The credit union industry set new records in the first quarter of 2016, driven by loan, share, and member growth despite a relatively dormant economy in the opening months of the year.

The total number of credit unions has dipped to 5,955, but membership has increased 3.9% year-over-year to a new high of 105.2 million, according to data collected by Callahan & Associates.

Overall loan growth was up 10.9% in the first quarter from one year ago while shares were up 6.9% to $1.1 trillion.

Here are three major takeaways from the company’s quarterly Trendwatch webinar.

No. 1: Performance Sets Stage For Strong 2016

Credit unions built on milestones set in 2015, including achieving all-time highs in membership, loan, and share balances and making more more than $101 billion in loans.

This continued momentum occurred despite relatively weak economic growth and spending nationally in the first quarter, says Callahan partner Jay Johnson. But low unemployment and gas prices coupled with strong consumer sentiment and retail sales seems to set the stage for an even stronger 2016.

U.S. CREDIT UNION INDUSTRY PERFORMANCE

For all FirstLook credit unions | Data as of 03.31.16

© Callahan & Associates | www.creditunions.com

| As Of 03.31.16 | 12-MO Growth 1Q 2016 |

12-MO Growth 1Q 2015 |

|

|---|---|---|---|

| Assets | $1.3T | 7.2% | 5.4% |

| Loans | $809.9B | 10.9% | 10.5% |

| Shares | $1.1T | 6.9% | 4.3% |

| Investments | $381.8B | -0.1% | -3.7 |

| Capital | $141.5B | 6.7% | 7.9% |

| Members | 105.2M | 3.9% | 2.8% |

Source: Peer-to-Peer Analytics by Callahan & Associates

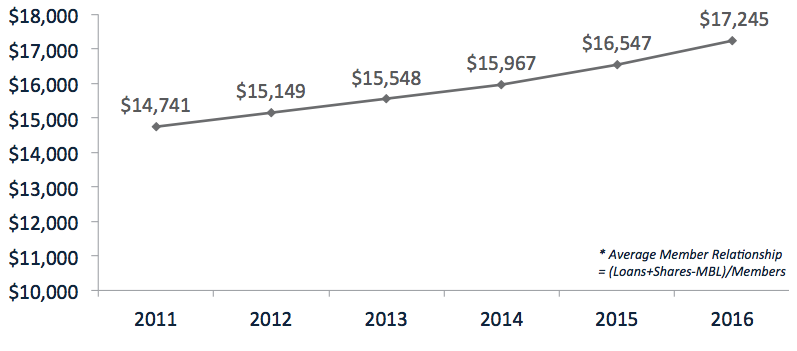

No. 2: Member Relationships Reach Highest Level Ever

The average member relationship also hit a new high in the first quarter $17,245. That’s a 4.2% jump from the year-ago quarter.

It’s great to see Americans continue to deepen their relationship with credit unions to get what they see as the best deals available in the financial marketplace, from the most responsible and trustworthy of providers, says Callahan partner Alix Patterson. The growth line has been steady and upward for the past several years and there’s no reason it can’t continue.

AVERAGE MEMBER RELATIONSHIP

For all FirstLook credit unions | Data as of 03.31.16

© Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

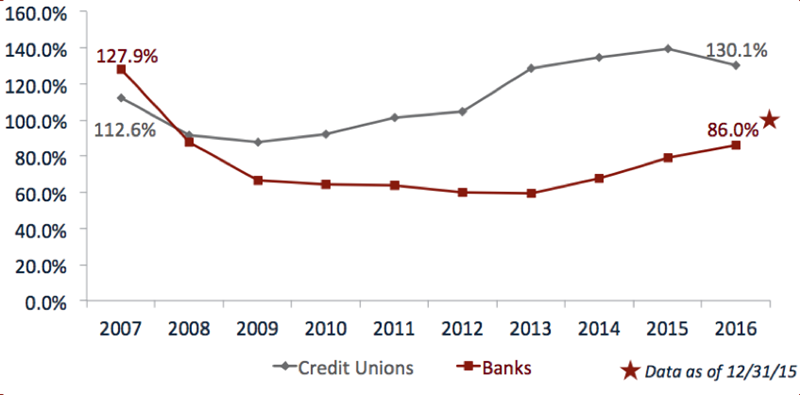

No. 3: Credit Unions Are Ready For A Downturn

Credit union members kept borrowing in the first quarter. Total loan originations expanded 13.1%, which powered a record-breaking loan balance of more than $810 billion.

Auto lending market share increased to 17.1%, up nearly four percentage points in the past five years. Indirect lending loan balances totaled $142.6 million, compared with $130 million for direct auto loans.

Share balances, meanwhile, hit another new high of $1.1 trillion, yielding an industrywide loan-to-share ratio of 76%, the highest since 2008.

COVERAGE RATIO: ALLOWANCE FOR LOAN LOSSES/DELINQUENT LOANS

For all FirstLook credit unions | Data as of 03.31.16

© Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

However, relatively low delinquency rates and strong share and asset growth have helped position credit unions’ balance sheets to handle a potential downturn. The ratio of allowance for loan losses to delinquent loans is 130.1%, compared with 86.0% for banks.

A detailed analysis of the credit union industry’s performance including regional and state performances is available in Callahan’s 1Q 2016 Trendwatch webinar.

Don’t Miss 1Q 2016 Trendwatch Day 2

If you missed today’s Trendwatch, you still have a chance to catch it tomorrow. Click now to register for the 11:30 a.m. broadcast on May 19.