CU QUICK FACTS

Data as of 09.30.19

HQ: Malborough, MA

ASSETS: $9.1B

MEMBERS: 856,779

BRANCHES: 23

12-MO SHARE GROWTH: 8.1%

12-MO LOAN GROWTH: 4.3%

ROA: 0.81%

Digital Federal Credit Union ($9.1B, Marlborough, MA) has evolved several times in its 40-year history. In 2020, planned operational updates will push the credit union into a new phase.

The big Massachusetts cooperative, known in its market as DCU, was founded in October 1979 as a single-SEG cooperative serving one of the country’s fastest-growing computer companies, Digital Equipment Corporation (DEC). In its early years, the credit union grew quickly largely through word of mouth. But changes to DEC’s business required the credit union to evolve.

It hired now CEO Jim Regan as an internal auditor in 1992, and in 1994 it added a second select employee group to its field of membership. By then, the credit union had reached $365 million in assets. It continued to expand its membership reach and in 1996 became the third credit union in the United States to have a website. That same year, DCU opened its first free-standing branch, in New Hampshire.

The credit union continued to add branches, members, and assets throughout the 90s and 2000s, reaching 19 branches and $4.5 billion in assets by the end of 2008. That’s the organization Jim Regan inherited when he became CEO in January 2009.

I wanted to continue building on the successes of my predecessor’s leadership, Regan says of his early priorities.

The financial crisis, however, forced the leader to forge a different path as delinquencies grew and assets fell at DCU.

Instead of expanding product and service offerings, we were helping our members navigate through financial challenges, Regan says.

Today, DCU remains focused on its member experience a critical advantage in an era when new technology and competitors threaten member loyalty and credit union relevancy as well as its vision:All members achieve their financial goals collaboratively. As it looks ahead to the 2020s, DCU’s current operations and planned changes are poised to keep the $9.1 billion shop top-of-mind for next-generation members and employees while staying on top of potential risks.

The Guiding Principles

DCU lives by three guiding principles, which it refers to asThe DCU Way:

- People come first.

- Make a difference.

- Do the right thing.

Together, those 10 words color (in DCU Green) how the credit union operates from its focus on the underserved to its culture of fun and respect.

We all believe in those words and try to live up to them every day, says Laurie LaChapelle, DCU’s senior vice president of finance.

But what it takes to live those principles is changing. Although the credit union has a physical presence in only Massachusetts and New Hampshire, it has members in all 50 states. Additionally, 50% of new DCU members are millennials. These shifts have caused the credit union to rethink how it puts people first, makes a difference, and does the right thing. Nowhere is this more evident than in its service strategy.

BEST PRACTICE: CATEGORIZE YOUR GIVEBACK

DCU tracks its charitable efforts according to category: Hospitals, medical research, community centers, police, firefighters, libraries, shelters, food pantries, veterans organizations, and education, among others. Why? So DCU can ensure its money helps organizations that make the most impact.

We’re focused now on creating experiences that are simple, digital, and self-service, says Craig Roy, senior vice president of retail lending.

For example, the credit union is currently in the testing and feedback phase of a revamped loan process that allows members to take out a loan without speaking to an employee. It hopes to deploy a solution in the next few years.

We all believe in [our guiding principles] and try to live up to them every day.

We believe our experience will be graded by how much we allow our members, especially our younger members, to do by themselves, says Julie Moran, senior vice president of branch services.

The credit union also has identified the need to monitor non-traditional competitors, the SoFis and Lending Clubs that have made inroads among younger populations. To develop its own next-gen technologies and experiences, better understand how fintechs work and think, and foster fintech innovation in its own communities, DCU launched the DCU FinTech Innovation Center in downtown Boston in 2014.

Since the launch, 55 companies have graduated from the program. Several of those are now credit union partners. Two called Project Finance and Posh are helping DCU introduce best-in-class user experiences in areas of organizational need.

Project Finance is a digital banking service that focuses on goals rather than transactions. The credit union is converting its online and mobile banking to this solution in 2020, and members will be able to glean insights on their spending and saving to help them make better financial decisions.

Posh offers conversational AI technologies that efficiently route members to where they need to go. DCU is beginning a three-tiered implementation of Posh in mid-2020 that will culminate in the addition of the chatbot feature to the credit union’s website as well as upgraded touchtone audio response and interactive voice response systems.

The chatbot will answer the phone, verify the member, and use natural language capability to either process a request or transfer callers to the appropriate live member service representative, Moran says.It’ll make life easier for our members.

An easy, seamless banking experience means a digital-first approach for some members. Others prefer a more human touch. For those who favor in-person support, DCU’s member service center in Methuen, MA, offers assistance for a range of simple as well as complex services from new account openings to credit score consulting.

Unlike DCU’s branches, which the Methuen area has three of, there are no tellers in the service center located some 40 miles northwest of Marlborough on the New Hampshire border. Housing member service representatives, private offices, ATMs, and iPads for service demos, the center is a hub for complex, human conversations.

We want to help them save time, effort, and money on the services they don’t need us for, Moran says.But when they do need us, we want to be available to them.

In the three weeks after opening the center in November 2019, the credit union opened 150 new memberships there, according to Moran.

Competing With Boston

Marlborough is a mere 30 miles west of Boston, but the proximity to Beantown is both a blessing and a curse.

We’re only a few miles from Boston, which attracts millennials to high-tech jobs, says Jane Fontaine, the credit union’s senior vice president of human resources and training.We’re in a suburb that’s maybe not quite as sexy.

That’s always posed a challenge for attracting bright talent to the organization. And with local unemployment at a 50-year low, recruitment has only grown in importance.

If people want to work in Boston, we can’t compete against that, Fontaine says.But we have a great culture and great benefits. We feel great when we come to work every day. That’s what we sell to applicants.

Most new members join from word-of-mouth referrals. That’s typically where the hiring process starts, too, Fontaine says. Frequently, applicants are members or have been referred by an employee. Culture starts at the top, where CEO Regan has fostered an approachable environment. The credit union has also enhanced it’s career website to include videos that showcase its culture.

Click the tabs below to view graphs.

LOAN COMPOSITION

LOAN COMPOSITION

FOR DIGITAL FCU | DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

DCU holds nearly two-thirds of its loan portfolio in autos and first mortgages. To ensure smart, stable future growth, the credit union sells loan participations and is now developing its own loan sale platform.

INDIRECT LOANS / TOTAL AUTO LOANS

INDIRECT LOANS / TOTAL AUTO LOANS

FOR U.S. CREDIT UNIONS $1B-$10B | DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

Less than one in five auto loans at DCU is an indirect loan that’s nearly 55 percentage points lower than its asset-based peers. The credit union focuses more of its lending efforts on direct lending to the tune of $5 million-$6 million per day and refinance activity.

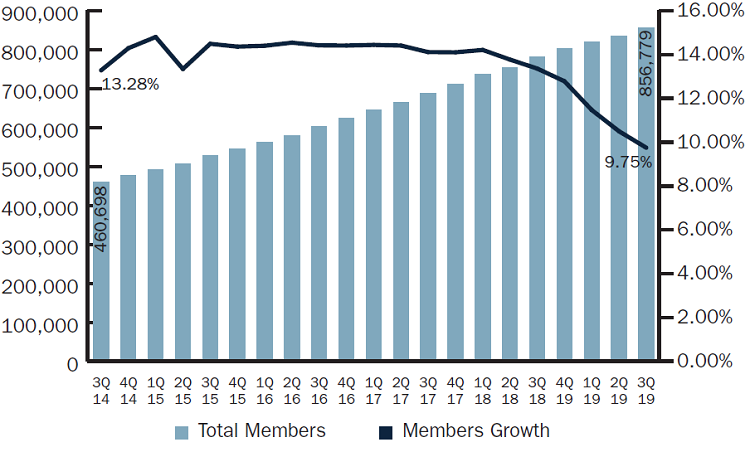

TOTAL MEMBERS AND MEMBER GROWTH

TOTAL MEMBERS AND MEMBER GROWTH

FOR DIGITAL FCU | DATA AS OF 09.30.19

Callahan & Associates |CreditUnions.com

Since 2014, DCU has added nearly 400,000 new members to a base that now totals some 860,000. During that period, member growth routinely exceeded 14%.

< id=”headingFour” role=”tab”>

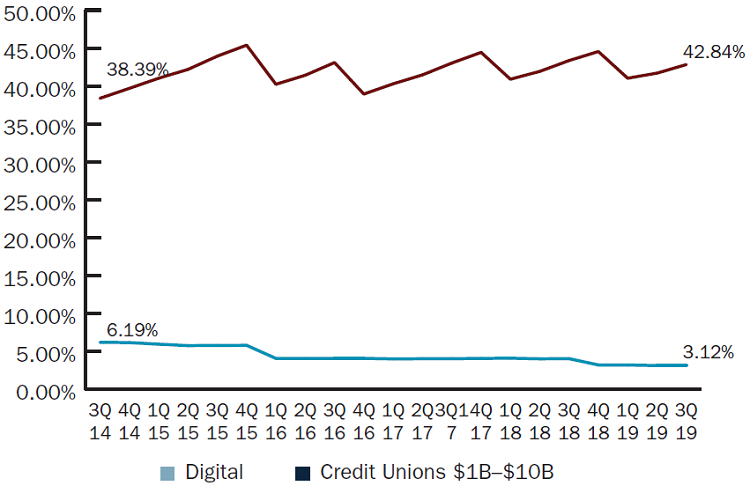

MEMBERS PER POTENTIAL MEMBERS

< aria-expanded=”false” aria-labelledby=”headingFour” id=”collapseFour” role=”tabpanel”

MEMBERS PER POTENTIAL MEMBERS

FOR U.S. CREDIT UNIONS $1B-$10B | DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

Of 309 credit unions with $1 billion to $10 billion in assets, DCU is in the top 10% with its ratio of members to potential members, showing just how well the $9 billion shop matches its products and services to members’ needs.

ROM – MEMBER SERVICE USAGE

role=”tabpanel”

ROM – MEMBER SERVICE USAGE

FOR U.S. CREDIT UNIONS $1B-$10B | DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

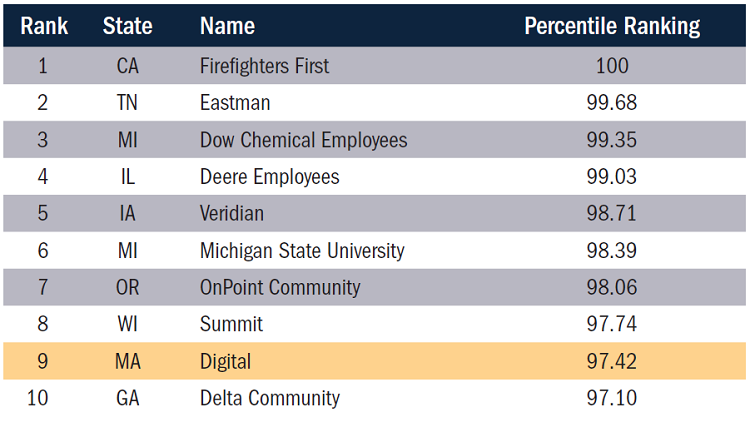

The Massachusetts cooperative ranks 9th in its asset-based peer group for the member service portion of Callahan’s proprietary member value metric, Return Of The Member (ROM).

id=”headingSix” role=”tab”>

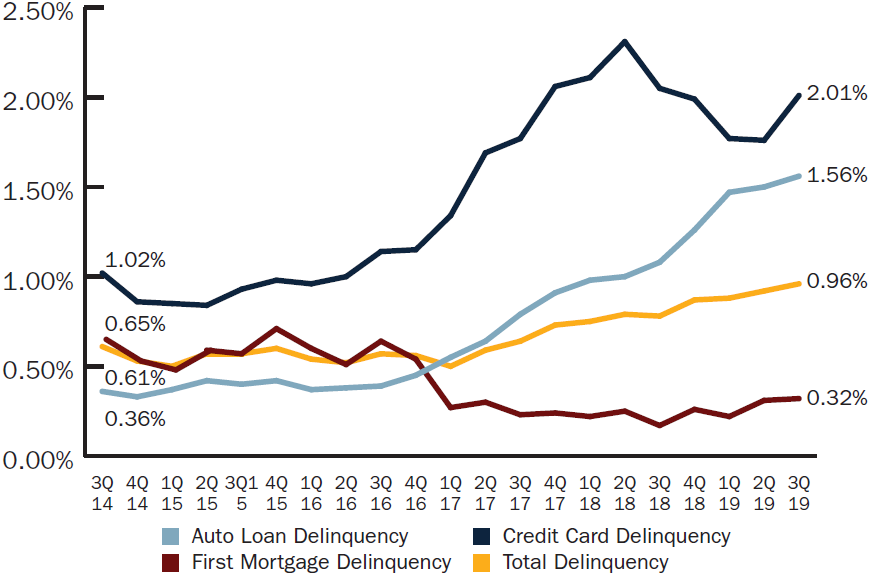

DELINQUENCY BY PRODUCT

aria-expanded=”false” aria-labelledby=”headingSix” id=”collapseSix” role=”tabpanel”

DELINQUENCY BY PRODUCT

FOR DIGITAL FCU | DATA AS OF 09.30.19</h5

Callahan & Associates | CreditUnions.co

First mortgage delinquency at DCU bests asset-based peer performance. While total delinquency has risen in the past two years, the credit union cites a higher risk tolerance to allow for a greater underserved focus as one reason for this growth.

To make the interview process itself easier, DCU recently piloted a call center virtual job fair with a third-party vendor. Candidates preregistered and entered a virtual lobby customized with the credit union’s branding and materials. Candidates couldsit in interview rooms and speak with the credit union about available opportunities.

Although we didn’t get as many participants as there might be have been at a traditional in-person job fair, the quality of the candidates was higher, Fontaine says.

On the benefits side, DCU introduced a student loan repayment program in 2016. This program helps employees pay down their student loans in less time, saving them thousands in interest and accelerating the payback period. This past summer, wanting to give its 60 to 70 interns more than just a paycheck, the credit union enhanced its internship program to provide more opportunities for interns to develop soft skills. DCU offered these employees seminars on resume writing, interviewing, and networking.

In a tight labor market, employee retention is vital, which is why the credit union begins engagement efforts as soon as possible. DCU recently started sending new hires a welcome package that includes a welcome letter, a DCU mug, and a notebook. In addition, Fontaine and Regan join groups of new employees for a breakfast on their first day of employment.

Many of them are pleasantly surprised that the CEO would take time out of his schedule to have breakfast with them, Fontaine says.The employee onboarding experience has a significant effect on whether someone stays with an organization. Ensuring that an employee is welcomed prior to their first day is key to engagement and contributes to retention.

BEST PRACTICE: GET DIGITAL

In keeping the flow of communication with employees open, in the past, DCU held live all-staff meetings. As the organization has grown, in-person meetings have become a challenge. As a solution, DCU piloted virtual all staff meetings. Using Cisco Webex, employees can participate in these meetings from anywhere. Prior to the meeting, employees have the ability to submit questions for the CEO, which are answered during the virtual event.

After those first crucial touchpoints, DCU continues to monitor employee engagement. Each year, it conducts an employee engagement survey that allows respondents to ask questions and submit comments.We want our employees to tell us what’s going well and where there are opportunities for improvement, Fontaine says.With almost 1,400 employees, you can imagine the amount of feedback received.

The HR team creates a high-level overview of the results for the senior team and department managers, who then share the results with staff. Managers identify at least two areas of action for which they can make improvements for the coming year and develop achievable goals to work toward. Based on past survey results, the credit union has worked hard to improve internal communication and enhance professional development opportunities. One outcome of the engagement survey was the development of a comprehensive leadership training program. This program provides opportunities for new and experienced leaders to increase their managerial capacity through the development of both technical and soft skills.

Scaling Up And Managing Risk

In the past five years, DCU has grown fast. Annualized growth rates for members (14.8%), assets (9.5%), loans (8.3%), and shares (10.4%) have helped the now-$9 billion organization become one of the largest credit unions in the country. But growth, especially at this scale, requires careful, managed planning.

For DCU, that started at the department level. As the organization became more complex, it created or expanded back-office teams that fell under the enterprise services umbrella. Five years ago, DCU hired two attorneys to start an internal legal team that now includes three full-time attorneys and one paralegal. Soon after, it split its audit and compliance department into two teams. And in 2018, the credit union hired its first director of enterprise risk management.

We’re not required to have an ERM program, but we wanted to push ourselves to develop one, says David DeWitt, senior vice president of enterprise services.

Another way the credit union is preparing for the future is by broadening the purview of its senior staff. In December 2017, it named Tim Garner senior vice president of capital planning. At the time, Garner was the senior vice president of marketing, and the credit union moved his marketing function to Julie Moran in branch services. DCU gave Garner a directive to create and maintain a capital plan and stress testing regimen. Since then, Garner has worked with outside consultants to develop guidelines, policies, and procedures for planning and testing. He has also enhanced and formalized data governance standards.

You can’t rely on the stress tests unless the data that goes into them is accurate and reliable, Garner says.

BEST PRACTICE: BECOME A VALIDATE-ORIAN

When stress testing, model risk management is key.If you are making any kind of financial decision based on a statistical model, you need to have a plan in place to validate that the model is telling you what you think it is, that you don’t expect it to tell you more than it’s designed to, and that there are controls in place so people can’t change it without some kind of process, says Tim Garner, SVP of capital planning.

The credit union is still formalizing its plan and will assign credit loss models to one of four major portfolio segments, mortgages, home equity loans, unsecured credit cards and lines of credit, and total vehicle loans. It will then run tests in one of three economic scenarios base, adverse, and severely adverse to gauge credit risk. And because these general scenarios aren’t as useful as something more tailored to the credit union’s membership, it will also stress test in a way that is more customized to the organization, Garner says.

According Garner, examiners want to see a capital plan on paper and formalized practices for keeping it up-to-date. DCU’s capital plan contains the results of its stress tests plus a series of written risk appetite statements that rationalize the decisions and assumptions the credit union has made.

To keep the plan up-to-date, the credit union must document procedures, audit those procedures to ensure they are being followed, and regularly update those procedures in a pre-defined way.

As the credit union continues to grow and serve members of modest means, defining and regularly managing its risk weighs large. Ultimately, however, the credit union understands that certain risks are required to live up to its guiding principles. Those come first.

Risk management, then, is the way we manage our balance sheet to allow for maximum member impact, DeWitt says.

As a new decade begins, new economic conditions might introduce different challenges to DCU’s members. As the adage goes, its prudent to always expect the unexpected. But whatever happens, the credit union has readied itself for the years to come. For Regan, it all boils down to one core tenant.

Our focus remains on our membership, the CEO says.We need to continue to adjust and adapt remaining relevant as an organization to ensure that we are there long-term to provide the services our members want and need.

Wait, There’s More!

This is just one section of the Anatomy Of Digital Federal Credit Union series that appears in Credit Union Strategy & Performance. Read the whole discussion today.