Read the full analysis or skip to the section you want to read by clicking on the links below.

LENDING AUTO LENDING MORTGAGE LENDING CREDIT CARDS MEMBER BUSINESS LENDING SHARES INVESTMENTS MEMBER RELATIONSHIPS EARNINGS SPECIAL SECTION: CUSOS

Credit card lending is on the rise at the nation’s credit unions.

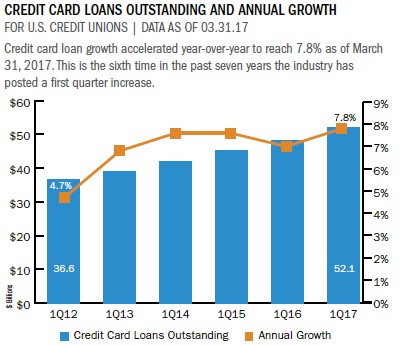

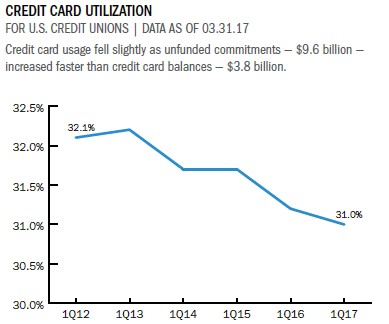

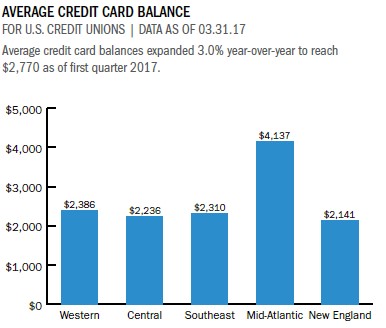

Credit card balances held by U.S. credit unions topped $52.1 billion at the end of the first quarter of 2017. That’s a 7.8% year-over-year increase. Credit card average balances have also increased over the past 12 months. Those are up $81 to $2,770. Credit card usage, on the other hand, has decreased 24 basis points year-over-year to 31.0%.

Credit cards accounted for 5.8% of the credit union loan portfolio as of March 31, 2017. And with a combined 5.5% market share, credit unions collectively are the third-largest provider of credit cards in the United States.

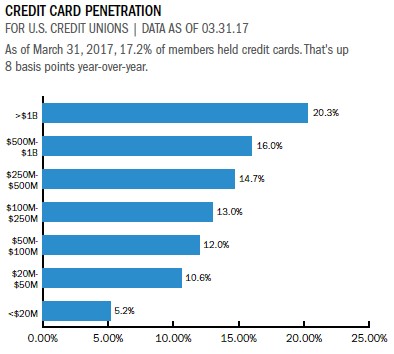

Today, 17.2% of credit union members hold a credit union credit card, up from 17.1% last year. Increases in credit card penetration have gradually slowed over the past three years, with year-overyear changes of 61 and 49 basis points from 2014 to 2015 and 2015 to 2016, respectively.

That deceleration in penetration growth appears to be a byproduct of membership increasing at a faster clip than credit card account growth. For example, credit unions extended 835,000 new credit card loans over the past 12 months, whereas membership increased by nearly 4.4 million members.

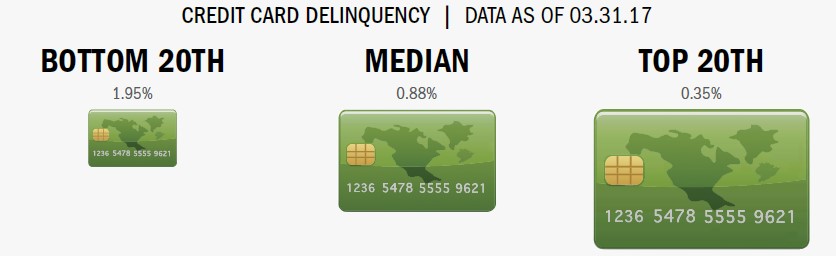

Credit card delinquency increased 15 basis points from 0.94% as of March 31, 2016, to 1.09% today. This is still below the 1.27% average credit card delinquency rate for FDIC-insured institutions. Accounts 60 days or more delinquent are also lower at credit unions compared to those 90 days or more delinquent as reported by FDIC-insured institution. The average net charge-off for credit cards rose 37 basis points over first quarter 2016 to 2.57%.

Click the graphs below to enlarge and then continue reading to see how First South Financial’s targeted marketing nets big returns.

Larger institutions underpinned the growth in average loan balances across the country. Whereas the median growth rate increased 2.8 percentage points, credit unions in the top 20th percentile posted gains of 9.6% per loan.

CASE STUDY

FIRST SOUTH FINANCIAL CREDIT UNION

First South Financial Credit Union has used targeted, analytics-driven marketing to post impressive metrics including industry-topping credit card growth.

The credit union turned out yearover- year credit card loan growth of 20.5% in the first quarter of 2017, placing it among the top 5% among all 5,913 credit unions, regardless of size, according to data from Callahan Associates.

To help drive those results, the Tennessee credit union often uses a local vendor’s turnkey service for high-value product campaigns such as home equity loans and credit cards.

The credit union chooses a focus and then leverages its own resources using tools from its marketing partner. Those tools can include anything from supplying a list for emails to designing an entire direct mail campaigns from start to finish.

We vary it by campaign, says Delynn Byars, the credit union’s senior vice president of marketing. Sometimes we create the email or direct mail piece. We’ve also done campaigns, like our non-member checking campaign, where [the vendor] handles it from start to finish and we tweak the message and the imagery.

First South also uses the firm to drill into member data that helps Byars focus marketing dollars on products or people. For example, the credit union might use the firm to target existing members who have the greatest capacity and propensity to take out a certain kind of loan, Byars says. Or, the firm might suggest a campaign or target segment and First South will develop its own list and collateral or give the lead list to the branches.

In a recent credit card campaign, First South targeted 4,436 member households, resulting in 62 new credit card accounts and $229,146 in new outstanding balances during the tracking period. It was the most successful cross-sell campaign to date.

Read The Whole Story

RETURN TO INDUSTRY PERFORMANCE BY THE NUMBERS 1Q 2017