Read the full analysis or skip to the section you want to read by clicking on the links below.

LENDING AUTO LENDING MORTGAGE LENDING CREDIT CARDS MEMBER BUSINESS LENDING SHARES INVESTMENTS MEMBER RELATIONSHIPS EARNINGS SPECIAL SECTION: EMPLOYEE ENGAGEMENT

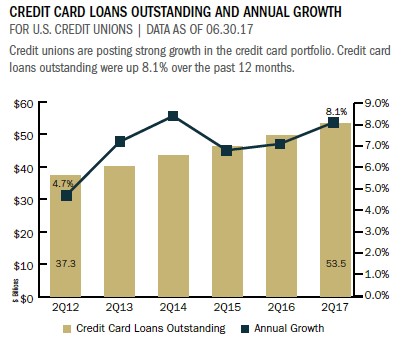

Total credit card balances at credit unions nationwide rose 8.1% year-over- year to top $53.5 billion as of June 30. Annual balance growth has surpassed 7.0% in five of the past six quarters, and growth this year is the highest rate in the past 11 quarters. Credit cards accounted for 5.8% of the $923.2 billion credit union loan portfolio at the conclusion of second quarter 2017.

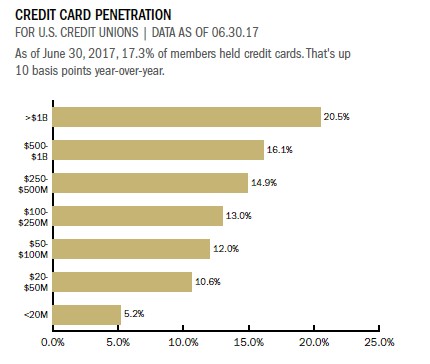

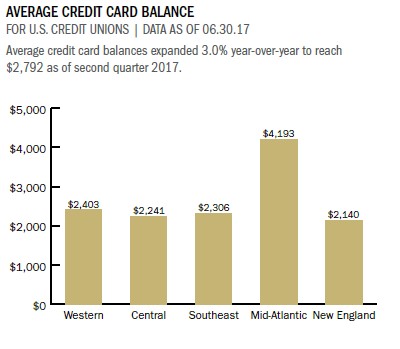

As of mid-year, 17.3% of members held a credit card with a credit union. Credit card penetration is 20 basis points higher than it was in the second quarter of 2017. The average credit card balance reached $2,792 in the second quarter, an increase of 3.1% year-over-year.

Credit unions in all the NCUA regions save the Southeast posted growth in average credit card balances in the second quarter of 2017. The average credit card balance was highest for credit unions in the Mid-Atlantic Region. Average balances there were $4,202. Mid-Atlantic credit unions also had the highest penetration, at 22.8%. On the other end of the spectrum, penetration for Central Region credit unions came in at 14.6%.

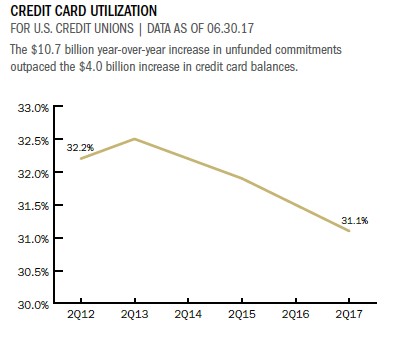

Balances and penetration rates have increased, but credit card utilization has not. Usage declined 40 basis points annually, dropping from 31.5% at midyear 2016 to 31.1% in 2017. Unfunded commitments rose nearly $11 million in the same time frame.

Over the past 12 months, credit card delinquency has increased 15 basis points to 1.08%. Although credit card delinquency increased year-over-year, it has improved 6 basis points compared to the end of 2016.

Click the graphs below to enlarge and then continue reading to see if InFirst FCU really has the richest credit card in credit union land.

As of June 30, 2017, credit card delinquency was up 15 basis points over mid-year 2016. This continued a recent upward trend.

CASE STUDY

INFIRST FEDERAL CREDIT UNION

InFirst Federal Credit Union took inspiration from retail giant Costco when the suburban Washington, DC, credit union launched a new credit card rewards program.

The world’s second-largest retailer rolled out its own new Visa card in 2016 after cutting ties with American Express. InFirst’s new Visa rewards credit card mirrors that program, only without the annual fee.

We looked at Costco and said we wanted to do one better, says Jeff Parish, the credit union’s chief marketing officer.

InFirst’s Visa rewards card offers 4% cash back on all gas purchases; 3% on all restaurant and travel; 2% cash back on all grocery stores, superstores, and wholesale clubs; and 1% cash back on all other purchases.

Rewards stimulate the use of the credit card and bring in additional members, Parish says. And then, of course, there are the side benefits interchange income from card use as well as interest income from those people who carry a balance.

The card has an introductory rate of 1.99% for six months that then adjusts to between 10.90% and 17.90%. The credit union’s Young Adult Visa Rewards card for 18- to 25-year-olds offers the same rewards benefits and introductory rates and no annual fee. However, cardholders do not need a credit score to qualify, and when they turn 25 their accounts convert into the regular portfolio.

As for getting the word out, the credit union relies on a combination of old school and social media outreach.

For us, the most effective form of marketing is digital mail, Parish says. But it’s hard for us to find people who are not already members.

Social media also has proven to be an effective channel, with personal reviews attracting more business than self-promotion.

Finally, the credit union offers a tool on its website, mobile app, and social media presence that calculates savings for members switching to the new credit card.

Strategy Performance 2Q 2017

Credit unions are indeed having an outstanding 2017 right on the heels of a very strong 2016 and 2015. Eliminating barriers and connecting with members distinguishes credit unions from other financial institutions and makes the movement stronger than it’s ever been. Learn what the industry’s most successful credit unions are doing in this issue of Strategy Performance.

RETURN TO INDUSTRY PERFORMANCE BY THE NUMBERS 2Q 2017