|

| Debora Almirall, CEO, Minnesota Power Employees Credit Union |

SEG-based credit unions don’t have to limit their marketing reach to their hometown, especially if their SEGs include the area’s largest employers. But they might need to rethink their definition of marketing, which in credit union land is really about relationships.

Debora Almirall’s strategy at Minnesota Power Employees Credit Union ($94.2M, Duluth, MN) is to deepen those ties through proximity and products.

Now nearing three years into her job as CEO at MPECU, she’s placed the emphasis on promoting financial wellness through value-priced products and services. She’s getting the word out through placing articles in local magazines, using TV screens in the branches, and changing the marketing collateral to include more graphics and in-house design.

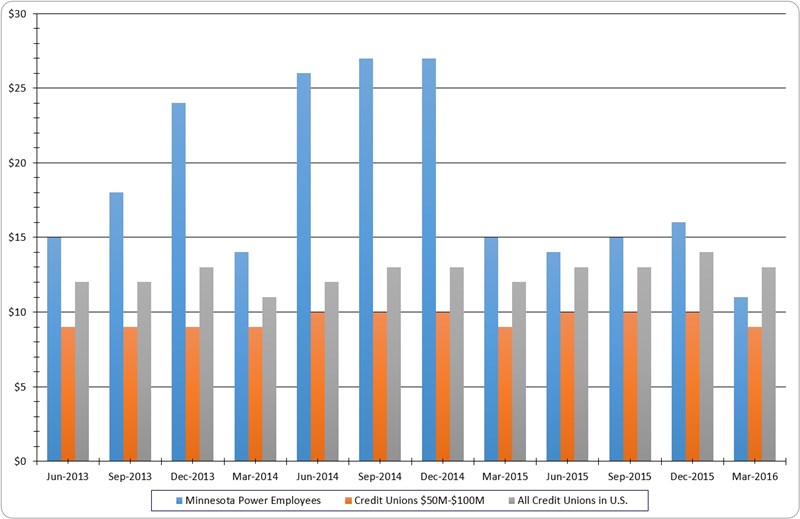

But those efforts cost time and money. MPECU spent $11 on marketing expenses per member in the first quarter of 2016. That’s more than the $9 average for credit unions of similar size but less than the $13 per member average for all credit unions in the country.

For the Duluth credit union, that was down from previous quarters after Almirall left the community banking world to succeed a 38-year veteran at MPECU. And although marketing is about consumer awareness, don’t call it selling.

We don’t sell anything, Almirall says. We listen a lot and recommend products based on what our members want and need.

MARKETING EXPENSE PER MEMBER

For all U.S. credit unions | Data as of 12.31.15

Callahan Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan Associates

For the past several years, MPECU has spent more on marketing expenses per member than credit unions of similar size and the industry as a whole. In first quarter 2016, however, it spent more than it asset-based peer average but less than the industry average.

The credit union is meeting those wants and needs through mobile banking, remote deposit checking, personal and business loans, shared branching, and now a third branch.

CU QUICK FACTS

MINNESOTA POWER EMPLOYEES CREDIT UNION

Data as of 03.31.16

- HQ: Duluth, MN

- ASSETS: $94.2M

- MEMBERS: 6,461

- BRANCHES: 2

- 12-MO SHARE GROWTH: 2.44%

- 12-MO LOAN GROWTH: 3.82%

- ROA: 0.49%

The new facility speaks volumes about MPECU’s strategy of deepening SEG relationships. The 3,500-square-foot branch will be one of three retail storefronts at the new corporate headquarters of Maurices, a clothing retailer with 900 locations across the United States and Canada.

We’re leasing from Maurices, so they had a lot of say in the design and specifications for the branch in terms of signage and space use, Almirall says. We’re hoping to re-create the great relationship we had with Maurices when it became a SEG in 2007, and we’re also going to make this a shared branch to serve members of other credit unions.

Almirall and her team began the relationship re-charge by meeting with that company’s CEO, George Goldfarb, as it built its new 11-story headquarters, consolidating its hometown operations and 425 or so employees there.

Looking for a better way to select a potential new SEG? BCU shares its matrix for doing just that, and it’s easily customizable for any credit union’s operation. That’s one of the many documents, policies, and templates borrowed from fellow credit unions and posted in Callahan’s Executive Resource Center.

Maurices has more than 9,000 employees in its string of women’s specialty shops, primarily in small towns.

We discussed our emphasis on financial literacy and how we help our members be financially successful through value-priced products and services, Almirall says of the meeting with Goldfarb. We talked about members helping members and the savings that can accrue by using a credit union. We stressed our 5,000 shared branches and vast ATM network throughout the United States.

Goldfarb was impressed, Almirall says. Along with the in-house branch, the credit union has the green light to give each employee a welcome packet and offer free financial literacy courses on topics such as identity theft, credit repair, and home buying through the company’s Maurices University (Almirall herself teaches such courses for the University of Phoenix.)

Maurices management understands that workers who are not worried about their finances perform better and are happier, Almirall says. We can help with that by helping them understand their finances and add value through much lower fees and better rates than they would get at a bank.

Follow The Leader

Explore dozens of leader tables and hundreds of pages of credit union performance data in Callahan’s Credit Union Directory. It’s the gold standard for reliable insight. Read the digital download today.

Explore dozens of leader tables and hundreds of pages of credit union performance data in Callahan’s Credit Union Directory. It’s the gold standard for reliable insight. Read the digital download today.

That philosophy permeates all the credit union’s SEG relationships as does consistent marketing across all channels and its own staff. MPECU has 26 employees and approximately 6,500 of 28,000 potential members enrolled. Its largest penetration among its 22 SEGs is at Allete/Minnesota Power, Duluth News Tribune, and ATT.

Almirall has just hired three additional MSRs, bringing the credit union’s employee base to 26, and doesn’t expect a lot of new employment in the new future. However, she hopes to increase lending enough to need another lender. And she plans to continue evolving roles based on member needs, which ultimately is at the heart of the credit union-SEG employee relationship.

I believe being SEG-based is a great opportunity, Almirall says. We are an employee benefit, not a solicitor, which can give us access other financial institutions can’t have. And we partner to give our SEGs’ employees the best products and services at the best prices.

You Might Also Enjoy

- A Matrix To Target New SEGs

- Onboarding With The Power Of The Pen

- Build A Team Of High-Producing Performers

- Why Is This Prepaid Worth $5 A Month?