Since the inception of the credit union system, branches have been one of the most influential aspects in the development of member relationships. For an industry that prides itself on its member-centricity, historically, the branch provides a direct line of communication.

But the proliferation of technology in recent years has expanded the available channels through which members can interact with their institution, and as a result the necessity and utility of the branch has come into examination.

On the one hand, there are industry analysts who believe the branch is dead; that online and mobile banking are powerful enough to make brick-and-mortar extinct. This is likely an overreaction.

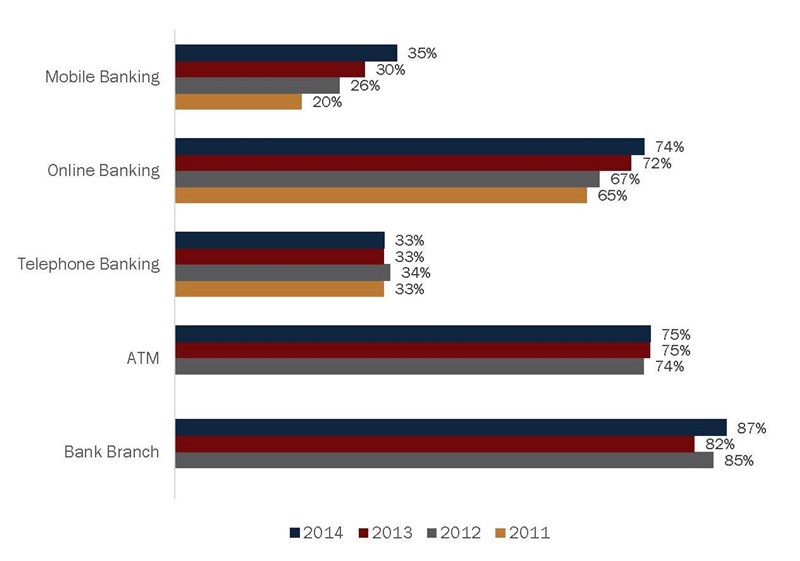

Based on the Federal Reserve’s 2015 Consumers and Mobile Financial Services report, which surveyed just north of 4,200 Americans, the most common way an individual interacts with a financial institution remains in-person at a branch. Fully 87% of individuals said they had visited a branch and spoken with a teller in the past 12 months. The percentage who used mobile banking? That was 35%, though that figure has grown from just 20% in 2011. Here’s the total breakdown:

Means Of Accessing Financial Services

Source: Federal Reserve

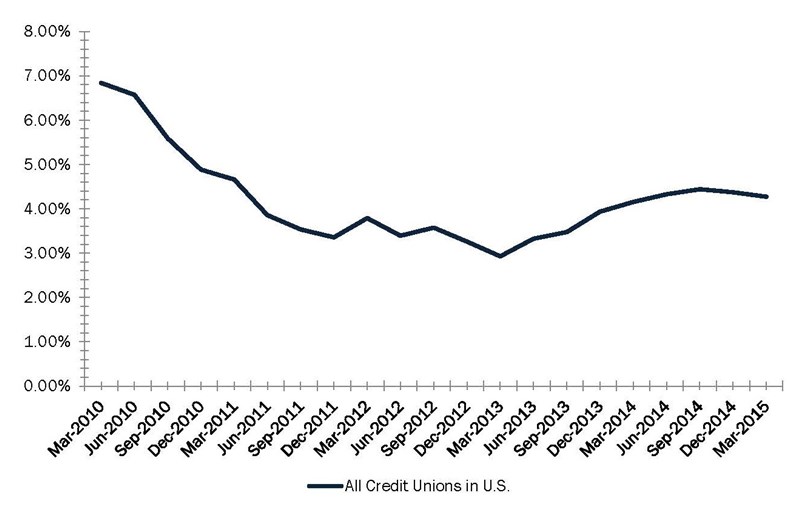

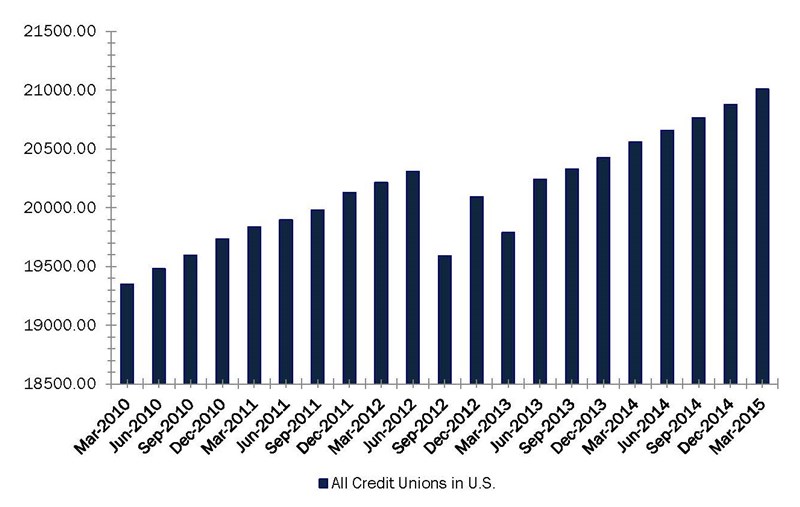

Total number of credit union branches has steadily increased from second quarter 2013 to first quarter 2015*, to a total of 21,009, according to Callahan & Associates’ Peer-to-Peer FirstLook data. Additionally, at first quarter, the credit union industry posted a 4.27% growth rate in land and building costs.

*More than 100 privately insured credit unions have not reported data for Callahan’s FirstLook data set. Because of this, second quarter branching numbers are unrepresentative of the industry at this time.

Land And Building Growth

For all U.S. credit unions | Data as of 03.31.15

Callahan & Associates | www.creditunions.com

Total Branches

For all U.S. credit unions | Data as of 03.31.15

Callahan & Associates | www.creditunions.com

Sources: Peer-to-Peer Analytics by Callahan & Associates

Instead of shuttering branches, more financial institutions are refurbishing them with new technologies or creative staffing designs to meet the needs of today’s consumer.

Which is why Arlington, MA-based Leader Bank’s first Boston-area branch looks one-part restaurant, one part financial-institution. Designed by local firm Margulies Perruzi Architects (MPA), the 2,700-square-foot space reflects the bank’s vision of itself going forward.

Leader’s Seaport branch

Our new branch locationbrings us closer to our entrepreneurial and commercial banking customers and provides a technology-focused and comfortable environment to develop those relationships, says Sushil Tuli, the bank’s president and chief executive, in a prepared statement.

Leader’s new branch is another in a growing footprint of financial institution branches of the future. That term is itself not without flaws, but it provides a useful categorization for the industry’s current shifting tide of branch design and utility.

The branch as we’ve known it is evolving. Here are three lessons in designing the branch of the future:

1. Go Consultative

In May 2014, First Tech Federal Credit Union ($7.9B, Mountain View, CA) opened a new branch in the Bellevue City Center. With this branch, the credit union looked to create a more consultative atmosphere with its Central Relationship Center a lounge for more comfortable, collaborative interactions and member suites for complex and private conversations.

As the financial services industry sees less foot traffic in many cases transferred to mobile or online transactions credit unions like First Tech are increasingly considering the consultative branch design, where teller lines and transactions are replaced with financial consultants who provide expert advice to receptive members.

To be a true partner, said Stephen Owen, the credit union’s chief retail and marketing officer, in a prepared statement, we believe we must transform from a servicing environment into a stronger consultative environment where we’re collaborating with our members, determining their financial needs, and recommending solutions that help them move forward financially.

2. Showcase Your Personality

The St. Petersburg, FL-based C1 Bank wanted to make a splash when it expanded south. It opened its branch in Wynwood, a Miami neighborhood revitalized by art and design galleries and new development, in early 2014 and has since added three branches within the city limits.

I try in at least one branch in a major market to have a unique style, said bank chief executive Trevor Burgess to the South Florida Business Journal. And that may be an understatement.

The branch itself, images of which you can view here, is wide-open. Artwork on loan from a local gallery hangs prominently including four by Andy Warhol. In the future, Burgess has said he will showcase local artists.

There is space for community and charitable events, and even a kitchen to cater such occasions. There’s a shower. For those who want a safe deposit box, they must move a wall of book cases, like you might at a haunted house.

Not only does this branch design match the bank’s personality, it fits nicely into an area known for its street art as much as anything else. By heavily incorporating the artistic side of design, C1 has created a buzz-worthy branch.

3. Go Digital

Like Leader, Eastern Bank in Massachusetts chose MPA to help it design a branch more self-sufficient and technologically-supported.

Rather than teller counters, the branch has multiple kiosks stations staffed with employees who can help customers with their banking needs or direct them to a virtual expert in a private room for additional information. There is also an interactive table with a touch-screen keyboard for customers who want to independently complete a transaction.

The largest technology piece, however, is a community wall with multiple touch screens which offer access to information on banking products, tips for setting up banking apps, local news feeds, and video games for children accompanying their parents to the bank.

The world of retail banking is changing rapidly, as customers ask for more electronic tools and digital channels to meet their banking needs, says Tom Dunn, senior vice president, Eastern Bank general services department, to the New England Real Estate Journal. The MPA design teamcollaborated with us to design a new branch concept that melds technology with an enhanced customer service experience.