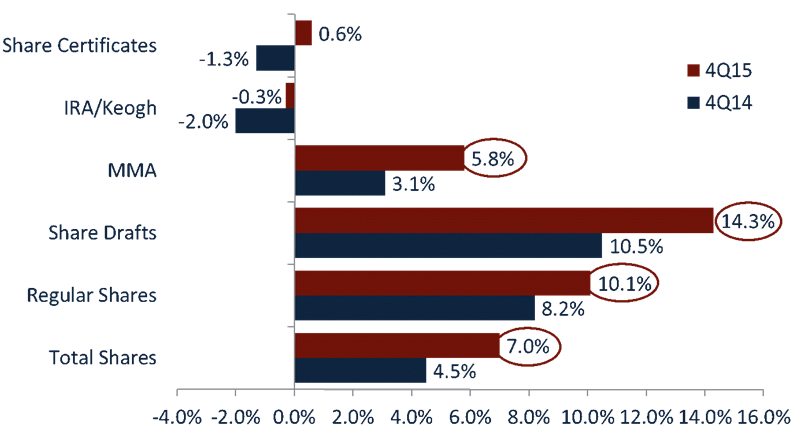

With more than 5,300 credit unions representing 94% of the industry’s total assets reporting in Callahan & Associates FirstLook program, many signs affirm the continued growth and health of the credit union industry. According to growth figures projected from reporting institutions, the industry’s loan portfolio continued its trend of expansion, increasing 10.6% year-over-year. Of equal importance, the share portfolio of the industry is projected to have expanded 7.0% as of December 2015, marking the fourth consecutive quarter of year-over-year growth.

LOAN GROWTH VS. SHARE GROWTH

For all FirstLook Credit Unions | Data as of 12.31.15

© Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

Core deposits (regular shares, share drafts, and money market shares) continue to be the primary drivers of growth in the share portfolio. In addition to posting double-digit growth in two of the three components of core deposits, every segment of the share portfolio grew faster than the previous year. As loan growth continues at a double-digit rate, it will become increasingly important for credit unions to grow deposits to maintain a well-balanced liquidity position.

YEAR-OVER-YEAR SHARE GROWTH

For all FirstLook Credit Unions | Data as of 12.31.15

© Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates