It may be the middle of winter, but the credit union loan portfolio has finally started to heat up. In early 2019, rising interest rates dampened consumer borrowing appetites, leading to the lowest first quarter loan origination performance in three years. In third quarter, however, originations have spiked.

Credit unions originated some $151.0 billion in loans in the third quarter of 2019, the highest third quarter performance on record. This, despite the fact that new and used auto loan growth decelerated 10.3 and 5.4 percentage points year-over-year, respectively.

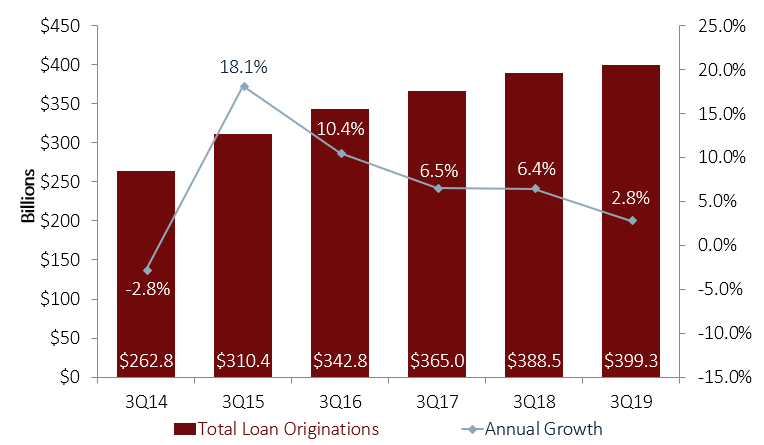

YTD LOAN ORIGINATIONS AND ANNUAL GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

Total originations surged in the third quarter, making up for a slower first half of the year. Year-to-date production is 2.8% above levels reported in September 2018, totaling $399.3 billion, and marks the largest nine-month origination total on record.

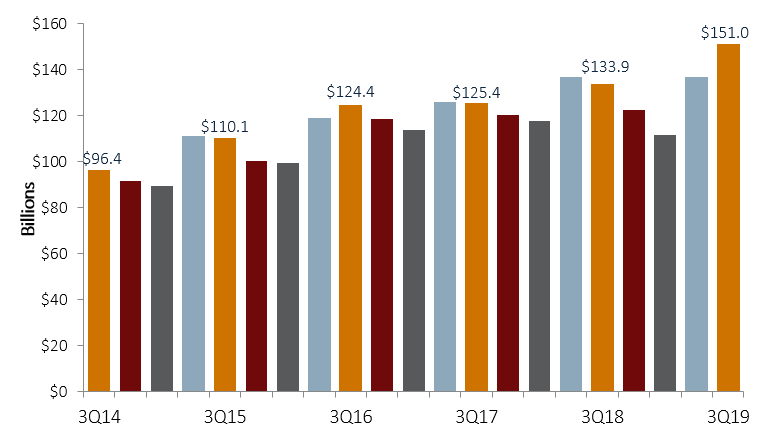

QUARTERLY LOAN ORIGINATIONS

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

In the third quarter alone, credit unions booked $151.0 billion in loans, which is also a third quarter high-water mark for the industry. This is up 10.3% from the second quarter of the year and 12.8% from levels reported in the third quarter of 2018. Credit unions nationwide rebounded from a slow start of the year when rising interest rates dampened consumer borrowing appetites. Through March 2019, cooperatives across the country originated $111.5 billion in loans, down 5.4% year-over-year.

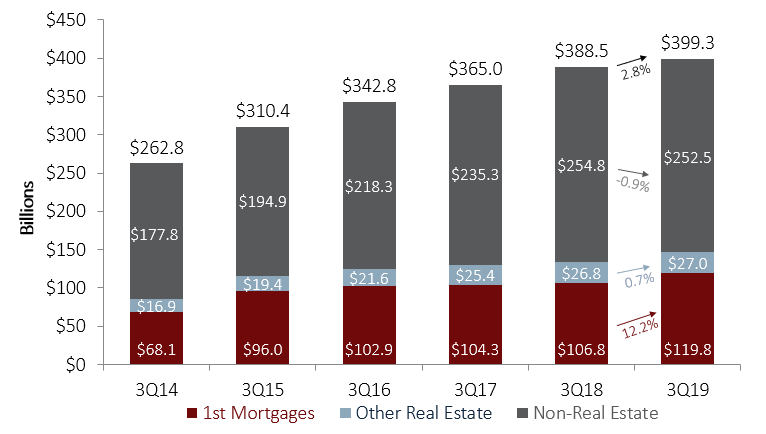

YTD LOAN ORIGINATIONS

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

First mortgage production bolstered origination growth through the third quarter of 2019. Up 12.2% from levels reported in the first nine months of 2018, year-to-date first mortgage originations at credit unions nationwide totaled $119.8 billion as of September. In contrast, credit unions across the country experienced the effects of waning demand for consumer loans, specifically autos. Year-to-date third quarter consumer originations contracted from 2018, shrinking 0.9% compared to the third quarter of last year.

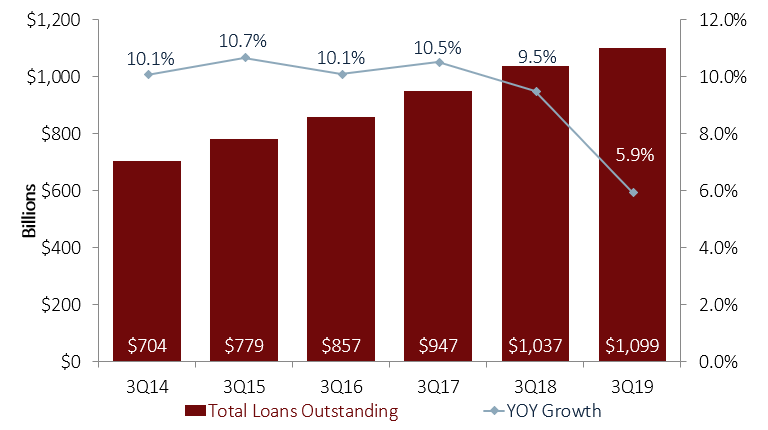

TOTAL LOANS AND ANNUAL GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

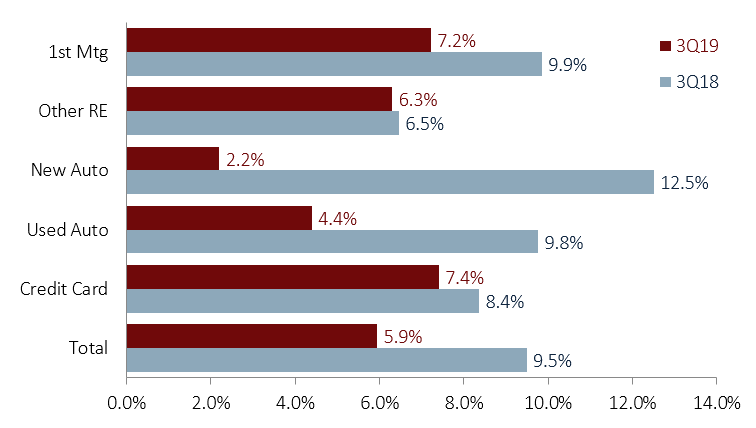

Loan balances increased $61.7 billion year-over-year to just under $1.1 trillion as of September 2019. At 5.9%, annual loan growth has been slowing since 2017 and marks the lowest reported rate since June 2013. Over the last five years, credit unions nationwide have grown their loan portfolios 56.2%.

ANNUAL GROWTH IN LOANS OUTSTANDING

FOR U.S. CREDIT UNIONS| DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

Credit unions experienced the largest slowdown in auto loans. New auto loan growth decelerated 10.3 percentage points while used autos slowed 5.4 percentage points to annual rates of 2.2% and 4.4%, respectively. Indirect loans, which have fueled credit union auto lending in recent years, posted a third quarter annual growth rate of 4.6%, down 10.9 percentage points year-over-year.

TOTAL LOAN COMPOSITION

FOR U.S. CREDIT UNIONS| DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

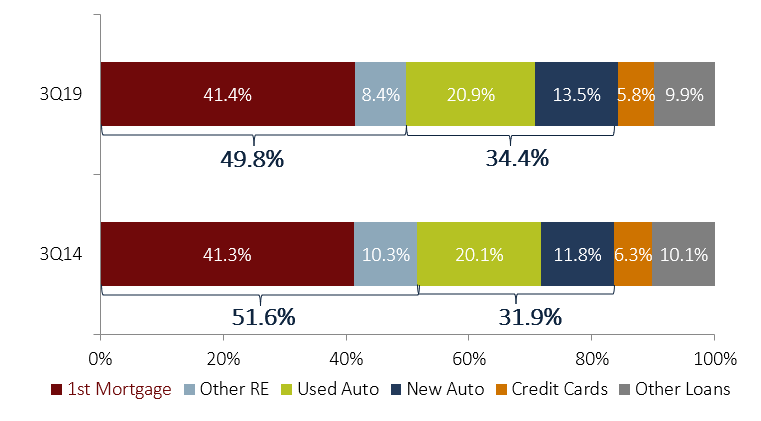

Real estate loans accounted for 49.8% of the credit union loan portfolio in the third quarter. First mortgages increased their share of the portfolio 49 basis points from last year, and 11 basis points from 2014. On the back of slowing consumer loan growth over the last 12 months, the proportion of loans comprised by autos decreased 80 basis points year-over-year to 34.4% as of September 2019.