Read the full analysis or skip to the section you want to read by clicking on the links below.

LENDING AUTO LENDING MORTGAGE LENDING CREDIT CARDS MEMBER BUSINESS LENDING SHARES INVESTMENTS MEMBER RELATIONSHIPS EARNINGS SPECIAL SECTION: CUSOS

For the 10th consecutive quarter, credit unions increased share balances. Share balances increased a record-breaking 8.4% and neared $1.2 trillion in the first quarter of 2017. Loan balances also posted rapid annual growth of 10.7% and totaled $895 billion as of March 31, 2017. The relatively faster growth of loan balances, however, helped to push up the loan-to-share ratio 1.7 percentage points to 77.7%.

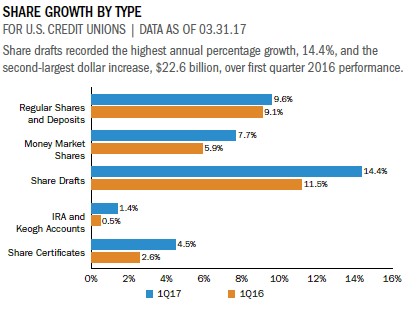

Regular shares accounted for the majority 35.6% of total shares. That was up 30 basis points from last year. Including non-member and other deposits, regular shares recorded a 9.6% year-over-year increase and hit $430.2 billion. These were a core contributor to the increase in total share balances. Share drafts expanded 14.4% over the past 12 months, the fastest year-over-year growth rate among share accounts. As of March 31, 2017, share drafts totaled nearly $180.3 billion and comprised 15.6% of the share portfolio, up 82 basis points from one year ago. Collectively, share drafts and regular shares accounted for 52.9% of the deposit portfolio.

At $259.5 billion, money market shares were the second-largest component of the share portfolio. These grew 7.7% from March 31, 2016, to March 31, 2017. Share certificates posted an annual increase of 4.5% and reached $204.4 billion at the end of the first quarter. Despite relatively slower growth compared to the other products in the deposit portfolio, certificate growth continued to recover as gradual interest rate increases and credit union deposit incentives attracted members to longer-term, higher-yielding products.

Callahan’s Peer-to-Peer quickly shows how your credit union stacks up against peers for key share-related metrics. Learn more today.

Average share balances increased 3.9% year-over-year and added $393 to total $10,459 as of March 31, 2017. In combination with strong and steady membership growth, this reinforces the positive trend of members choosing credit unions as their primary financial institution.

Click the graphs below to enlarge and then continue reading to see how Pioneer FCU uses marketing, deposit, lending, and ALM strategies to increase member value.

Larger institutions underpinned the growth in average loan balances across the country. Whereas the median growth rate increased 2.8 percentage points, credit unions in the top 20th percentile posted gains of 9.6% per loan.

CASE STUDY

PIONEER FEDERAL CREDIT UNION

Share, loan, and member growth are three major metrics that help formulate a big picture of a credit union’s performance.

In a third quarter clean sweep in 2016, Pioneer Federal Credit Union topped the leader tables for all three of those measures, besting 343 credit unions in the $250 million to $500 million asset range, according to data from Callahan Associates.

As of the first quarter of 2017, the Idaho credit union was still posting respectable numbers, including 10.2% share growth versus 7.3% for the average credit union of its size.

Leaders at the 63-year-old former air base credit union that now serves most of southwest Idaho have relied on upgraded systems and processes to fuel growth. A merger, relationship lending, a core processing conversion, mobile apps, and old-fashioned asset liability management have underpinned growth as well. And, of course, people make a difference, too.

You need to establish the right chemistry, find the right employees, and then growth should come, says Curt Perry, who joined the credit union in 2002 and became CEO in 2011. Bigger doesn’t always lead to better, but better can easily lead to bigger. Do your part to nail down the culture and work atmosphere first, the rest will follow.

Perry says efforts to increase core deposits over the past few years have included instant issue cards, personalized debit and credit cards, programs that round up debit card purchases, reward and youth checking accounts, and self-service conveniences.

Those, along with competitive savings rates, have helped give the Idaho credit union the liquidity needed to sharply build lending. Pioneer’s loan-to-share ratio in the first quarter of 2017 was 82.7%, versus 73.7% on average for credit unions with $250 million to $500 million in assets and 77.7% for all credit unions nationwide, according to data from Callahan Associates.

Read The Whole Story

RETURN TO INDUSTRY PERFORMANCE BY THE NUMBERS 1Q 2017