It’s hard to spend time in Tampa Bay, FL, without hearing about the region’s prospects for growth. Florida’s state population added 293,000 residents in 2014, surpassing New York as it reached 19.9 million, according to the U.S. Census Bureau. Most of the growth over the next 15 years is expected to follow two major highway corridors beginning in Orlando and Jacksonville and pointing like an arrow at the bay-area counties of Hillsborough, Pinellas, Manatee, Pasco, and Hernando.

With an additional 600,000 people projected to call Hillsborough County home by 2040, the region’s ability to attract new residents is helping Grow Financial Federal Credit Union ($2.1B, Tampa, FL) increase its membership.

According to first quarter data reported by Callahan Associates, Grow Financial’s 12-month member growth rate was 8.76% compared to 5.81% for credit unions with $1 billion or more in assets.

That performance, however, isn’t just the result of favorable economic factors in Florida. In 2013, Grow Financial expanded into South Carolina and now has branches in the high-growth areas of Columbia and Charleston and will soon enter Greenville.

CU QUICK FACTS

GROW FINANCIAL Credit Union

Data as of 03.31.15

- HQ: Tampa, FL

- ASSETS: $2.1B

- MEMBERS: 185,705

- BRANCHES: 28

- 12-MO SHARE GROWTH: 4.07%

- 12-MO LOAN GROWTH: 6.82%

- ROA: 0.70%

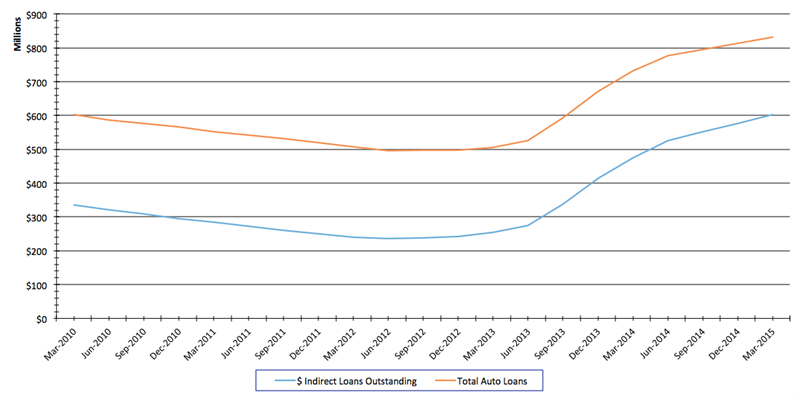

Like many credit unions, Grow Financial has spent the past three years shifting its loan portfolio from real estate to auto loans. Consequently, its auto loan volume has jumped from $500 million in 2012 to nearly $900 million today, representing slightly more than 53% of its loan portfolio as of March, 31, 2015. By comparison, new and used autos represented 30.17% of the first quarter loan portfolio for credit unions with $1 billion or more in assets.

Grow Financial’s auto loan penetration is more than 10 percentage points higher than credit unions in its asset peer group 29.23% versus 18.87%. And despite the credit union’s auto concentration and subsequent lower loan sizes its average loan balance is only slightly lower than its peers $13,869 versus $14,868 for credit unions with $1 billion or more in assets.

Much of its auto growth has come through indirect lending through dealerships in Florida and South Carolina, but the team at Grow Financial is quick to point out approximately 40% of those new members are also engaging with the credit union’s other services.

We focus on onboarding, says Jason Moss, senior vice president of delivery channels, which includes contact center, branch operations, inside sales, and indirect lending sales. You have a pool of new members, but how do you engage them? That’s something a lot of FIs wrestle with, and that’s an area where we’ve been trying different tactics.

The credit union’s penetration in share drafts and credit cards suggests the credit union is indeed engaging members. As of first quarter 2014, its share draft penetration a metric that indicates members are using the credit union as their primary financial institution was 60.73%. That’s slightly higher than the 59.58% for other credit unions in its asset peer group. Likewise, its credit card penetration is 22.17% versus 20.25% for peers.

The leadership team at Grow Financial attributes the organization’s success to teamwork. It has brought together sales, underwriters, marketers, and more. New underwriting strategies, modern systems, and geographic expansion have also helped the credit union live up to its name.

A Focus On The Indirect Market

At the time Grow Financial was branching out from its home state, the U.S. auto lending market was posting its best results in eight years, reaching $102 billion in the fourth quarter of 2014, up from $87.5 billion in the year-earlier period, according to the Fed. Credit unions only accounted for 14.7% of the lending market in 2014, according to Experian, so they faced intense competition from captives, banks, and a variety of hungry financial institutions when the new auto lending rate dipped to a record 1.99% in June 2013.

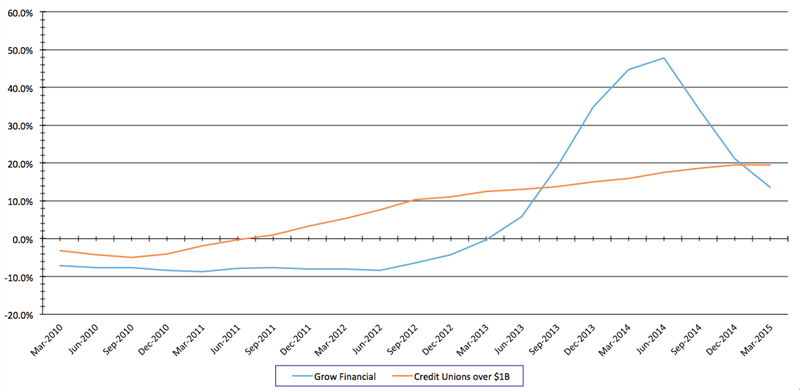

That quarter marks the beginning of a steep and steady, four-quarter upsurge in Grow Financial’s auto loan portfolio. The credit union held its own during the rush for new business, posting total auto loan growth of 34.81% at the end of 2013, 47.79% at mid-year 2014, and 21.2% at the end of 2014. It ranked 93 out of 228 peer credit union with more than $1 billion in assets on Dec. 31, 2014. The credit union’s growth averaged 33.61% between September 2013 and December 2014, compared to 16.75% for peer credit unions during the same period.

TOTAL AUTO LOAN GROWTH

For $1B+ credit unions | Data as of 03.31.5

Callahan Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan Associates

Much of that growth came by way of indirect loans, which grew from 64.74% of its auto loan portfolio in 2013 to 70.89% in 2014 compared to 54.96% on average at other credit unions. At year-end, its indirect loan portfolio topped $577 million.

INDIRECT LOANS VERSUS TOTAL AUTO LOANS

For Grow Financial Credit Union | Data as of 03.31.15

Callahan Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan Associates

Centralized Underwriting

Historically, indirect lending has been a majority of our business, says Dona Svehla, senior vice president of lending and loss prevention at Grow Financial. It’s a challenge. We don’t have the ability to interview, so we base it on analytics and look for ways to make loans to members we can’t talk to. We also ask: What else can we do for you even though you’re in a dealership?

Before ramping up its lending program in 2013, Grow Financial did something that turned out to be foundational to the whole program it converted its operations from a traditional lending platform to a centralized underwriting business unit. The move in 2012 took underwriting decisions out of the branches and enabled branch personnel to focus on sales and service.

It gives us more consistency and ensures folks are doing what they do best, Svehla says. I think our team members are amazing at what they do. We allow the underwriters to focus on the analytics in the back office. Sales builds those relationships, talks with the members, and finds out what their needs are.

At the same time, the credit union is constantly tweaking its automated underwriting guidelines to ensure dealerships receive quick responses electronically, especially when applicants meet Grow Financial’s loan criteria.

On the back end, we need to be able to decision dealer loans and fund their loans in the amount of time we say we can, Svehla says. Nobody wants to wait three hours in a dealership for an answer. That’s why we have underwriters and dealer reps available seven days a week, 361 days a year, which is the same schedule the dealerships follow.

Successful Onboarding

Many credit unions measure member engagement by whether a new borrow opens a deposit account after the initial interaction. However, that’s not always the best measure, says Moss, especially if the member uses the account solely to make car payments. Grow Financial looks at indicators such as active checking accounts and credit cards. According to the credit union, 40% of indirect members have taken on at least one of those other products over the past year.

In many cases, after we’ve done the onboarding, these members are coming to us and asking about our products and services, Moss says.

Looking ahead, Svehla says the Grow Financial is focusing on understanding its markets and using analytics to determine the best companies to partner with to drive sustainable growth. The credit union’s 550 employees are a key part of that future.

Every employee is an advocate for growth, she says.

2 Tips To Onboard Indirect members

What’s the secret to onboarding indirect members? According to Moss and Svehla, it’s all about the basics of people, processes, and technology. Here are two tips from the team at Grow Financial.

- Start onboarding within two weeks. On top of the marketing materials that come with membership, Grow Financial makes personal calls to new members. It’s not so much a sales call as it is welcoming them into the Grow Financial membership and explaining what that means, Moss says. This is where the people who are doing the onboarding are critical to the process.

- Make sure CRM systems capture interactions across all channels. Grow Financial upgraded its CRM system four years ago with Synapsis, which helps build a profile on each member from the first onboarding call to each subsequent interaction. This helps Moss’ team look for opportunities for follow-up calls about other products such as checking accounts, credit cards, and CDs. That goes a long way in building confidence with that member, Moss says. And when we approach that member about a potential cross-sale, we’ve already built rapport.

You Might Also Enjoy

- Don’t Just Onboard, E-Board

- How To Boost Retention, Reduce Attrition, And Improve Member Engagement

- 5 Credit Unions Share How To Onboard EMV, Apple Pay, And RDC

- How Star One Uses Member Onboarding To Drive Account Growth And Efficiency