The U.S. Treasury Department’s fund for Community Development Financial Institutions (CDFI) has awarded more than $2 billion since its inception in 1994. CDFI grants allow institutions to bolster loan loss reserves so they can provide additional investment to distressed communities and meet the needs of traditionally underserved low-income populations.

Historically, the majority of funding from the CDFI Fund has helped real estate initiatives. However, the Fund is currently seeking a more diverse pool of applicants and is emphasizing different ways in which its awards can enhance financial inclusion and reduce asset-stripping services, such as predatory lending, which continue to wreak havoc nationwide.

The Case For CDFI Funding

During a CDFI roundtable at this year’s Governmental Affairs Conference, William Myers, director of NCUA’s Office of Small Credit Union Initiatives, shared that 48% of all credit union members are low-income based on average median income and their location. This demographic has made it increasingly important for credit unions to rethink their product and service suite so they can better integrate underserved populations.

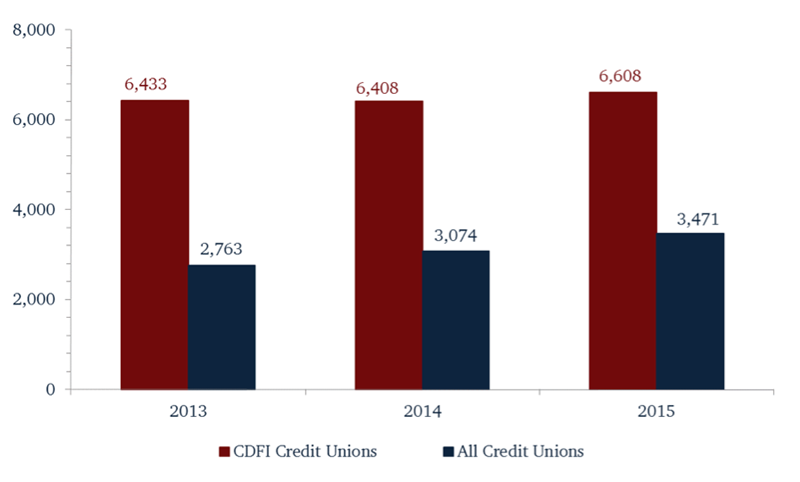

CDFI designation is based on what institutions do, not just the low-income members they serve. To seek additional funds, a financial institution must show it is increasing volume, expanding target groups, and making new products or services for members. For example, as of third quarter 2015, CDFI credit unions had originated an average of 6,608 loans in that year alone, representing an annual growth rate of 3.1%.

AVERAGE YEAR-TO-DATE LOAN ORIGINATIONS

For all U.S. credit unions | Data as of 09.30.15

© Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

The Fund is committed to tracking loan depth and breadth as part of its analysis of fund recipient performance. Examples include emergency funds for members with liquidity issues and credit-building products to improve credit scores. Additionally, the Fund is enhancing service tests to ensure financial institutions are meeting low-income members’ needs such as access to bank accounts, credit cards, and wealth-building products.

The Fund also encourages CDFI credit unions to build sustainable product bases by piloting new programs. And beyond CDFI grants, credit unions are leveraging community-based partnerships to raise capital as needed.

An Evolving Application For Evolving Needs

Panelists at the GAC CDFI roundtable announced application changes that will reduce burdens to receive initial CDFI certification and recertification, complete annual reporting, and fulfill grant-reporting requirements. Additional benefits to the revamped application include greater speed and consistency in reporting and granular analysis of financial performance.

The Fund has certified more than 250 credit unions to date and expects these additional certification resources will help that number expand to 500 within the next 10 months.

Approximately 400 credit unions meet NCUA’s low-income eligibility requirement based on the Automated Integrated Regulatory Examination System (AIRES). The Fund encourages credit union loan officers to use these resources, along with FIPS codes, Census Track level, and Census Block level data, to determine and maintain their CDFI eligibility.

Thanks to the Fund’s continued investment in credit unions, a range of groups including recent immigrants, people with disabilities, and Native communities are feeling financial gains. And the application changes underway will help CDFIs spend more time serving members and less time filling out paperwork.

Visit the CDFI Fund for details including eligibility requirements, upcoming application deadlines, and area CDFIs.

Read more about CDFI certification and benefits in Turn A Rebrand Into A Re-Statement,There’s No Place Like Hope, and Take The Leap