INSURANCE OPTIONS AT U.S. CREDIT UNIONS

Member insurance offerings at U.S. credit unions tend to fall into three categories.

INSURANCE AVAILABILITY AND PAY OUTS

For all U.S. credit unions | Data as of 03.31.15

Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

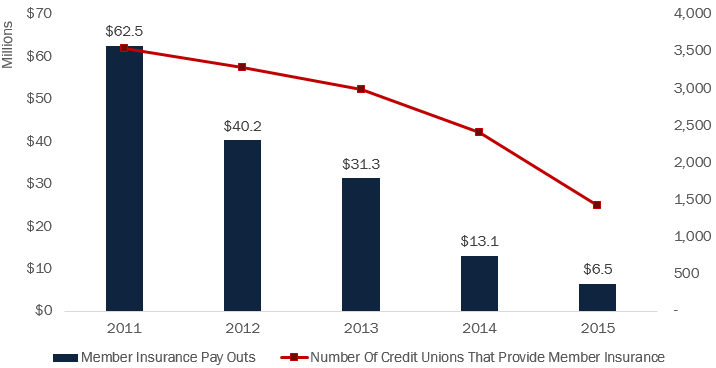

Fewer than 25% of U.S. credit unions offer member insurance today; that’s a 46% decrease from three years ago. Accordingly, pay outs are trending down, too. Total member insurance pay outs at the end of first quarter 2015 are half of where they were one year ago. Credit unions are either terminating these costly programs or turning them into sources of non-interest income.

LEADERS IN MEMBER INSURANCE

For all U.S. credit unions | Data as of 03.31.15

Callahan & Associates | www.creditunions.com

| State | Percentage Of Credit Unions Offering Member Insurance | |

|---|---|---|

| 1 | KS | 55.4% |

| 2 | ND | 55.3% |

| 3 | AR | 48.3% |

| 4 | NM | 47.8% |

| 5 | AL | 47.5 |

Source: Peer-to-Peer Analytics by Callahan & Associates

According to first quarter data available in Callahan’s FirstLookprogram, more credit unions as a percentage of total credit unions in central states offer member insurance. Kansas leads the nation with 55.4% of its credit unions offering members insurance versus 23.4% for all credit unions in the United States.