Rising new vehicle prices, increasing loan terms, and market uncertainty resulting from tumult in the global economy present challenges to the health of the U.S. auto market.

New car prices in the United States averaged $32,119 in the second quarter of 2019, according to Experian Automotive. That’s up from $30,958 one year ago. With rising prices, consumers are considering new as well as used options when purchasing. Accordingly, seasonally adjusted new light vehicle sales fell 168,000 year-over-year to 17.1 million units in September, according to the Bureau of Economic Analysis. The share of auto originations from new vehicle sales likewise decreased by 2.1 percentage points.

Key Points

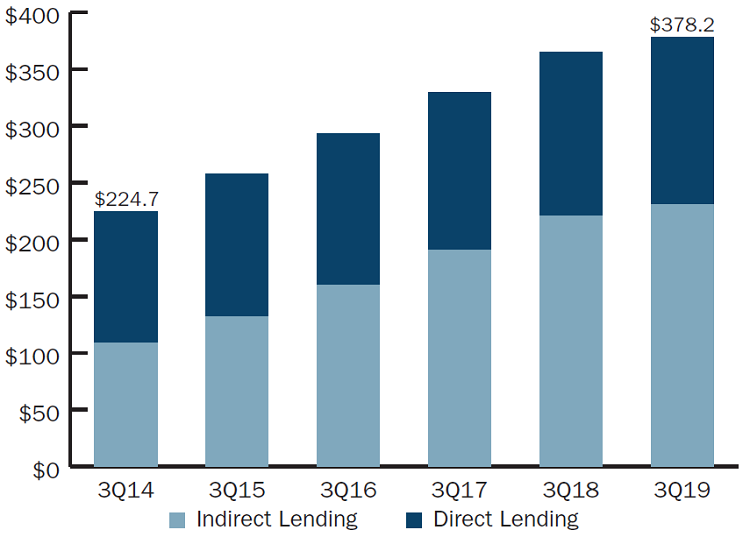

- In the past 12 months, auto loan balances for credit unions grew by 3.5% to a record $378.2 billion. Today auto loans account for 34.4% of the industry’s total loan portfolio.

- Indirect loan growth has fallen 16.9 percentage points since the third quarter of 2014. It was 4.6% in the third quarter of 2019.

- Auto loan penetration increased 24 basis points year-over-year to 21.3% as of Sept. 30, 2019.

- Year-to-date, auto loan market share for all credit unions declined to 18.5%, according to data from Experian. That’s down 1.9 percentage points versus one year ago.

- Average auto loan balances for credit unions fell $156 year-over-year to $14,700 as of Sept. 30, 2019.

Click the tabs below to view graphs.

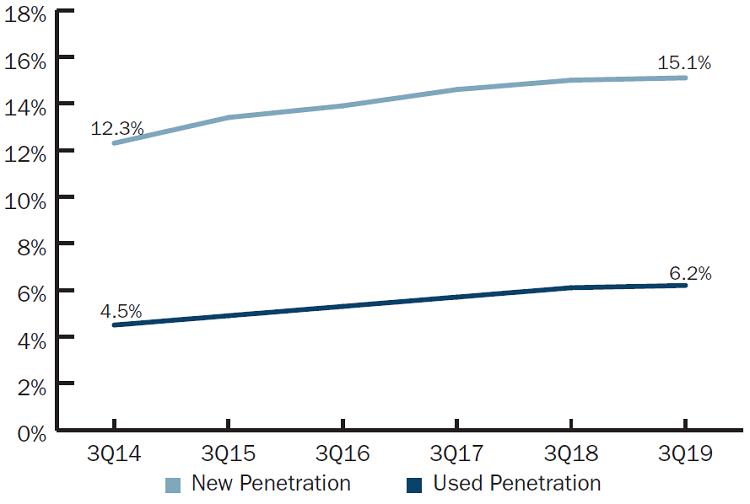

AUTO LOAN PENETRATION

AUTO LOAN PENETRATION

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

The average penetration for used autos and new in the past five years is 14.0% and 5.5%, respectively.

INDIRECT LENDING

INDIRECT LENDING

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

Annual growth in indirect lending declined sharply in the third quarter of 2019. As a result, year-over-year growth for total auto loan balances fell to 2.6%.

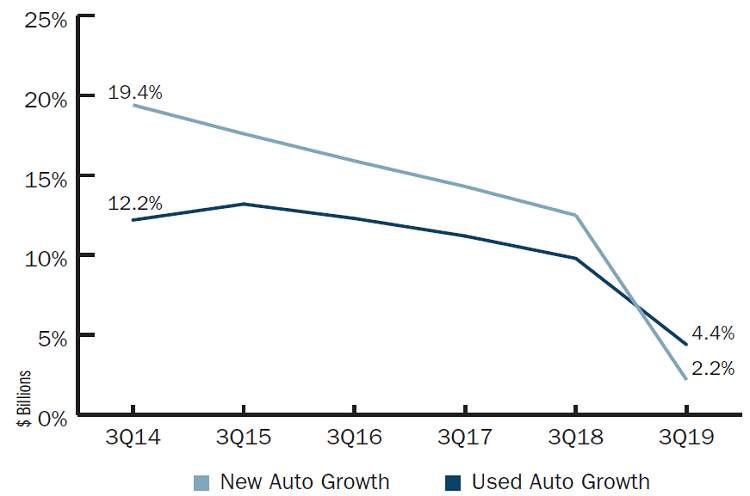

AUTO LOAN GROWTH

AUTO LOAN GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

The steepest decline in annual growth occurred in new auto loans, which pulled total growth in the auto portfolio down to 3.5%.

The Bottom Line

Despite slowing consumer demand across the country, auto loans remain the most well-penetrated market segment for credit unions. However, an increasing number of loans that result in negative equity and longer credit terms, among other factors, mean credit unions should still closely monitor this segment. Looking ahead, key factors to watch include consumer confidence changes stemming from evolving macroeconomic dynamics as well impacts from the Fed rate cuts on member demand, product pricing, and margin compression.

This article appeared originally in Credit Union Strategy & Performance. Read More Today.