The hometown of California Coast Credit Union ($2.0B, San Diego, CA) is an expensive place to live relative to much of the United States; however, as in any city, building a productive, engaged workforce is an imperative.

One way to do this, according to the credit union’s board and senior managers, is to provide a living wage.

We realized we were paying some of our entry-level tellers the front-line people serving our members most directly less than some of those great kids they hire at In-N-Out Burger, says California Coast president and CEO Todd Lane.

The credit union pays a minimum of $11.25 an hour to beginning tellers, the same as other credit unions and banks in its market. But Lane and his team questioned whether that was enough.

CU QUICK FACTS

CALIFORNIA COAST CREDIT UNION

Data as of 12.31.15

- HQ: San Diego, CA

- ASSETS: $2.0B

- MEMBERS: 140,517 members

- BRANCHES: 23

- 12-MO SHARE GROWTH: 9.45%

- 12-MO LOAN GROWTH: 21.87%

- ROA: 1.09%

Do we have a responsibility, an obligation, to pay more? he asks. To pay a wage that translates to a living wage?

That kind of thinking launched a three-step process that includes identifying the local living wage, moving the credit union’s compensation platform to a new provider, and adjusting staff salaries based on new pay grade ranges, perhaps based on that living wage. California Coast has already completed two of the three.

The last piece is taking place in steps, Lane says. Once we complete this process we intend to compare our wages again to the local living wage and perhaps then make another round of wage adjustments.

|

| Todd Lane, President and CEO, California Coast Credit Union |

It’s A Living

A living wage takes into consideration all the factors needed for a decent living such as food, housing, clothing, and medical care for workers and their families. It varies widely geographically. For example, according to the Massachusetts Institute of Technology, the living wage for families of four with two working adults and two children is $54,073 in South Carolina and $84,337 in the District of Columbia, the highest in the nation. The average for western states is $62,506.

A living wage is not the same as a minimum wage. Nationally, the minimum wage is $7.25 an hour. According to the MIT living wage calculator, the living wage In San Diego County is $12.72 an hour.

The topic first came up at a board planning session last September, Lane says. Unemployment is low in the credit union’s service area greater San Diego and southern Riverside County and the board wanted California Coast to keep churn low and service levels high. The credit union started by looking at the living wage.

The result is a new system of job descriptions, performance reviews, and pay grades for 65 different positions in the 450-person workforce at California Coast.

Writing a job description? Don’t reinvent the wheel. Get rolling on important initiatives using documents, policies, and templates borrowed from fellow credit unions. Pull them off the shelf and tailor them to the credit union’s needs. Visit Callahan’s Executive Resource Center today.

But it’s not just about software.

We’re not just creating new pay grades, Lane says. We’re creating a new pay philosophy.

Room To Grow

That philosophy includes considering such factors as a person’s living situation. Does a living wage apply to everyone? After all, many of the $11.25-an-hour entry-level tellers live at home.

We have some insight into their personal situations, Lane says. We know when we’re hiring students, for instance. But can we act on that? Some will say that’s none of our business, of course, but it will be part of the future conversations we’ll be having with our board.

Those discussions will aim to resolve this question: Does the living wage apply to everybody, including entry-level employees?

The new system already has determined a handful of employees are being paid less than the low end of the new pay ranges.

We’re not just creating new pay grades. We’re creating a new pay philosophy.

We’re increasing those to at least the minimum, perhaps some even higher, Lane says. Then we’ll look at where everyone else has moved in pay raises.

Although the credit union offers a companywide bonus and incentive program, California Coast has some margin to work with when it comes to comparison with its peers.

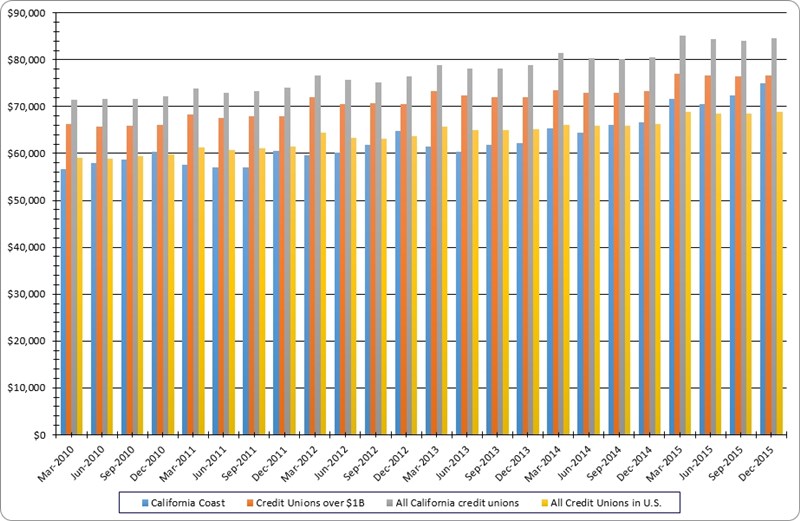

California is a relatively expensive place to do business in terms of pay and benefits. Year-end performance data by Callahan & Associates shows California Coast spent $74,893 per employee in 2015, compared with $84,568 for all 339 California credit unions and $76,676 for the nation’s 250 credit unions with $1 billion or more in assets. The average for all 6,017 credit unions nationwide was $68,947.

SALARIES AND BENEFITS PER EMPLOYEE

For all U.S. credit unions | Data as of 09.30.15

© Callahan & Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan & Associates

California Coast currently spends $74,893 per employee on salaries and benefits, more than the national average of all credit unions but less than the California average and the average $1 billion credit union nationwide.

The People Will Decide

Lane says he knows the new strategy will increase the credit union’s expenses, but he can see significant benefits from paying a living wage that’s more than market benefits like attracting and retaining high-caliber employees.

There’s also a general positive attitude and happiness of employees that’s important here, Lane says. I also think some of our membership would be supportive of paying that living wage.

California Coast Credit Union uses the Compease system for human resources administration. Find your next solution in the Callahan & Associates online Buyer’s Guide.

Providing a living wage is a question for the California Coast board to decide It’s not required by law, Lane notes but support for wage reform is a hot button issue nationwide. Several cities already have enacted or are considering a $15 an hour minimum wage, including Los Angeles County, where it will hit that mark by mid 2020.

San Diego voters, meanwhile, will decide in June whether to approve increasing that city’s minimum wage to $11.50 an hour by next January.

Of course, that’s less than the living wage. And whether to make that measure the standard at California Coast, and how to do it, remain to be decided. But according to Lane, it is where the credit union is heading.

This is the dialogue we’re having, he says. There are pros and cons to this and there will be different opinions. But it’s up to the board members to decide. They speak for the members.

You Might Also Enjoy

- 3 Ways To Improve Incentive Programs

- The Benefits Of Hiring From Inside – And Outside – The Credit Union

- People-Powered Progress