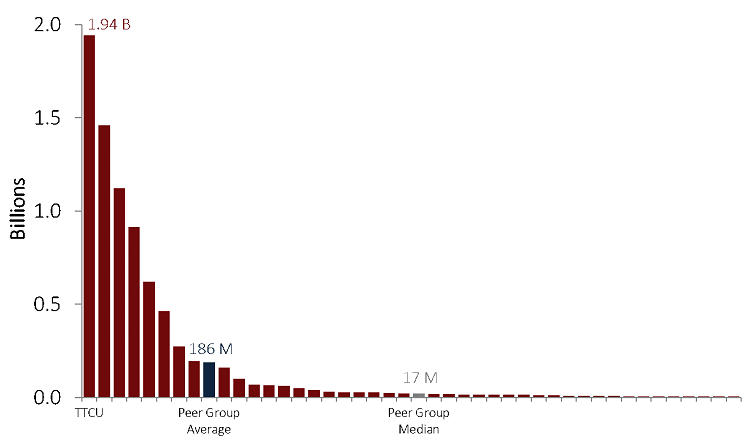

A change from a federal charter to a state charter or vice versa can be a viable strategy to revise a credit union’s target member base. Since the beginning of 2014, 54 credit unions have converted from a federal to a state charter, whereas 42 ditched their state charter in favor of operating under federal legislation.

Every credit union faces its own set of circumstances when deciding whether it’s time to change charters. In the case of St. Cloud Financial Credit Union ($200M, St. Cloud, MN) CEO Jed Meyer believes the pace of change within the financial services industry will only increase in the coming years. For him, converting to a state charter in January 2019 allows the credit union to compete more holistically today while setting up the Gopher State shop for continued success in the future.

We need to win in the communities in which we operate, Meyer says. The moment we don’t win in the community and we’re forced to compete against bigger budgets and virtual services, we’ll be in trouble.

For St. Cloud, converting to a state charter will help it extend its field of membership into counties in which it already has high membership penetration. But that’s just one story, one data point. When viewing conversion data in the collective, using the data from the 5300 Call Report and Callahan & Associates Peer-to-Peer, certain performance trends start to unfold.

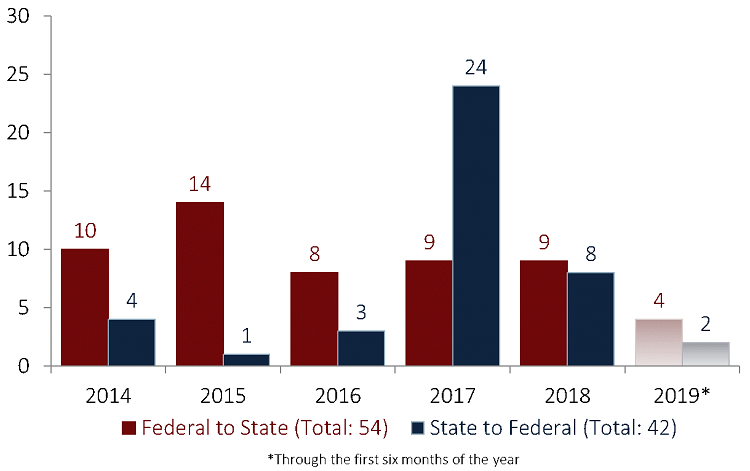

NUMBER OF CHARTER CHANGES BY YEAR

NUMBER OF CHARTER CHANGES BY YEAR

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Credit unions have converted from federal to state charters at a consistent rate of close to 10 institutions per year since 2014. State to federal conversions are less common and often the result of regulatory changes in an individual state. In 2017, for example, 17 of the 24 credit unions that converted to a federal charter were headquartered in the state of Mississippi. This shift in the Magnolia State was not a comment on the value of a state charter, says Charles Elliott, the president and CEO of the Mississippi Credit Union Association. Rather, in 2017 the Mississippi Department of Banking and Consumer Finance rescinded previous guidance from a decade prior that established parity in the cost of examinations for state chartered financial institutions. In doing so, smaller credit unions in our state saw an extremely large increase in the cost of exams, Elliott says. The average assets of the 17 Mississippi credit unions that converted to a state charter in 2017 was $8.8 million.

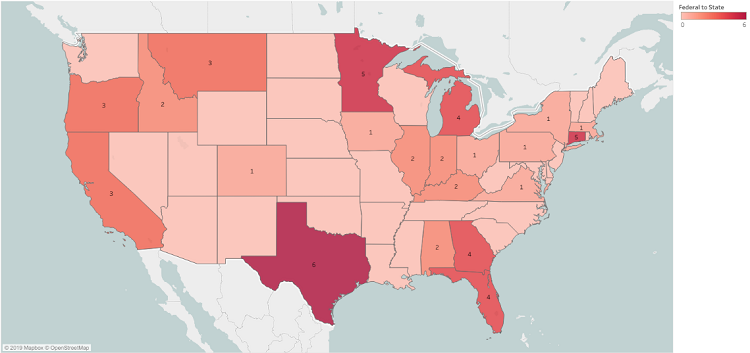

FEDERAL TO STATE CONVERSIONS, BY STATE

FEDERAL TO STATE CONVERSIONS, BY STATE

FOR U.S. CREDIT UNIONS SINCE JANUARY 1, 2014 | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

During the past five years, credit unions from all regions of the country have converted from a federal to a state charter. The desire to focus on a more localized member base is geographically universal. We knew we need to grow to survive, and the state regulator is more knowledgeable and understands Montana, says Eddie Black, CEO of Vocal Credit Union ($32.3M, Helena, MT). The credit union officially converted to a state charter in March 2016 and rebranded at the same time, from Trico Community FCU.

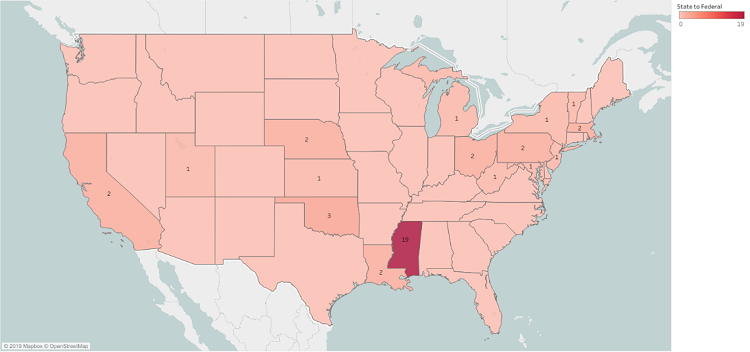

STATE TO FEDERAL CONVERSIONS, BY STATE

STATE TO FEDERAL CONVERSIONS, BY STATE

FOR U.S. CREDIT UNIONS SINCE JANUARY 1, 2014 | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Most of the credit unions that have converted from a state to a federal charter in the past five years came from the state of Mississippi and followed an increase in the cost of a state examination, a policy change from the Mississippi Department of Banking and Consumer Finance. State regulation changes were a common cause of conversion, but credit unions also switched to a federal charter to expand their geographic reach. Such is the case with West Virginia Central Credit Union ($194.6M, Parkersburg, WV). Before the credit union converted to a federal charter in July 2017, the multi-SEG credit union found marketing its membership requirements challenging. To receive its desired community charter, however, the West Virginia Division of Financial Institutions required the Mountaineer State credit union to convert to a federal charter: We now concentrate on a six-county region when marketing to and serving our members, says CEO Michael Tucker. Since the change, the credit union’s average new account openings has grown from 110 to more than 200.

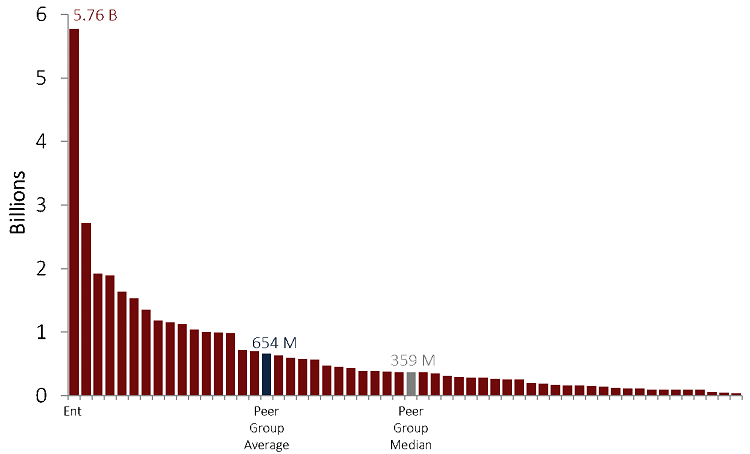

FEDERAL TO STATE CONVERSIONS, BY ASSET SIZE

FEDERAL TO STATE CONVERSIONS, BY ASSET SIZE

FOR U.S. CREDIT UNIONS SINCE JANUARY 1, 2014 | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Since 2014, there has not been a strong correlation in either direction between asset size and credit unions that switched to a state charter. Most asset ranges were comparably represented over the past five years. Because of its size, Ent Credit Union ($5.8B, CO) is a notable outlier.

STATE TO FEDERAL CONVERSIONS, BY ASSET SIZE

STATE TO FEDERAL CONVERSIONS, BY ASSET SIZE

FOR U.S. CREDIT UNIONS SINCE JANUARY 1, 2014 | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Credit unions that have converted from a state charter to a federal charter in the past five years have tended to be smaller, on average, than those that changed from federal to state. Smaller credit unions are more drastically affected by unfavorable regulatory changes at the state level and, therefore, might feel greater pressure to change charters. I don’t love the regulatory piece, says CEO Black of Vocal, the now-state chartered Montana credit union. But we appreciate our regulator’s local understanding and focus.

Among the larger credit unions that converted to a federal charter, Firefighters First Credit Union ($1.5B, Los Angeles, CA) was not focused on the regulatory piece. Its April 2017 conversion coincided with its creation of a firefighter TIP charter, allowing it to serve fighters nationwide, says Kelly Ramsay, the credit union’s senior vice president of marketing. ‘We wanted to grow as an organization, stay true to the firefighting profession, and determine how to best mitigate risk from a concentration perspective, she says.

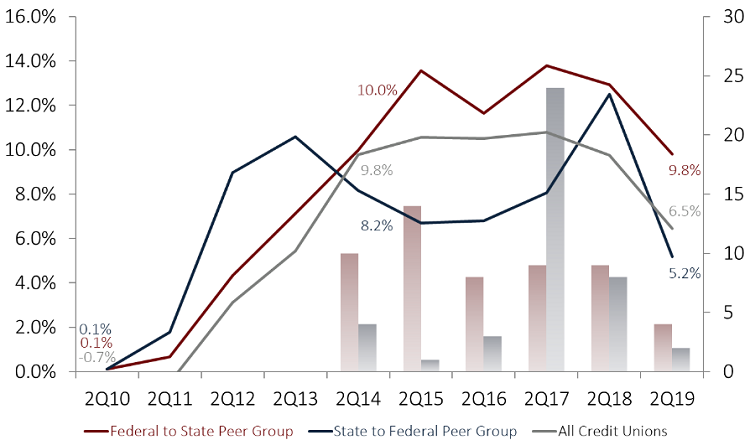

The next four charts show annual growth rates for credit unions that have changed charters in either direction during the past five years. This growth is superimposed over the number of conversions each year, for reference. An additional five years of historical data is also shown to help track trends.

LOAN GROWTH

LOAN GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Credit unions that converted from a federal to a state charter tended to outperform the industry average in average loan growth rates. State to federal converters had a more volatile history, but the spike in loan growth in 2018 after the 17 Mississippi credit unions converted to a federal charter highlights how this can be a beneficial change in certain circumstances.

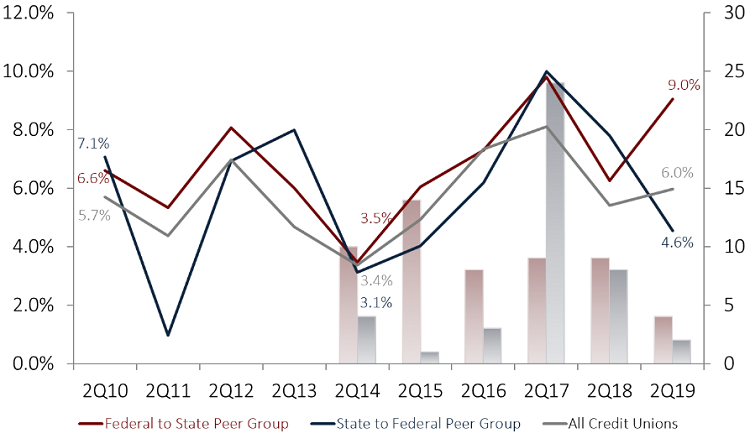

SHARE GROWTH

SHARE GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Regardless of the direction of charter conversion, share growth tracked the industry average more closely than loan growth over the past decade. State charters tended to have the highest share growth performance of the three groups.

MEMBER GROWTH

MEMBER GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Member growth boomed for newly federally chartered credit unions after the Mississippi conversion in 2017, but the historical trend implies that a localized, state-level focus is more likely to attract member growth.

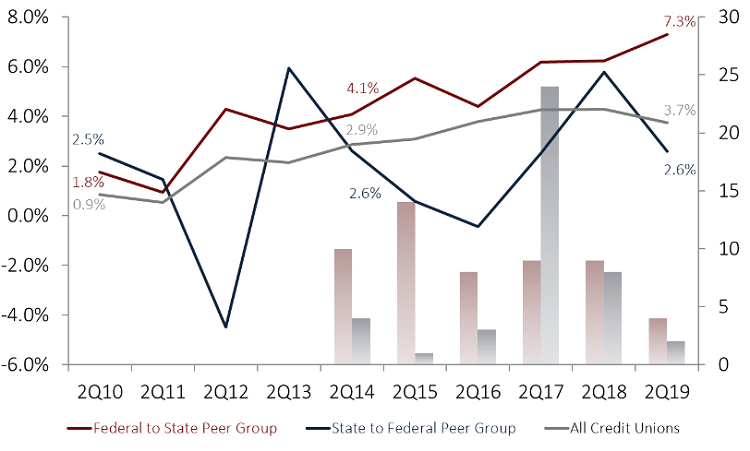

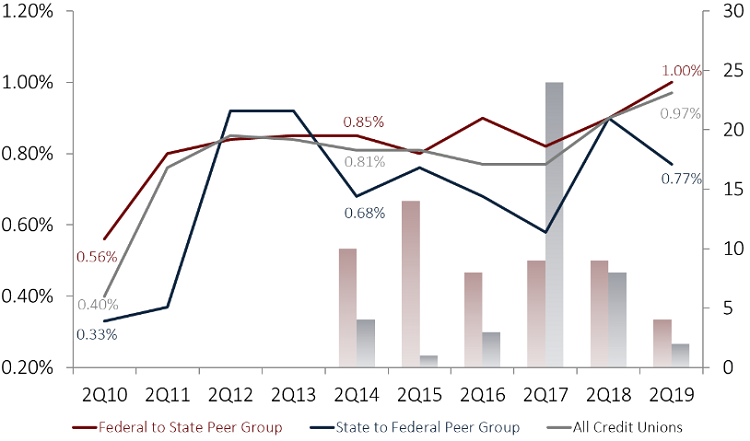

ROA

ROA

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.19

Callahan & Associates | CreditUnions.com

Cooperatives that switched to a state charter reaped the most return from their assets, but they also started from a higher, pre-conversion benchmark. Credit unions that converted from a state to a federal charter trailed the ROA rates of the industry but reported the greatest increase in returns over the past decade.