To read a more in-depth analysis on specific 3Q19 industry trends, select a section below.

LOANS

MORTGAGES

AUTO LENDING

SHARES

INVESTMENTS

EARNINGS

MEMBER RELATIONSHIPS

HUMAN CAPITAL

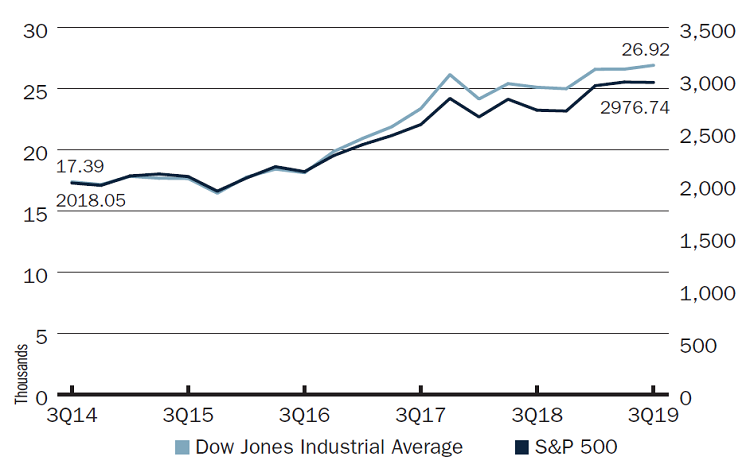

The macroeconomic climate offered mixed signals throughout the third quarter of 2019. On a positive note, real GDP increased at an annual rate of 1.9%, continuing the economic expansion into 22 consecutive quarters. The unemployment rate dropped to a five-decade low of 3.5% in September, and the Dow Jones Industrial Average surpassed 28,000 for the first time ever in November.

Tensions, however, create an uncertain outlook for the beginning of 2020. Notably, trade issues and uncertainty with China persisted throughout the third quarter. Trade woes coupled with recession fears have led to falling consumer confidence across the economy. In its September Index of Consumer Sentiment, the University of Michigan reported the lowest consumer sentiment levels since the fourth quarter of 2016.

Key Points

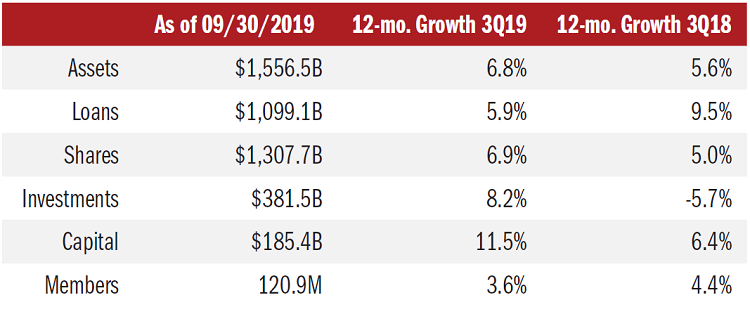

- Total assets across the nation’s 5,396 credit unions increased 6.8% year-over-year and neared $1.6 trillion as of Sept. 30, 2019.

- Total membership hit 120.9 million. Cooperatives nationwide have added 4.2 million members year-to-date, clocking in with a member growth rate of 3.6%.

- Credit union branches totaled 21,265 nationwide as of the third quarter. That’s 85 fewer than one year ago.

- Credit union loan balances neared $1.1 trillion, despite slowing loan growth, deposit balances surpassed $1.3 trillion for the first time ever, growing 6.9% year-over-year.

- Average ROA in the third quarter was up 2 basis points annually to 0.98%. This led to the average net worth ratio increasing 18 basis points to 11.40%.

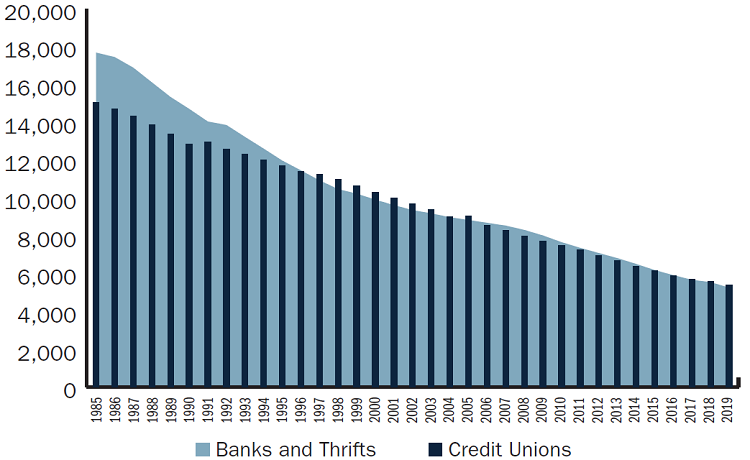

- The number of credit unions operating in the United States dropped by 153 over the last 12 months to 5,396. Of this, 148 were mergers and 5 were purchases, acquisitions, or liquidations.

Click the tabs below to view graphs.

CREDIT UNION INDUSTRY OVERVIEW

CREDIT UNION INDUSTRY OVERVIEW

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

Despite an uncertain macroeconomic environment, credit unions reported strong performance trends in the third quarter of 2019.

NUMBER OF BANKS AND CREDIT UNIONS

NUMBER OF BANKS AND CREDIT UNIONS

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

The number of financial institutions operating in the United States was down 486 year-over-year to 10,652 as of Sept. 30.

DOW JONES INDUSTRIAL AND S&P 500 AVERAGE

DOW JONES INDUSTRIAL AND S&P 500 AVERAGE

DATA AS OF 09.30.19

Callahan & Associates | CreditUnions.com

The Dow Jones surpassed 28,000 for the first time ever following the end of the third quarter.

Source: Freddie Mac

The Bottom Line

The U.S. economy has expanded for 22 consecutive quarters, and the Federal Reserve hopes its easing strategy will ensure continued moderate growth. Declining interest rates and low unemployment both point to a strong economy to begin 2020.

This article appeared originally in Credit Union Strategy & Performance. Read More Today.