Ohio’s credit unions shared in the solid performance turned in during the fourth quarter of 2018 by the nation’s member-owned financial cooperatives.

Positive metrics were recorded in all the major metrics culled from the movement’s 5300 Call Reports and analyzed by Callahan & Associates for the quarterly report commissioned by the Ohio Credit Union League.

They begin with the heart of the movement: Some 74,700 new members joined the 264 credit unions based in the Buckeye State, a year-over-year growth rate that pushed total membership to 3 million.

MEMBER GROWTH RATES

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.18

Callahan & Associates | CreditUnions.com

Nearly 5 million new members joined America’s credit unions in 2018, including 74,700 at the 264 credit unions based in the Buckeye State. The state’s growth rate actually slowed 35 basis points from a year ago, while its national and regional peer rates were up 26 and 17 basis points, respectively.

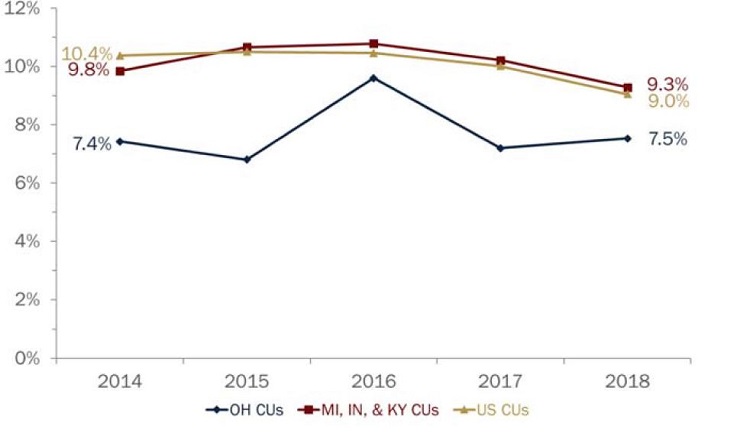

Loan growth among Ohio credit unions was up 33 basis points year-over-year to 7.5%, defying the decline in growth rate posted by all U.S. credit unions on average and among all credit unions in the Buckeye State’s regional peer group that includes Michigan, Indiana, and Kentucky. Used auto loans and first mortgage loans drove the performance in Ohio, rising 10.4% and 10.1%, respectively.

Loan originations, however, increased 5.3% nationally in 2018, topping $500 billion for the first time. Ohio’s credit unions saw 1.3% growth to $9.1 billion. Every loan segment has seen positive origination growth for the past three years.

ANNUAL LOAN GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.18

Callahan & Associates | CreditUnions.com

Buckeye State cooperatives bucked national and regional trends in 2018, posting year-over-year loan growth of 7.5% in the fourth quarter. That’s up 33 basis points, compared with total loan growth slowing 93 basis points regionally and 97 basis points nationally in the same time frame.

In the past year, credit unions in Ohio grew loan balances by 7.5% and shares by 4.6%, pushing the state’s loan-to-share ratio up 2.3 percentage points and boosting total share balances at those 264 credit unions past $26.6 billion.

That 4.6% growth was actually 80 basis points lower than in the fourth quarter of 2017, but share drafts and share certificates turned in stronger numbers, growing 9.9% and 8.7%, respectively, in the final three months of last year.

Overall, the fourth quarter was the 23rd in a row in which the nation’s financial cooperatives grew loans faster than shares.

LOAN-TO-SHARE RATIO

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.18

Callahan & Associates | CreditUnions.com

Credit unions nationwide posted the highest loan-to-share ratio on record, 85.5%, in the fourth quarter of 2018. Ohio’s cooperatives were close behind at 82.5%.

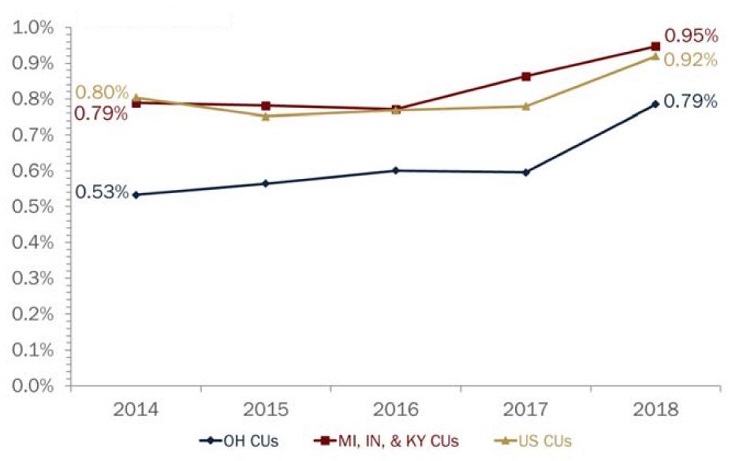

Ohio’s credit unions saw their return-on-assets grow faster than regional and national averages in the past year, bringing that key metric closer to those peer groups’ levels. Helping power that was 38.5% year-over-year net income growth in the fourth quarter, 33.5 percentage points more than the annual growth in assets.

That ROA performance also was helped by rising interest rates that boosted income from loans and investments, particularly as credit unions rolled off investments to satisfy consistent loan demand.

ROA

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.18

Callahan & Associates | CreditUnions.com

Ohio credit unions grew their return on assets by 19 basis points year-over-year to 0.79%, moving closer to the national average of 0.92% and its regional peers at 0.92%.

Ohio’s credit union environment reflects both national trends for the year, and for the past 10 years, of shrinking numbers but soaring assets, lending, and membership.

To wit, there were 7,967 U.S. credit unions in December 2008 and 413 of them were based in Ohio. At the end of 2018, those numbers were 5,492 and 264, respectively.

But membership nationally grew 30.8% over that decade to 117.6 million, and 15.0% in Ohio to just more than 3 million.

Similarly, assets grew 78.6% nationally from 2008 to 2018 compared to 29.6% for banks and loans grew by 83.7% during those 10 years, compared to 28.9% for banks.

Ohio’s credit unions were part of that success story as American consumers migrated in great numbers to the financial cooperatives that stood by them during the Great Recession. Credit unions continued to provide loans and other vital banking services to Americans that for-profit companies were rebuffing, burnishing the movement’s reputation and attracting new member-owners in record numbers.

Save Time. Improve Performance.

NCUA data is right at your fingertips. Build displays, filter data, track performance, and more with Callahan’s CUAnalyzer.