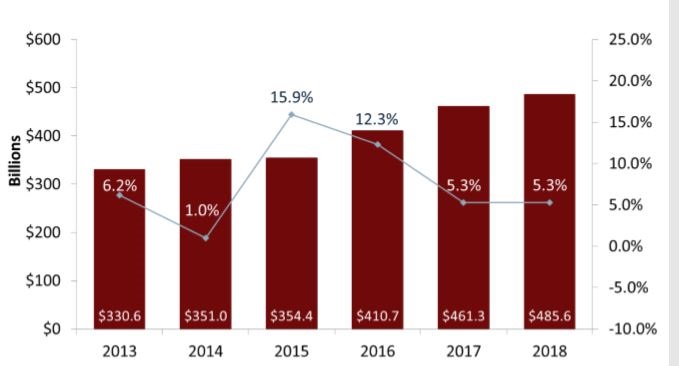

Arkansas, Oklahoma, and Texas credit unions reported record loan originations in 2018, reflecting the positive industry momentum nationwide that saw improvements on both sides of the balance sheet.

With auto lending leading the way, the 570 credit unions in those three states saw total loan originations increase 4.1% annually to $42.6 billion as of Dec. 31, 2018, according to data culled from the movement’s 5300 Call Reports and analyzed by Callahan & Associates for the quarterly report commissioned by the Cornerstone Credit Union League.

That was part of a national trend that saw loan originations jump 5.3% from the fourth quarter of 2017 to exceed $500 billion for the first time. In the Cornerstone states, other real estate originations showed the fastest growth at 11.2% followed by consumer originations at 4.8%. First mortgage loans increased 6.6% annually, and overall loan balances topped $90.3 billion, a 6.5% increase year-over-year.

YTD LOAN ORIGINATIONS AND ANNUAL GROWTH

FOR ARKANSAS, OKLAHOMA, TEXAS CREDIT UNIONS | DATA AS OF 12.31.18

Callahan & Associates | CreditUnions.com

Cornerstone credit unions underwrote $1.7 billion more in loans in 2018 than in 2017, a growth rate of 4.1% that reversed a downward trend that began after a peak of 10.2% in 2014.

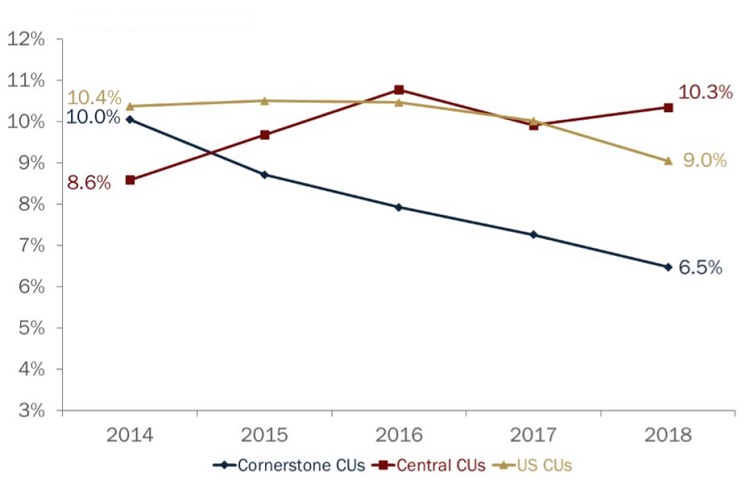

Meanwhile, Cornerstone credit unions grew their loan portfolio 6.5% year-over-year, a 78 basis point decline from the 7.3% recorded in the last three months of 2017. That reflected the national trend, which saw the credit union industry as a whole posting loan growth of 9.0% in the fourth quarter of 2018, down 97 basis points year-over-year.

Cornerstone’s peer group of credit unions in the NCUA’s Central region actually accelerated loan growth in that same time period, posting a 10.3% rate. (The Central Region includes: Colorado, Illinois, Iowa, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, North Dakota, Oklahoma, South Dakota, Texas, Wyoming).

ANNUAL LOAN GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.18

Callahan & Associates | CreditUnions.com

While credit unions are posting record origination balances, loan growth has decelerated among the 570 credit unions in Texas, Arkansas, and Oklahoma since 2014, as it has nationally. The Central region, however, has bucked that trend.

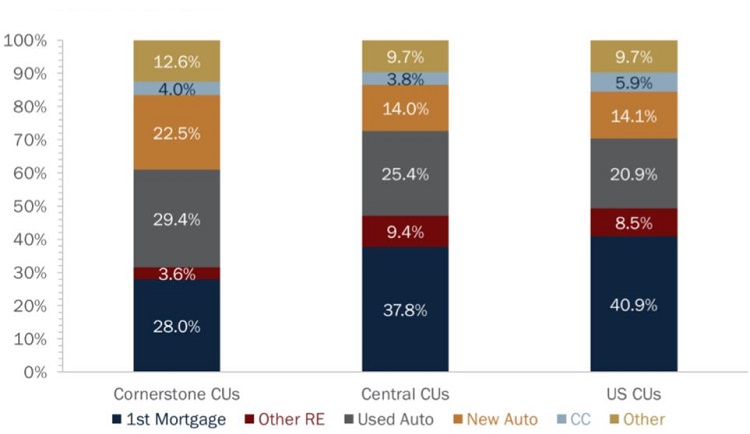

Credit unions in the Cornerstone states of Texas, Arkansas, and Oklahoma are more heavily reliant on auto loans and slightly less on mortgage lending when compared to their regional peers and nationally.

In fact, while mortgage loans comprise the largest share of the national credit union portfolio, auto loans narrowly take the lead in the Cornerstone region. That shows in the penetration rates, too, where 25.4% of the 10.7 million members in those three states have a car loan from their cooperatives, compared with a penetration rate of 21.2% for all U.S. credit unions.

LOAN PORTFOLIO COMPOSITION

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.18

Callahan & Associates | CreditUnions.com

At year-end 2018, auto loans comprised 51.9% of the Cornerstone portfolio, compared with 39.4 percent for the Central region and 35% for all U.S. credit unions. New auto loans at 22.5% help drive that difference for the Cornerstone states.

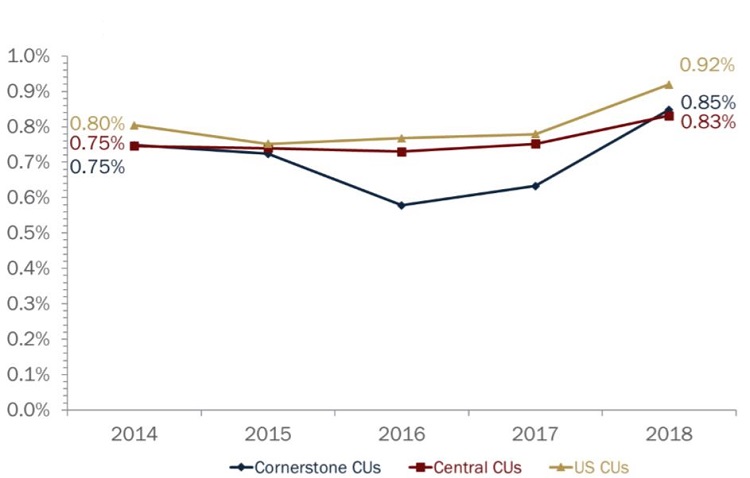

Rising interest rates have benefited both loan and investment portfolios at credit unions nationwide, even as investments were sold to fund loans, and the Cornerstone cooperatives are no exception.

Total interest income among Texas, Arkansas, and Oklahoma credit unions rose 11.2% annually in 2018 and non-interest income was up 12.6%. That helped produce a net income jump of 39% in those states and a regional ROA of 0.85%, seven basis points lower than the industry average of 0.92%.

ROA

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.18

Callahan & Associates | CreditUnions.com

Cornerstone credit unions grew ROA 22 basis points year-over-year in 2018, bouncing off a two-year low and edging past the average for all credit unions in the Central region.

The 570 credit unions in Arkansas, Oklahoma, and Texas added nearly 330,000 members in 2018, meaning 10.7 million members across that large piece of American real estate are benefitting from the rates and services provided by their member-owned financial cooperatives.

Their response to that value proposition has helped produce another year of positive financial performance for the members of the Cornerstone Credit Union League and the credit union movement nationwide.

Save Time. Improve Performance.

NCUA data is right at your fingertips. Build displays, filter data, track performance, and more with Callahan’s CUAnalyzer.