments and occasionally borrow. For the past five quarters, credit unions have posted a negative annual net change in share growth minus total loans. This is good because the loan-to-share ratio has increased, and credit unions net interest margins have slowly improved as members access credit.

A $26.6 Billion Funding Gap

A turning point from positive to negative liquidity buildup in the credit union system occurred during the third quarter of 2013. The fortunate outcome is that the loan-to-share ratio has risen from 70.8% to 74.8% in the past year.

Specifically, since December 2013, loans on the balance sheet have increased $67.7 billion while shares have grown $41.1 billion. Credit unions met this $26.6 billion funding gap in three ways: They drew down investments by $11.6 billion, they increased borrowings by $8.3 billion, and they increased net worth by $8.7 billion.

Change In Net Liquidity

For all U.S. credit unions | Data as of 12.31.14

Callahan & Associates | www.creditunions.com

Credit unions experienced a 2.69% decline in net liquidity as a percentage of shares from one year earlier.

Source: Callahan & AssociatesPeer-to-Peer Analytics

Quarterly Reality Is Different From Annual Trends

However, when this net change of shares minus loan growth is calculated quarter by quarter, a different picture emerges.

Two facts jump out from this five-year picture. First, most of the share growth for credit unions occurs in the first quarter of each year. With the exception of 2010 and 2011, loan growth surpasses share growth in each of the following three quarters of the year.

Second, the trend of loans growing faster than shares is accelerating. With one minor exception, the first quarter of each year is the only quarter from 2012 through 2014 when shares grew faster than loans.

Quarterly Change In Share And Loan Balances ($ in Billions)

For all U.S. credit unions | Data as of 12.31.14

Callahan & Associates | www.creditunions.com

With the exception of the first quarter, loan growth has significantly outpaced share growth in recent periods, contributing to a gradual increase in the national loan-to-share ratio.

Source: Callahan & AssociatesPeer-to-Peer Analytics

Annual and Quarterly % Change in Net Liquidity

For all U.S. credit unions | Data as of 12.31.14

Callahan & Associates | www.creditunions.com

Credit unions typically receive the majority of their annual liquidity inflow in the first quarter of the year yet net liquidity balances continue to decline into 2015, further demonstrating the urgency for credit unions to grow share balances.

Source: Callahan & AssociatesPeer-to-Peer Analytics

The Urgency For Marketing Shares in 2015

Combining the long-term annual change in shares minus loan growth with the quarterly pattern produces the following picture.

Growing shares early on in the year should be a top priority for credit unions. If they are to continue to fund the increasing loan demand that is generated by an improving economy, then they must re-energize their share growth.

With the prospect of short-term rates rising in the second half of 2015, it may make sense to pay slightly above market now in order to lock in some longer-term CDs and possibly reactivate interest in money market offerings.

Additional Factors Driving Savings Growth

The seasonal pattern of first quarter’s net share increases reflects a pullback by consumers after holiday shopping sprees. This is also when people accumulate savings for tax returns due in April. Historically, share growth also benefited from year-end bonuses paid by major corporations, but that factor is declining for most credit unions.

For those paying close attention to trends inside and outside the industry, a clear consensus is emerging: the time is right and the need is eminent to start launching share campaigns aplenty.

Daily Dose Of Industry Insights

Stay informed, inspired, and connected with the latest trends and best practices in the credit union industry by subscribing to the free CreditUnions.com newsletter.

Share this Post

Latest Articles

Markets React To Consequential Announcements

Meet The Finalists For The 2026 Innovation Series: Data And Decision Intelligence

A New Product Playbook Is Driving Change At Premier Credit Union

Keep Reading

Related Posts

Markets React To Consequential Announcements

Financial Nihilism Is Real, But How Can Credit Unions Respond?

2026 Begins With Market Sentiment Similar To 2025

Markets React To Consequential Announcements

Jason HaleyMeet The Finalists For The 2026 Innovation Series: AI-Powered Member Experience

Callahan & AssociatesWhen Members Don’t Turn To FIs, They Turn To Friends And Family

Andrew LepczykView all posts in:

More on: